Enlarge image

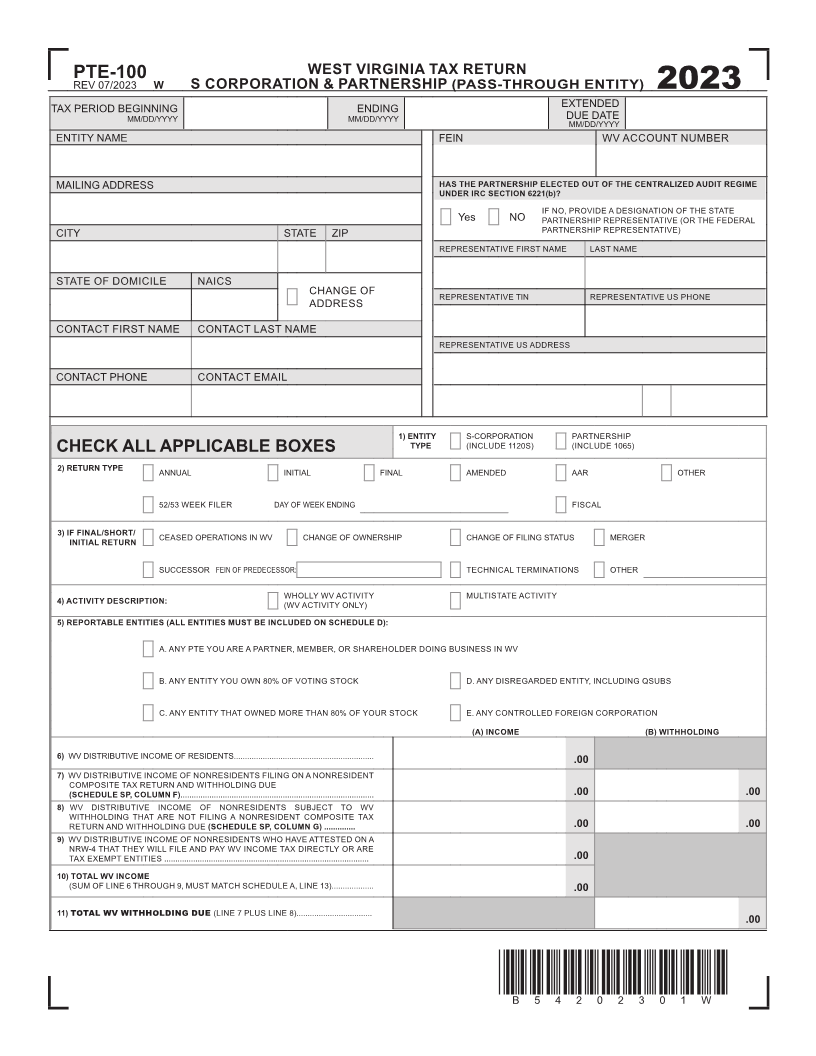

WEST VIRGINIA TAX RETURN

REVPTE-10007/2023 W S CORPORATION & PARTNERSHIP (PASS-THROUGH ENTITY) 2023

TAX PERIOD BEGINNING ENDING EXTENDED

MM/DD/YYYY MM/DD/YYYY DUE DATE

MM/DD/YYYY

ENTITY NAME FEIN WV ACCOUNT NUMBER

MAILING ADDRESS HAS THE PARTNERSHIP ELECTED OUT OF THE CENTRALIZED AUDIT REGIME

UNDER IRC SECTION 6221(b)?

IF NO, PROVIDE A DESIGNATION OF THE STATE

Yes NO PARTNERSHIP REPRESENTATIVE (OR THE FEDERAL

CITY STATE ZIP PARTNERSHIP REPRESENTATIVE)

REPRESENTATIVE FIRST NAME LAST NAME

STATE OF DOMICILE NAICS

CHANGE OF REPRESENTATIVE TIN REPRESENTATIVE US PHONE

ADDRESS

CONTACT FIRST NAME CONTACT LAST NAME

REPRESENTATIVE US ADDRESS

CONTACT PHONE CONTACT EMAIL

1) ENTITY S-CORPORATION PARTNERSHIP

CHECK ALL APPLICABLE BOXES TYPE (INCLUDE 1120S) (INCLUDE 1065)

2) RETURN TYPE ANNUAL INITIAL FINAL AMENDED AAR OTHER

52/53 WEEK FILER DAY OF WEEK ENDING FISCAL

3) IF FINAL/SHORT/ CEASED OPERATIONS IN WV CHANGE OF OWNERSHIP CHANGE OF FILING STATUS MERGER

INITIAL RETURN

SUCCESSOR FEIN OF PREDECESSOR: TECHNICAL TERMINATIONS OTHER

4) ACTIVITY DESCRIPTION: WHOLLY WV ACTIVITY MULTISTATE ACTIVITY

(WV ACTIVITY ONLY)

5) REPORTABLE ENTITIES (ALL ENTITIES MUST BE INCLUDED ON SCHEDULE D):

A. ANY PTE YOU ARE A PARTNER, MEMBER, OR SHAREHOLDER DOING BUSINESS IN WV

B. ANY ENTITY YOU OWN 80% OF VOTING STOCK D. ANY DISREGARDED ENTITY, INCLUDING QSUBS

C. ANY ENTITY THAT OWNED MORE THAN 80% OF YOUR STOCK E. ANY CONTROLLED FOREIGN CORPORATION

(A) INCOME (B) WITHHOLDING

6) WV DISTRIBUTIVE INCOME OF RESIDENTS............................................................... .00

7) WV DISTRIBUTIVE INCOME OF NONRESIDENTS FILING ON A NONRESIDENT

COMPOSITE TAX RETURN AND WITHHOLDING DUE

(SCHEDULE SP, COLUMN F)....................................................................................... .00 .00

8) WV DISTRIBUTIVE INCOME OF NONRESIDENTS SUBJECT TO WV

WITHHOLDING THAT ARE NOT FILING A NONRESIDENT COMPOSITE TAX

RETURN AND WITHHOLDING DUE (SCHEDULE SP, COLUMN G) .............. .00 .00

9) WV DISTRIBUTIVE INCOME OF NONRESIDENTS WHO HAVE ATTESTED ON A

NRW-4 THAT THEY WILL FILE AND PAY WV INCOME TAX DIRECTLY OR ARE

TAX EXEMPT ENTITIES ............................................................................................ .00

10) TOTAL WV INCOME

(SUM OF LINE 6 THROUGH 9, MUST MATCH SCHEDULE A, LINE 13)................... .00

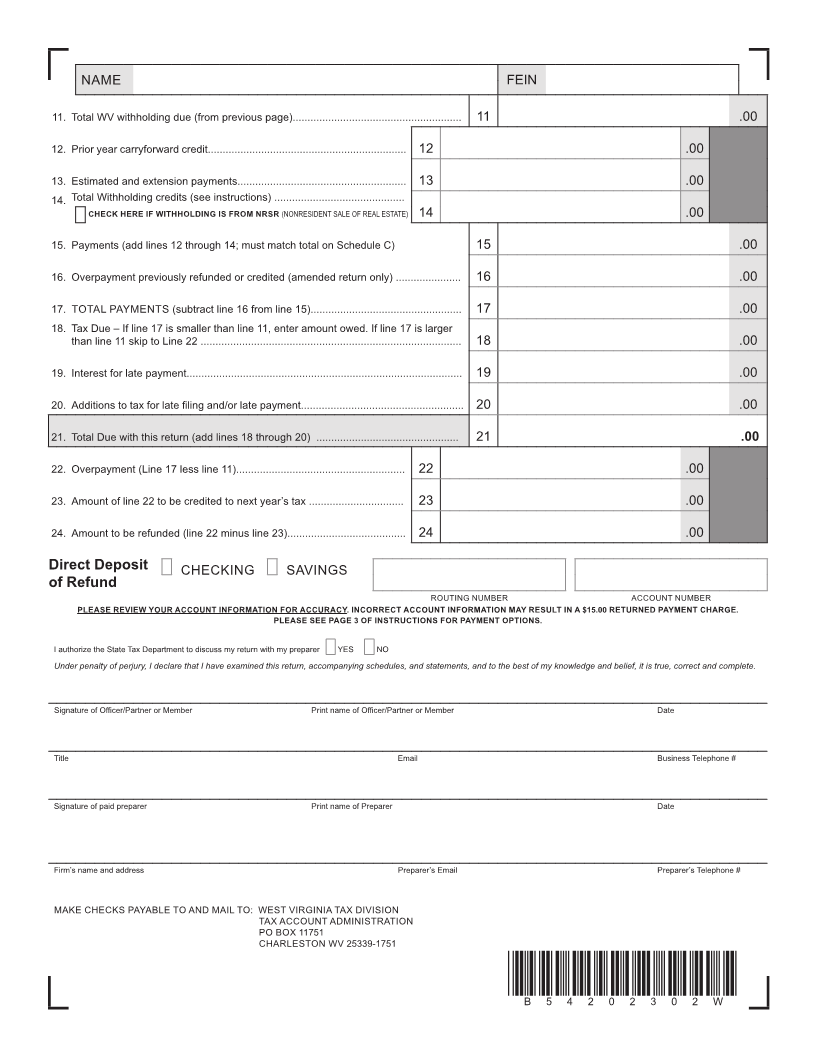

11) TOTAL WV WITHHOLDING DUE (LINE 7 PLUS LINE 8)..................................

.00

*B54202301W*

B54202301W