Enlarge image

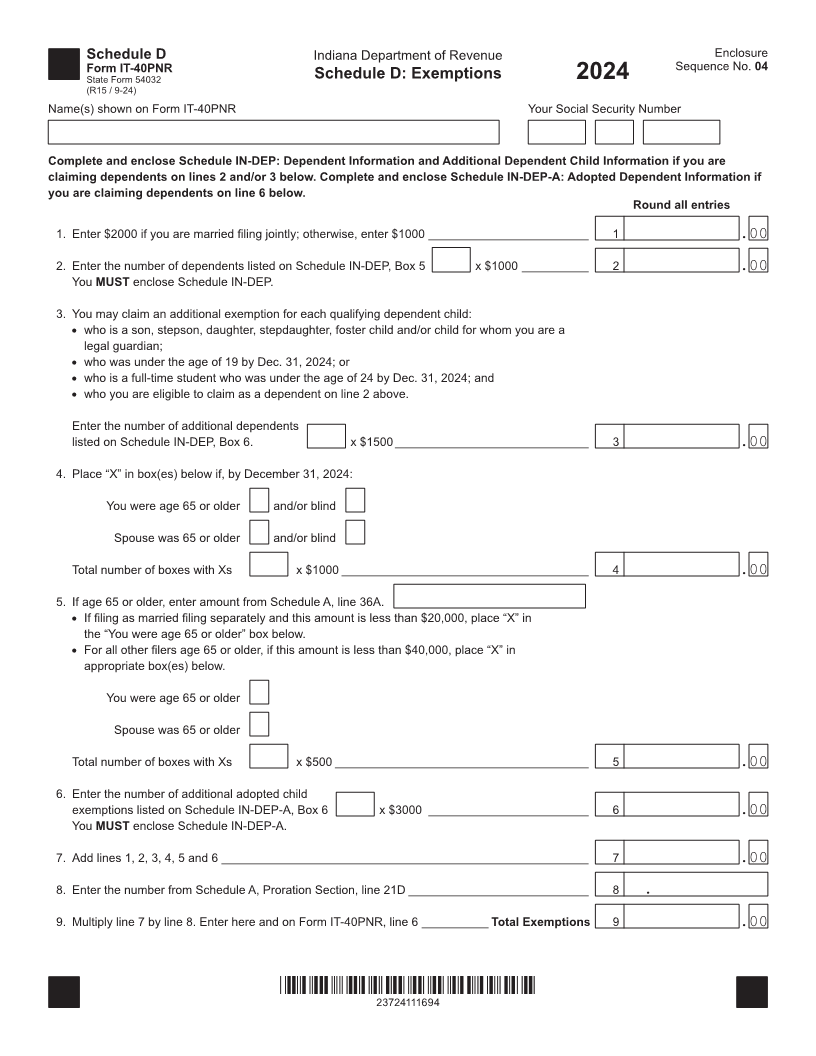

Schedule D Indiana Department of Revenue Enclosure

Form IT-40PNR Sequence No. 04

State Form 54032 Schedule D: Exemptions 2024

(R15 / 9-24)

Name(s) shown on Form IT-40PNR Your Social Security Number

Complete and enclose Schedule IN-DEP: Dependent Information and Additional Dependent Child Information if you are

claiming dependents on lines 2 and/or 3 below. Complete and enclose Schedule IN-DEP-A: Adopted Dependent Information if

you are claiming dependents on line 6 below.

Round all entries

1. Enter $2000 if you are married filing jointly; otherwise, enter $1000 ________________________ 1 .00

2. Enter the number of dependents listed on Schedule IN-DEP, Box 5 x $1000 __________ 2 .00

You MUST enclose Schedule IN-DEP.

3. You may claim an additional exemption for each qualifying dependent child:

• who is a son, stepson, daughter, stepdaughter, foster child and/or child for whom you are a

legal guardian;

• who was under the age of 19 by Dec. 31, 2024; or

• who is a full-time student who was under the age of 24 by Dec. 31, 2024; and

• who you are eligible to claim as a dependent on line 2 above.

Enter the number of additional dependents

listed on Schedule IN-DEP, Box 6. x $1500 _____________________________ 3 .00

4. Place “X” in box(es) below if, by December 31, 2024:

You were age 65 or older and/or blind

Spouse was 65 or older and/or blind

Total number of boxes with Xs x $1000 _____________________________________ 4 .00

5. If age 65 or older, enter amount from Schedule A, line 36A.

• If filing as married filing separately and this amount is less than $20,000, place “X” in

the “You were age 65 or older” box below.

• For all other filers age 65 or older, if this amount is less than $40,000, place “X” in

appropriate box(es) below.

You were age 65 or older

Spouse was 65 or older

Total number of boxes with Xs x $500 ______________________________________ 5 .00

6. Enter the number of additional adopted child

exemptions listed on Schedule IN-DEP-A, Box 6 x $3000 ________________________ 6 .00

You MUST enclose Schedule IN-DEP-A.

7. Add lines 1, 2, 3, 4, 5 and 6 _______________________________________________________ 7 .00

8. Enter the number from Schedule A, Proration Section, line 21D ___________________________ 8 .

9. Multiply line 7 by line 8. Enter here and on Form IT-40PNR, line 6 __________Total Exemptions 9 .00

*23724111694*

23724111694