Enlarge image

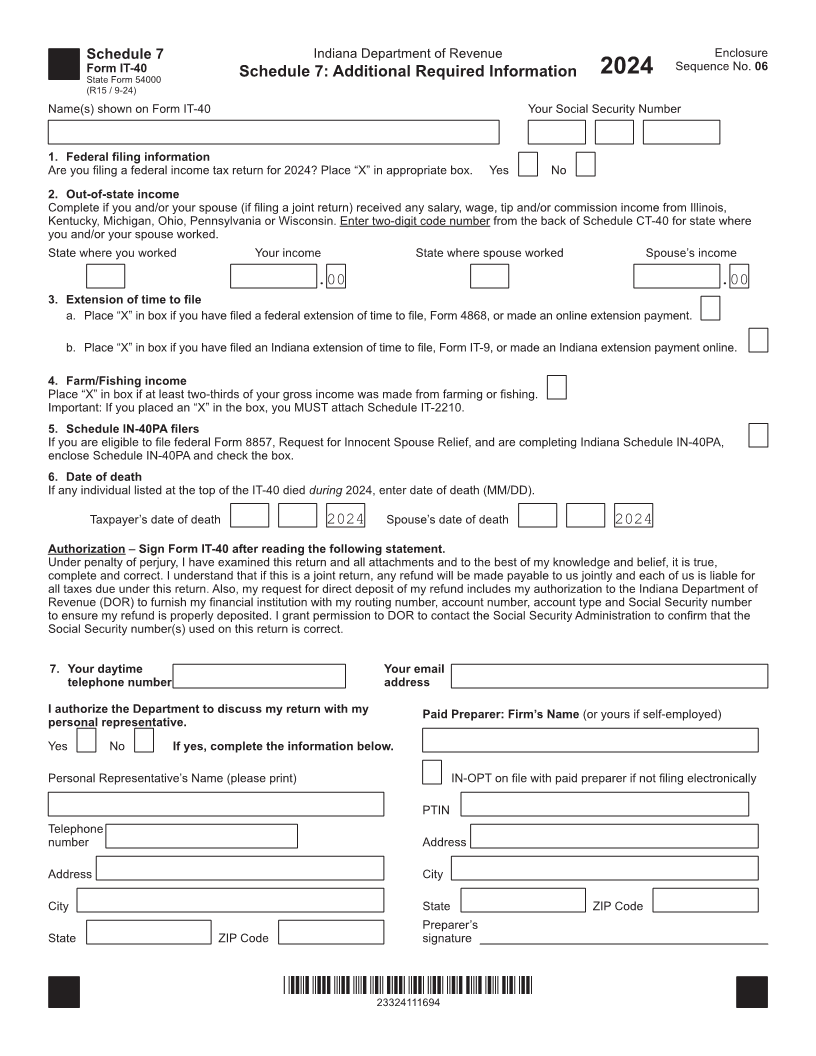

Schedule 7 Indiana Department of Revenue Enclosure

Sequence No. 06

Form IT-40 Schedule 7: Additional Required Information 2024

State Form 54000

(R15 / 9-24)

Name(s) shown on Form IT-40 Your Social Security Number

1. Federal filing information

Are you filing a federal income tax return for 2024? Place “X” in appropriate box. Yes No

2. Out-of-state income

Complete if you and/or your spouse (if filing a joint return) received any salary, wage, tip and/or commission income from Illinois,

Kentucky, Michigan, Ohio, Pennsylvania or Wisconsin. Enter two-digit code number from the back of Schedule CT-40 for state where

you and/or your spouse worked.

State where you worked Your income State where spouse worked Spouse’s income

.00 .00

3. Extension of time to file

a. Place “X” in box if you have filed a federal extension of time to file, Form 4868, or made an online extension payment.

b. Place “X” in box if you have filed an Indiana extension of time to file, Form IT-9, or made an Indiana extension payment online.

4. Farm/Fishing income

Place “X” in box if at least two-thirds of your gross income was made from farming or fishing.

Important: If you placed an “X” in the box, you MUST attach Schedule IT-2210.

5. Schedule IN-40PA filers

If you are eligible to file federal Form 8857, Request for Innocent Spouse Relief, and are completing Indiana Schedule IN-40PA,

enclose Schedule IN-40PA and check the box.

6. Date of death

If any individual listed at the top of the IT-40 died during 2024, enter date of death (MM/DD).

Taxpayer’s date of death 2024 Spouse’s date of death 2024

Authorization – Sign Form IT-40 after reading the following statement.

Under penalty of perjury, I have examined this return and all attachments and to the best of my knowledge and belief, it is true,

complete and correct. I understand that if this is a joint return, any refund will be made payable to us jointly and each of us is liable for

all taxes due under this return. Also, my request for direct deposit of my refund includes my authorization to the Indiana Department of

Revenue (DOR) to furnish my financial institution with my routing number, account number, account type and Social Security number

to ensure my refund is properly deposited. I grant permission to DOR to contact the Social Security Administration to confirm that the

Social Security number(s) used on this return is correct.

7. Your daytime Your email

telephone number address

I authorize the Department to discuss my return with my Paid Preparer: Firm’s Name (or yours if self-employed)

personal representative.

Yes No If yes, complete the information below.

Personal Representative’s Name (please print) IN-OPT on file with paid preparer if not filing electronically

PTIN

Telephone

number Address

Address City

City State ZIP Code

Preparer’s

State ZIP Code signature

*23324111694*

23324111694