Enlarge image

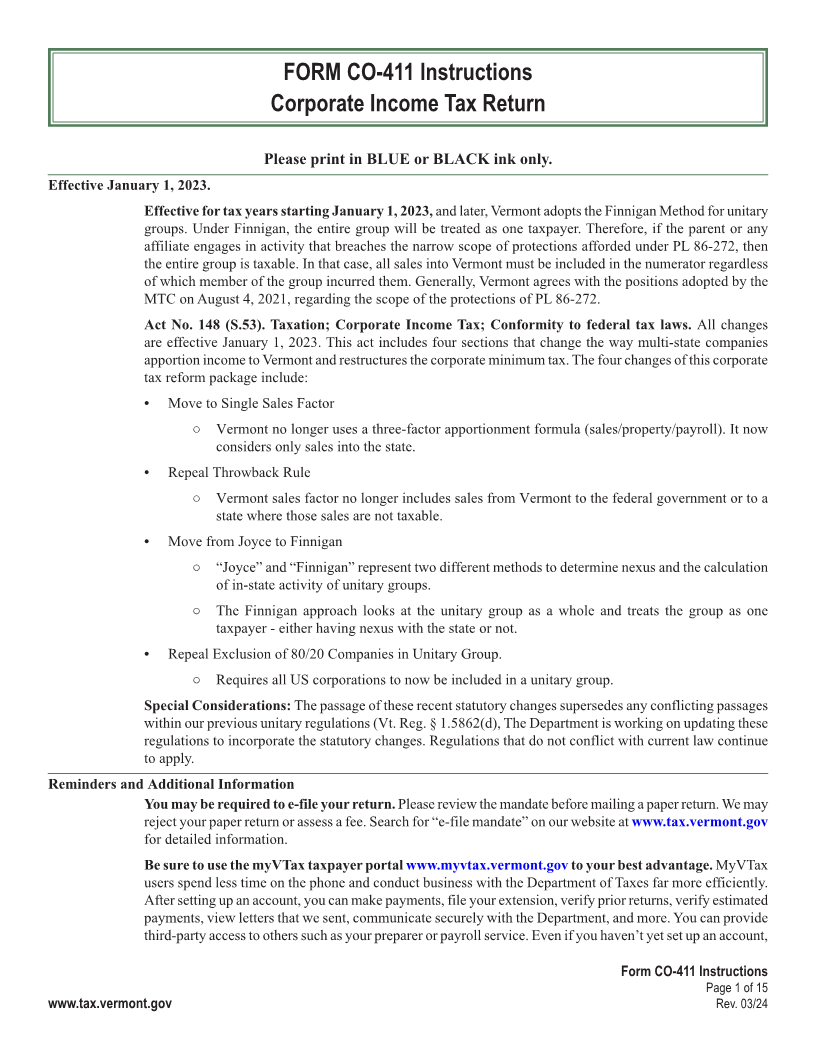

FORM CO-411 Instructions

Corporate Income Tax Return

Page 1

Please print in BLUE or BLACK ink only.

Effective January 1, 2023.

Effective for tax years starting January 1, 2023, and later, Vermont adopts the Finnigan Method for unitary

groups. Under Finnigan, the entire group will be treated as one taxpayer. Therefore, if the parent or any

affiliate engages in activity that breaches the narrow scope of protections afforded under PL 86-272, then

the entire group is taxable. In that case, all sales into Vermont must be included in the numerator regardless

of which member of the group incurred them. Generally, Vermont agrees with the positions adopted by the

MTC on August 4, 2021, regarding the scope of the protections of PL 86-272.

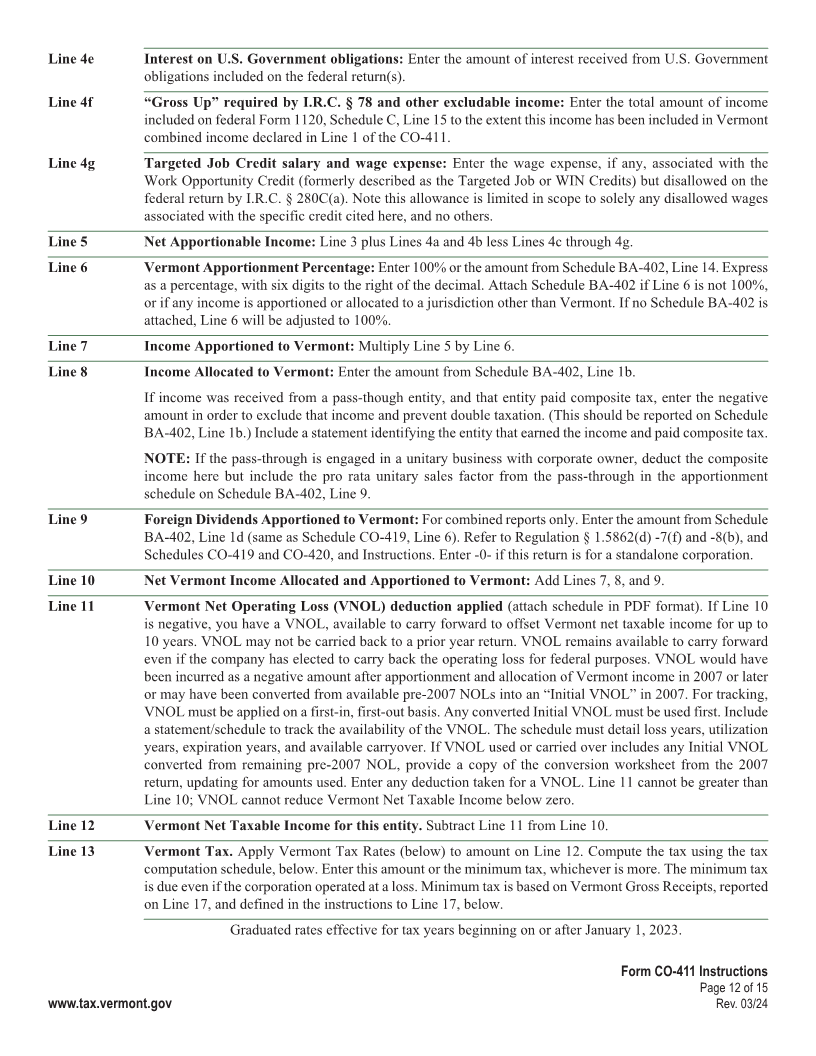

Act No. 148 (S.53). Taxation; Corporate Income Tax; Conformity to federal tax laws. All changes

are effective January 1, 2023. This act includes four sections that change the way multi-state companies

apportion income to Vermont and restructures the corporate minimum tax. The four changes of this corporate

tax reform package include:

INSTR (Place at FIRST page)

• Move to Single Sales Factor Instr. pages

○ Vermont no longer uses a three-factor apportionment formula (sales/property/payroll). It now

considers only sales into the state.

• Repeal Throwback Rule

○ Vermont sales factor no longer includes sales from Vermont to the federal government or to a 1 - 16

state where those sales are not taxable.

• Move from Joyce to Finnigan

○ “Joyce” and “Finnigan” represent two different methods to determine nexus and the calculation

of in-state activity of unitary groups.

○ The Finnigan approach looks at the unitary group as a whole and treats the group as one

taxpayer - either having nexus with the state or not.

• Repeal Exclusion of 80/20 Companies in Unitary Group.

○ Requires all US corporations to now be included in a unitary group.

Special Considerations: The passage of these recent statutory changes supersedes any conflicting passages

within our previous unitary regulations (Vt. Reg. § 1.5862(d), The Department is working on updating these

regulations to incorporate the statutory changes. Regulations that do not conflict with current law continue

to apply.

Reminders and Additional Information

You may be required to e-file your return. Please review the mandate before mailing a paper return. We may Instructions have NOT

reject your paper return or assess a fee. Search for “e-file mandate” on our website at www.tax.vermont.gov

for detailed information.

Be sure to use the myVTax taxpayer portal www.myvtax.vermont.gov to your best advantage. MyVTax

users spend less time on the phone and conduct business with the Department of Taxes far more efficiently. been edited for 2015 yet

After setting up an account, you can make payments, file your extension, verify prior returns, verify estimated

payments, view letters that we sent, communicate securely with the Department, and more. You can provide

third-party access to others such as your preparer or payroll service. Even if you haven’t yet set up an account,

Form CO-411 Instructions

Page 1 of 15

www.tax.vermont.gov Rev. 03/24