Enlarge image

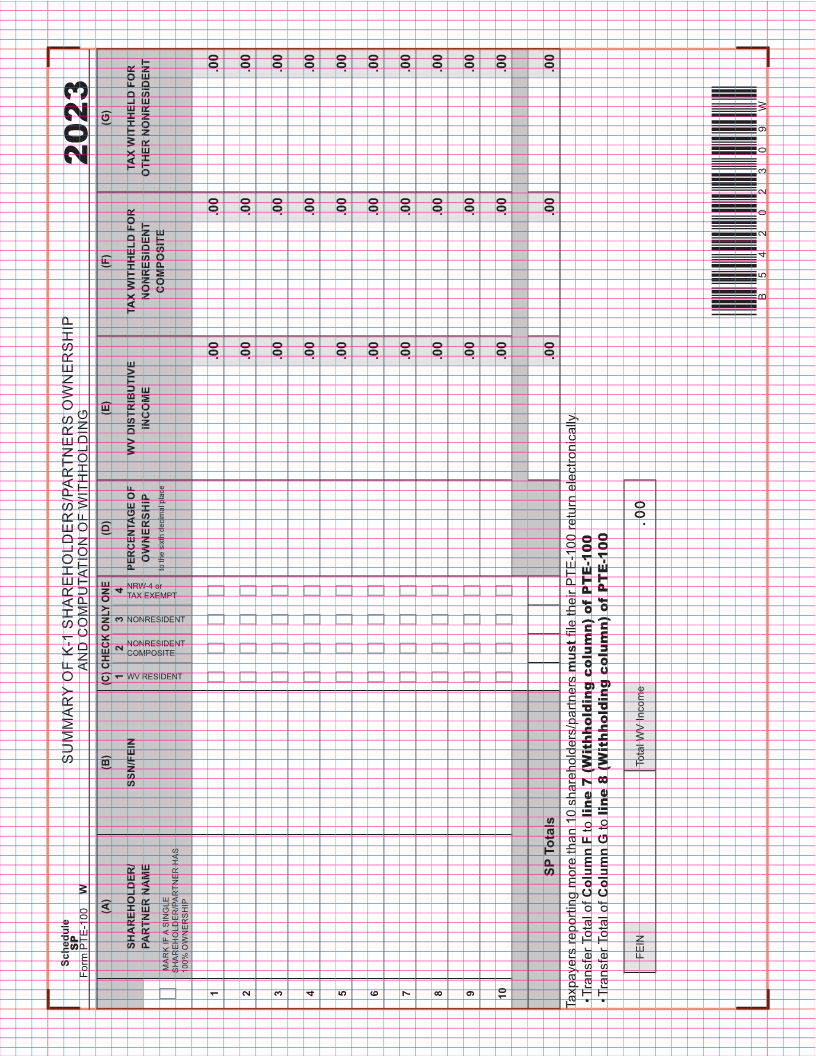

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

(G)

2023

TAX WITHHELD FOR OTHER NONRESIDENT

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

(F)

COMPOSITE

NONRESIDENT B54202309W

TAX WITHHELD FOR *B54202309W*

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

(E)

INCOME

WV DISTRIBUTIVE

.

.00

(D)

OWNERSHIP

PERCENTAGE OF to the sixth decimal place

4NRW-4 or

TAX EXEMPT

3NONRESIDENT

file their PTE-100 return electronically.

2NONRESIDENT

COMPOSITE

AND COMPUTATION OF WITHHOLDING must

(C) CHECK ONLY ONE 1WV RESIDENT

SUMMARY OF K-1 SHAREHOLDERS/PARTNERS OWNERSHIP (B) Total WV Income

SSN/FEIN

line 7 (Withholding column) of PTE-100 line 8 (Withholding column) of PTE-100

to to

SP Totals

W Column F Column G

(A)

SP SHAREHOLDER/ PARTNER NAME

FEIN

Schedule MARK IF A SINGLE SHAREHOLDER/PARTNER HAS 100% OWNERSHIP

Form PTE-100

1 2 3 4 5 6 7 8 9 10 • Transfer Total of • Transfer Total of

Taxpayers reporting more than 10 shareholders/partners