Enlarge image

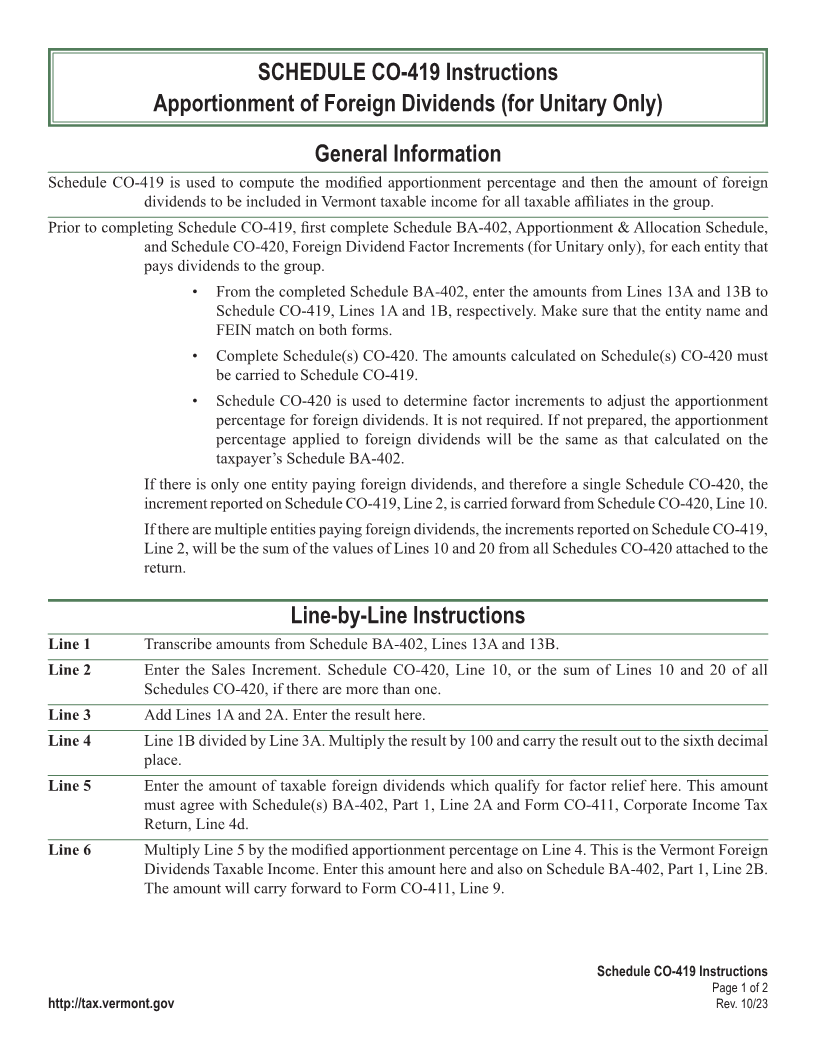

SCHEDULE CO-419 Instructions

Apportionment of Foreign Dividends (for Unitary Only)

Page 1

General Information

Schedule CO-419 is used to compute the modified apportionment percentage and then the amount of foreign

dividends to be included in Vermont taxable income for all taxable affiliates in the group.

Prior to completing Schedule CO-419, first complete Schedule BA-402, Apportionment & Allocation Schedule,

and Schedule CO-420, Foreign Dividend Factor Increments (for Unitary only), for each entity that

pays dividends to the group.

• From the completed Schedule BA-402, enter the amounts from Lines 13A and 13B to

Schedule CO-419, Lines 1A and 1B, respectively. Make sure that the entity name and

FEIN match on both forms.

• Complete Schedule(s) CO-420. The amounts calculated on Schedule(s) CO-420 must

be carried to Schedule CO-419.

INSTR (Place at FIRST page)

• Schedule CO-420 is used to determine factor increments to adjust the apportionment Instr. pages

percentage for foreign dividends. It is not required. If not prepared, the apportionment

percentage applied to foreign dividends will be the same as that calculated on the

taxpayer’s Schedule BA-402.

If there is only one entity paying foreign dividends, and therefore a single Schedule CO-420, the

1 - 2

increment reported on Schedule CO-419, Line 2, is carried forward from Schedule CO-420, Line 10.

If there are multiple entities paying foreign dividends, the increments reported on Schedule CO-419,

Line 2, will be the sum of the values of Lines 10 and 20 from all Schedules CO-420 attached to the

return.

Line-by-Line Instructions

Line 1 Transcribe amounts from Schedule BA-402, Lines 13A and 13B.

Line 2 Enter the Sales Increment. Schedule CO-420, Line 10, or the sum of Lines 10 and 20 of all

Schedules CO-420, if there are more than one.

Line 3 Add Lines 1A and 2A. Enter the result here.

Line 4 Line 1B divided by Line 3A. Multiply the result by 100 and carry the result out to the sixth decimal

place.

Line 5 Enter the amount of taxable foreign dividends which qualify for factor relief here. This amount

must agree with Schedule(s) BA-402, Part 1, Line 2A and Form CO-411, Corporate Income Tax

Return, Line 4d.

Line 6 Multiply Line 5 by the modified apportionment percentage on Line 4. This is the Vermont Foreign

Dividends Taxable Income. Enter this amount here and also on Schedule BA-402, Part 1, Line 2B.

The amount will carry forward to Form CO-411, Line 9.

Schedule CO-419 Instructions

Page 1 of 2

http://tax.vermont.gov Rev. 10/23