Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

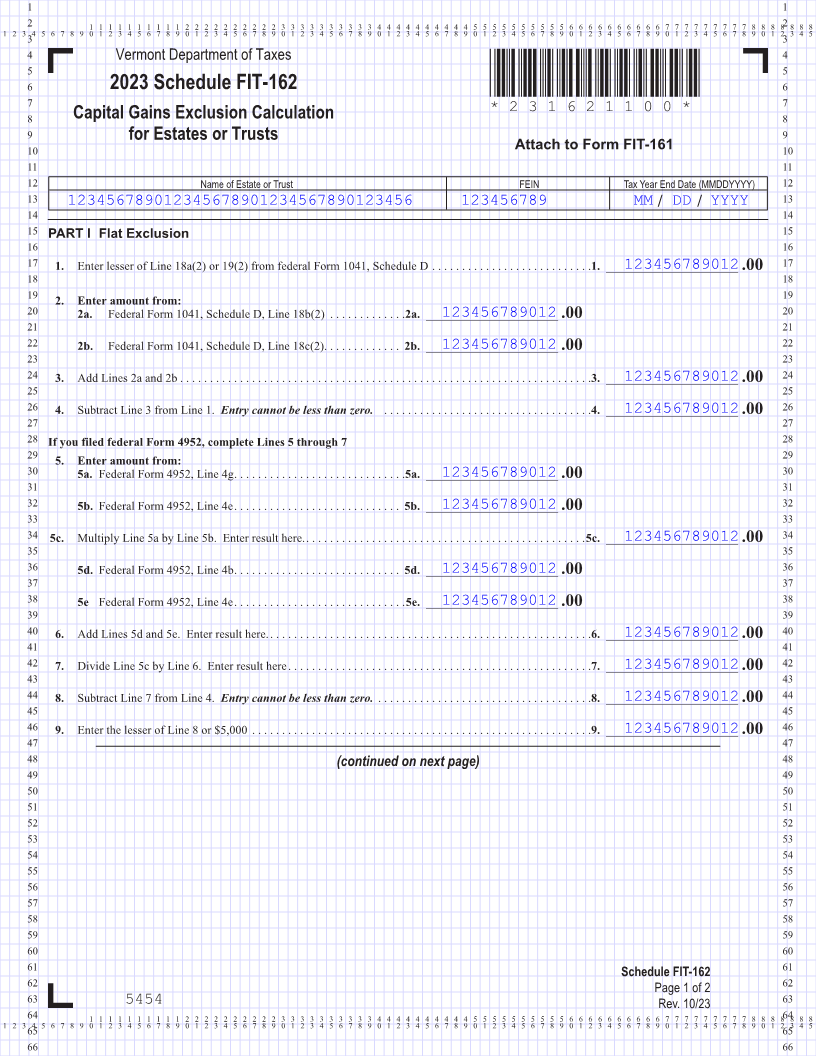

4 Vermont Department of Taxes 4

5 5

6 2023 Schedule FIT-162 *231621100* 6

7 7

Capital Gains Exclusion Calculation *231621100*

8 8 Page 3

9 for Estates or Trusts 9

10 Attach to Form FIT-161 10

11 11

12 Name of Estate or Trust FEIN Tax Year End Date (MMDDYYYY) 12

13 123456789012345678901234567890123456 123456789 MM / DD / YYYY 13

14 14

15 PART I Flat Exclusion 15

16 16

17 1. 123456789012Enter lesser of Line 18a(2) or 19(2) from federal Form 1041, Schedule D . . . . . . . . . . . . . . . . . . . . . . . . . . 1.. ______________________ .00 17

18 18

19 19

2. Enter amount from:

20 123456789012 2a. Federal Form 1041, Schedule D, Line 18b(2) . . . . . . . . . . . . 2a.. ______________________.00 20

21 21

22 123456789012 2b. Federal Form 1041, Schedule D, Line 18c(2) . . . . . . . . . . . . . 2b. ______________________.00 22

23 23

24 3. 123456789012Add Lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.. ______________________.00 24

25 25 FORM (Place at FIRST page)

26 4. 123456789012Subtract Line 3 from Line 1 . Entry cannot be less than zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.. ______________________ .00 26 Form pages

27 27

28 If you filed federal Form 4952, complete Lines 5 through 7 28

29 29

5. Enter amount from:

30 123456789012 5a. Federal Form 4952, Line 4g . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5a.. ______________________.00 30

31 31

3 - 4

32 123456789012 5b. Federal Form 4952, Line 4e . . . . . . . . . . . . . . . . . . . . . . . . . . . .5b. ______________________.00 32

33 33

34 5c. 123456789012Multiply Line 5a by Line 5b . Enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5c.. . ______________________.00 34

35 35

36 1234567890125d. Federal Form 4952, Line 4b . . . . . . . . . . . . . . . . . . . . . . . . . . . .5d. ______________________.00 36

37 37

38 123456789012 5e Federal Form 4952, Line 4e . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5e.. ______________________.00 38

39 39

40 6. 123456789012Add Lines 5d and 5e . Enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6.. . ______________________.00 40

41 41

42 7. 123456789012Divide Line 5c by Line 6 . Enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.. ______________________.00 42

43 43

44 8. 123456789012Subtract Line 7 from Line 4 . Entry cannot be less than zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.. ______________________ .00 44

45 45

46 9. 123456789012Enter the lesser of Line 8 or $5,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.. ______________________ .00 46

47 47

48 (continued on next page) 48

49 49

50 50

51 51

52 52

53 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 Schedule FIT-162 61

62 Page 1 of 2 62

63 5454 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66