Enlarge image

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

4 4

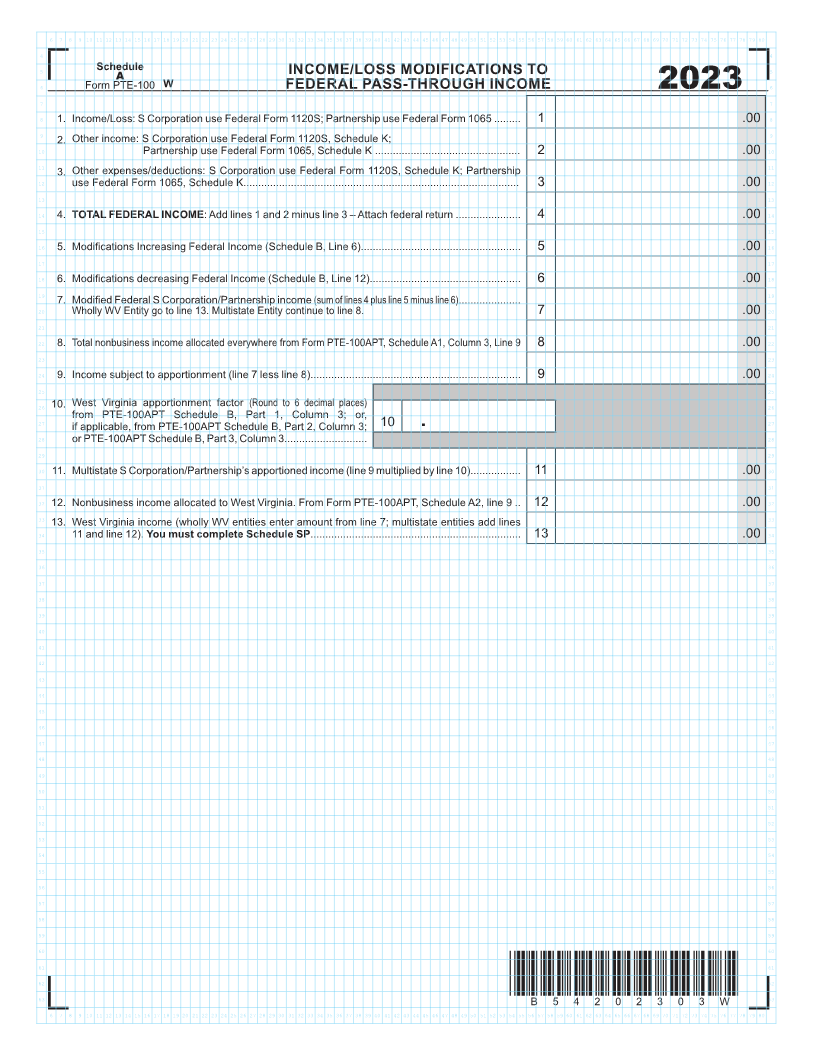

5 Schedule INCOME/LOSS MODIFICATIONS TO 5

A

6 6

Form PTE-100 W FEDERAL PASS-THROUGH INCOME 2023

7 7

8 1. Income/Loss: S Corporation use Federal Form 1120S; Partnership use Federal Form 1065 ......... 1 .00 8

9 9

2. Other income: S Corporation use Federal Form 1120S, Schedule K;

10 Partnership use Federal Form 1065, Schedule K ................................................. 2 .00 10

11 11

3. Other expenses/deductions: S Corporation use Federal Form 1120S, Schedule K; Partnership

12 use Federal Form 1065, Schedule K............................................................................................. 3 .00 12

13 13

14 4. TOTAL FEDERAL INCOME: Add lines 1 and 2 minus line 3 – Attach federal return ...................... 4 .00 14

15 15

16 5. Modifications Increasing Federal Income (Schedule B, Line 6)...................................................... 5 .00 16

17 17

18 6. Modifications decreasing Federal Income (Schedule B, Line 12)................................................... 6 .00 18

19 19

7. Modified Federal S Corporation/Partnership income (sum of lines 4 plus line 5 minus line 6).....................

20 Wholly WV Entity go to line 13. Multistate Entity continue to line 8. 7 .00 20

21 21

22 8. Total nonbusiness income allocated everywhere from Form PTE-100APT, Schedule A1, Column 3, Line 9 8 .00 22

23 23

24 9. Income subject to apportionment (line 7 less line 8)....................................................................... 9 .00 24

25 25

26 10. West Virginia apportionment factor (Round to 6 decimal places) 26

27 from PTE-100APT Schedule B, Part 1, Column 3; or, 27

if applicable, from PTE-100APT Schedule B, Part 2, Column 3; 10 .

28 or PTE-100APT Schedule B, Part 3, Column 3............................ 28

29 29

30 11. Multistate S Corporation/Partnership’s apportioned income (line 9 multiplied by line 10)................. 11 .00 30

31 31

32 12. Nonbusiness income allocated to West Virginia. From Form PTE-100APT, Schedule A2, line 9 .. 12 .00 32

33 13. West Virginia income (wholly WV entities enter amount from line 7; multistate entities add lines 33

34 11 and line 12). You must complete Schedule SP....................................................................... 13 .00 34

35 35

36 36

37 37

38 38

39 39

40 40

41 41

42 42

43 43

44 44

45 45

46 46

47 47

48 48

49 49

50 50

51 51

52 52

53 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

*B54202303W*

63 B54202303W 63

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980