Enlarge image

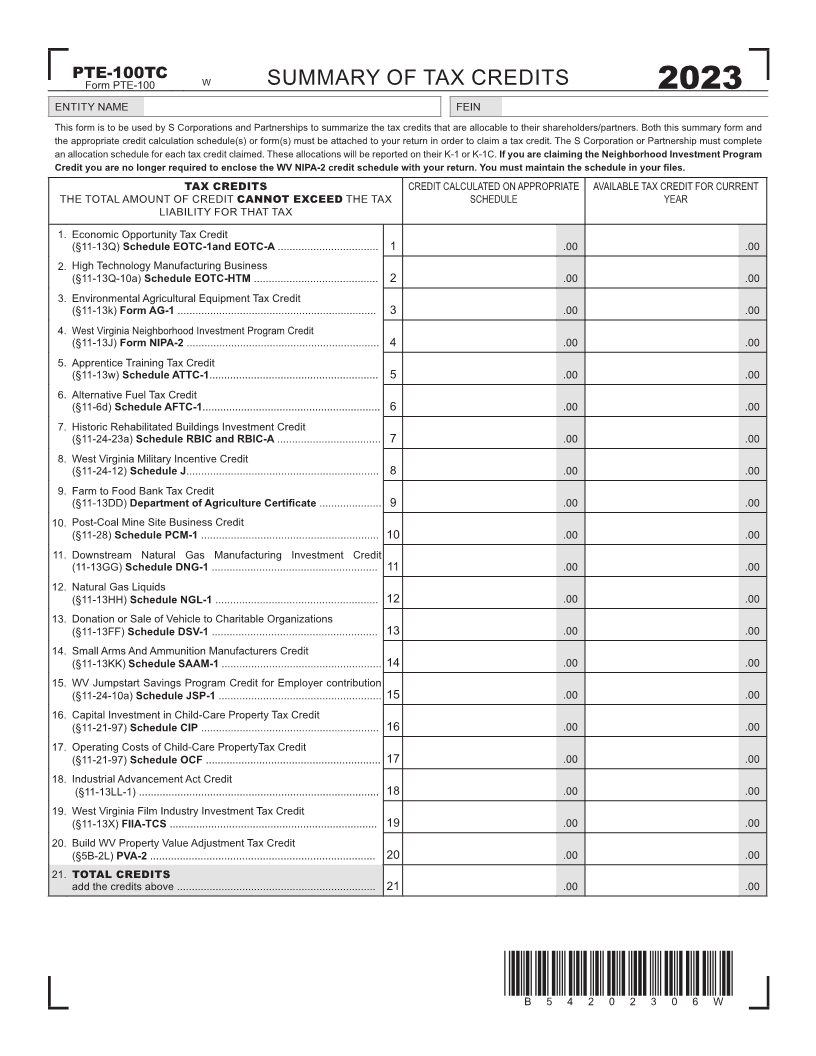

PTE-100TC W

Form PTE-100 SUMMARY OF TAX CREDITS

2023

ENTITY NAME FEIN

This form is to be used by S Corporations and Partnerships to summarize the tax credits that are allocable to their shareholders/partners. Both this summary form and

the appropriate credit calculation schedule(s) or form(s) must be attached to your return in order to claim a tax credit. The S Corporation or Partnership must complete

an allocation schedule for each tax credit claimed. These allocations will be reported on their K-1 or K-1C. If you are claiming the Neighborhood Investment Program

Credit you are no longer required to enclose the WV NIPA-2 credit schedule with your return. You must maintain the schedule in your files.

TAX CREDITS CREDIT CALCULATED ON APPROPRIATE AVAILABLE TAX CREDIT FOR CURRENT

THE TOTAL AMOUNT OF CREDIT CANNOT EXCEED THE TAX SCHEDULE YEAR

LIABILITY FOR THAT TAX

1. Economic Opportunity Tax Credit

(§11-13Q) Schedule EOTC-1and EOTC-A .................................. 1 .00 .00

2. High Technology Manufacturing Business

(§11-13Q-10a) Schedule EOTC-HTM .......................................... 2 .00 .00

3. Environmental Agricultural Equipment Tax Credit

(§11-13k) Form AG-1 ................................................................... 3 .00 .00

4. West Virginia Neighborhood Investment Program Credit

(§11-13J) Form NIPA-2 ................................................................. 4 .00 .00

5. Apprentice Training Tax Credit

(§11-13w) Schedule ATTC-1......................................................... 5 .00 .00

6. Alternative Fuel Tax Credit

(§11-6d) Schedule AFTC-1............................................................ 6 .00 .00

7. Historic Rehabilitated Buildings Investment Credit

(§11-24-23a) Schedule RBIC and RBIC-A ................................... 7 .00 .00

8. West Virginia Military Incentive Credit

(§11-24-12) Schedule J................................................................. 8 .00 .00

9. Farm to Food Bank Tax Credit

(§11-13DD) Department of Agriculture Certificate ..................... 9 .00 .00

10. Post-Coal Mine Site Business Credit

(§11-28) Schedule PCM-1 ............................................................ 10 .00 .00

11. Downstream Natural Gas Manufacturing Investment Credit

(11-13GG) Schedule DNG-1 ........................................................ 11 .00 .00

12. Natural Gas Liquids

(§11-13HH) Schedule NGL-1 ....................................................... 12 .00 .00

13. Donation or Sale of Vehicle to Charitable Organizations

(§11-13FF) Schedule DSV-1 ........................................................ 13 .00 .00

14. Small Arms And Ammunition Manufacturers Credit

(§11-13KK) Schedule SAAM-1 ...................................................... 14 .00 .00

15. WV Jumpstart Savings Program Credit for Employer contribution

(§11-24-10a) Schedule JSP-1 ....................................................... 15 .00 .00

16. Capital Investment in Child-Care Property Tax Credit

(§11-21-97) Schedule CIP ............................................................ 16 .00 .00

17. Operating Costs of Child-Care PropertyTax Credit

(§11-21-97) Schedule OCF ........................................................... 17 .00 .00

18. Industrial Advancement Act Credit

(§11-13LL-1) ................................................................................. 18 .00 .00

19. West Virginia Film Industry Investment Tax Credit

(§11-13X) FIIA-TCS ...................................................................... 19 .00 .00

20. Build WV Property Value Adjustment Tax Credit

(§5B-2L) PVA-2 ............................................................................ 20 .00 .00

21. TOTAL CREDITS

add the credits above ................................................................... 21 .00 .00

*B54202306W*

B54202306W