Enlarge image

Vermont Department of Taxes

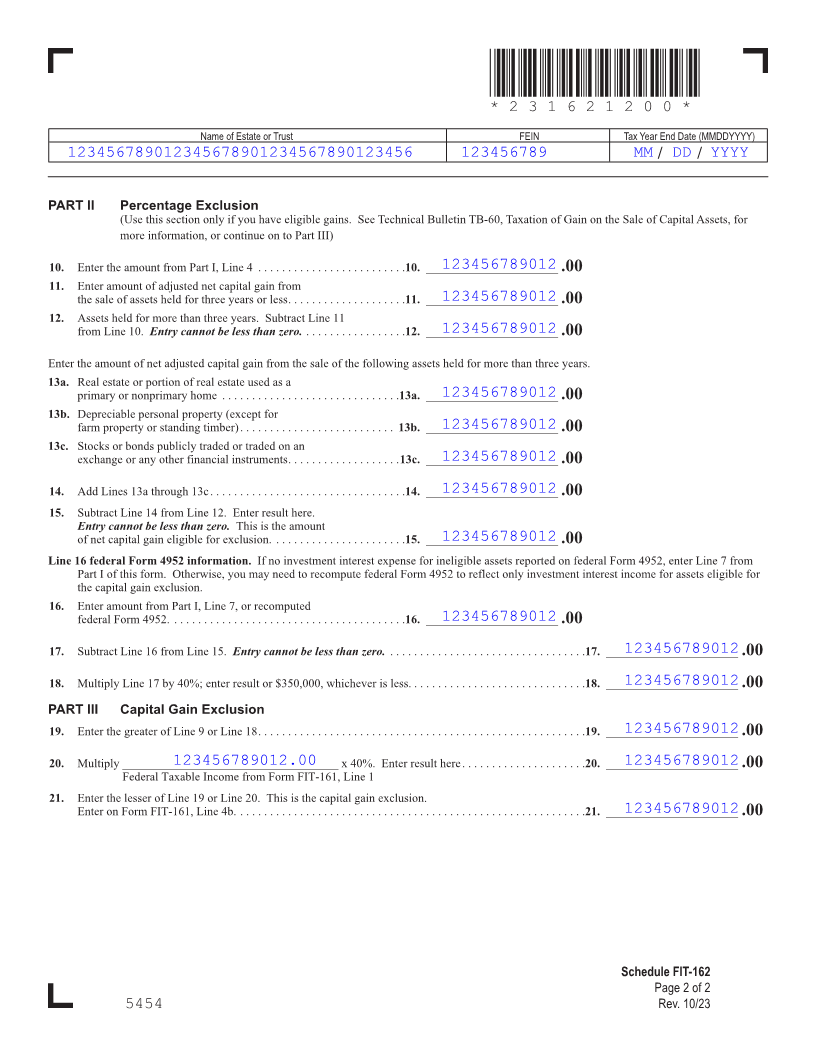

2023 Schedule FIT-162 *231621100*

Capital Gains Exclusion Calculation *231621100*

Page 3

for Estates or Trusts

Attach to Form FIT-161

Name of Estate or Trust FEIN Tax Year End Date (MMDDYYYY)

123456789012345678901234567890123456 123456789 MM / DD / YYYY

PART I Flat Exclusion

123456789012 1. Enter lesser of Line 18a(2) or 19(2) from federal Form 1041, Schedule D . . . . . . . . . . . . . . . . . . . . . . . . . . 1.. ______________________ .00

2. Enter amount from:

123456789012 2a. Federal Form 1041, Schedule D, Line 18b(2) . . . . . . . . . . . . 2a.. ______________________.00

123456789012 2b. Federal Form 1041, Schedule D, Line 18c(2) . . . . . . . . . . . . . 2b. ______________________.00

123456789012 3. Add Lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.. ______________________.00

FORM (Place at FIRST page)

4. 123456789012Subtract Line 3 from Line 1 . Entry cannot be less than zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.. ______________________ .00 Form pages

If you filed federal Form 4952, complete Lines 5 through 7

5. Enter amount from:

123456789012 5a. Federal Form 4952, Line 4g . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5a.. ______________________.00

3 - 4

123456789012 5b. Federal Form 4952, Line 4e . . . . . . . . . . . . . . . . . . . . . . . . . . . .5b. ______________________.00

123456789012 5c. Multiply Line 5a by Line 5b . Enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5c.. . ______________________.00

1234567890125d. Federal Form 4952, Line 4b . . . . . . . . . . . . . . . . . . . . . . . . . . . .5d. ______________________.00

123456789012 5e Federal Form 4952, Line 4e . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5e.. ______________________.00

123456789012 6. Add Lines 5d and 5e . Enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6.. . ______________________.00

123456789012 7. Divide Line 5c by Line 6 . Enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.. ______________________.00

123456789012 8. Subtract Line 7 from Line 4 . Entry cannot be less than zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.. ______________________ .00

123456789012 9. Enter the lesser of Line 8 or $5,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.. ______________________ .00

(continued on next page)

Schedule FIT-162

Page 1 of 2

5454 Rev. 10/23