Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

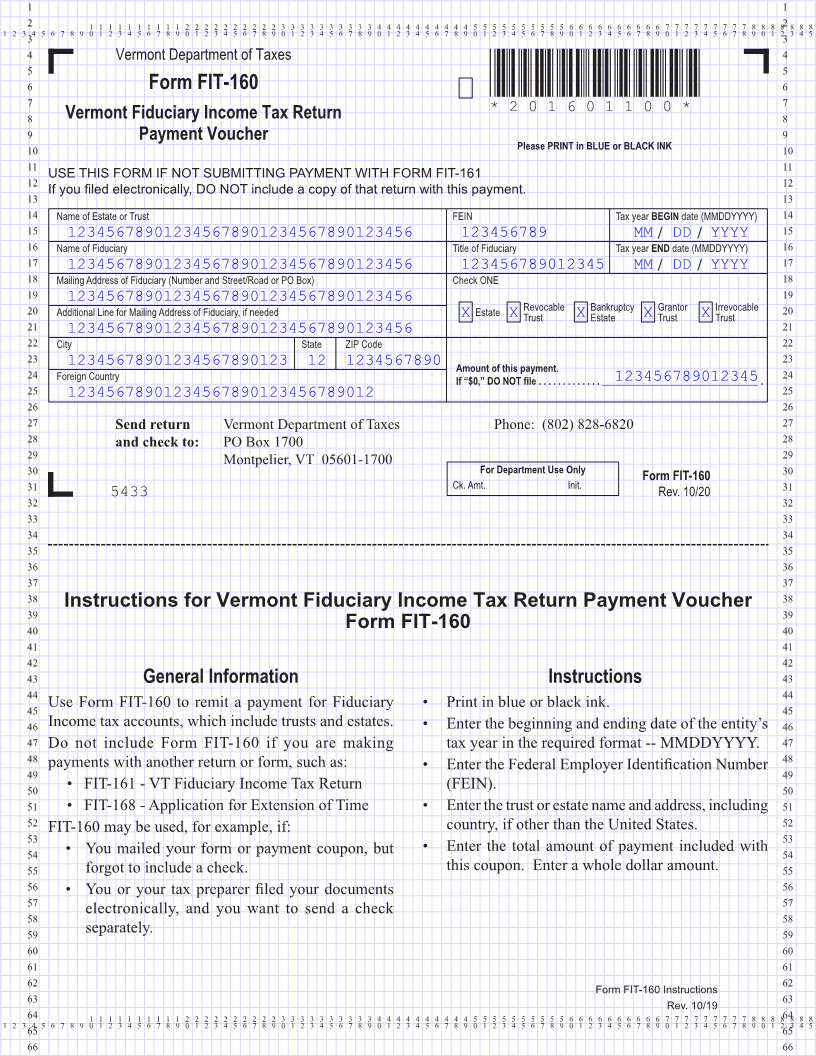

4 Vermont Department of Taxes 4

5 5

6 Form FIT-160 *201601100* 6

7 7

Vermont Fiduciary Income Tax Return *201601100*

8 8 Page 1

9 Payment Voucher 9

10 Please PRINT in BLUE or BLACK INK 10

11 11

USE THIS FORM IF NOT SUBMITTING PAYMENT WITH FORM FIT-161

12 12

If you filed electronically, DO NOT include a copy of that return with this payment.

13 13

14 Name of Estate or Trust FEIN Tax year BEGIN date (MMDDYYYY) 14

15 123456789012345678901234567890123456 123456789 MM / DD / YYYY 15

16 Name of Fiduciary Title of Fiduciary Tax year END date (MMDDYYYY) 16

17 123456789012345678901234567890123456 123456789012345 MM / DD / YYYY 17

18 Mailing Address of Fiduciary (Number and Street/Road or PO Box) Check ONE 18

19 19

20 123456789012345678901234567890123456Additional Line for Mailing Address of Fiduciary, if needed Estate Revocable Bankruptcy Grantor Irrevocable 20

X X Trust X Estate X Trust XTrust

21 21

123456789012345678901234567890123456

22 City State ZIP Code 22

23 23

12345678901234567890123 12 1234567890 Amount of this payment.

24 123456789012345Foreign Country If “$0,” DO NOT file ............. ________________________________ . 24

25 25

12345678901234567890123456789012

26 26

27 Send return Vermont Department of Taxes Phone: (802) 828-6820 27

28 and check to: PO Box 1700 28

29 29

Montpelier, VT 05601-1700

For Department Use Only

30 Form FIT-160 30

Ck. Amt. Init.

31 5433 Rev. 10/20 31

32 32

33 33

34 34

35 35

36 36

37 37

38 38

Instructions for Vermont Fiduciary Income Tax Return Payment Voucher

39 39

40 Form FIT-160 40

41 41

42 42

43 General Information Instructions 43

44 44

45 Use Form FIT-160 to remit a payment for Fiduciary • Print in blue or black ink. 45

46 Income tax accounts, which include trusts and estates. • Enter the beginning and ending date of the entity’s 46

47 Do not include Form FIT-160 if you are making tax year in the required format -- MMDDYYYY. 47

48 payments with another return or form, such as: • Enter the Federal Employer Identification Number 48

49 49

50 • FIT-161 - VT Fiduciary Income Tax Return (FEIN). 50

51 • FIT-168 - Application for Extension of Time • Enter the trust or estate name and address, including 51

52 country, if other than the United States. 52

FIT-160 may be used, for example, if:

53 53

54 • You mailed your form or payment coupon, but • Enter the total amount of payment included with 54

55 forgot to include a check. this coupon. Enter a whole dollar amount. 55

56 • You or your tax preparer filed your documents 56

57 57

electronically, and you want to send a check

58 58

59 separately. 59

60 60

61 61

62 62

Form FIT-160 Instructions

63 63

Rev. 10/19

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66