Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

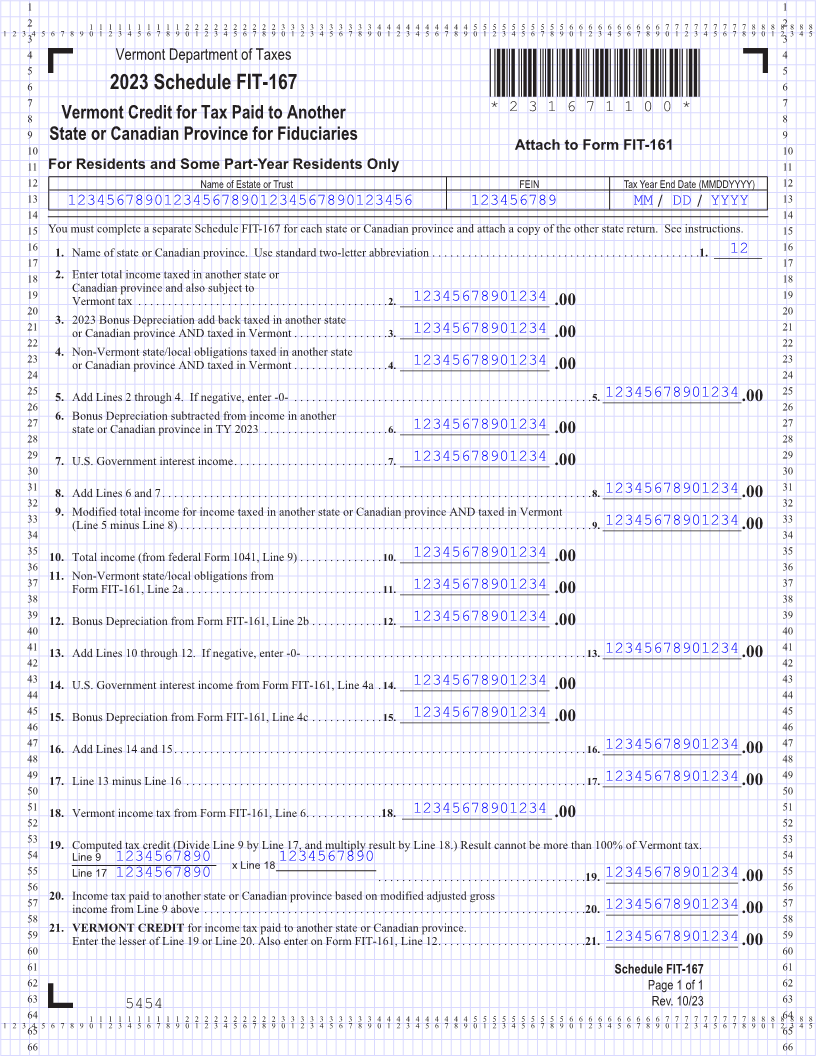

4 Vermont Department of Taxes 4

5 5

6 2023 Schedule FIT-167 *231671100* 6

7 7

Vermont Credit for Tax Paid to Another *231671100*

8 8 Page 3

9 State or Canadian Province for Fiduciaries 9

10 Attach to Form FIT-161 10

11 For Residents and Some Part-Year Residents Only 11

12 Name of Estate or Trust FEIN Tax Year End Date (MMDDYYYY) 12

13 123456789012345678901234567890123456 123456789 MM / DD / YYYY 13

14 14

15 You must complete a separate Schedule FIT-167 for each state or Canadian province and attach a copy of the other state return. See instructions. 15

16 121. Name of state or Canadian province. Use standard two-letter abbreviation ............................................. 1. ________ 16

17 17

18 2. Enter total income taxed in another state or 18

19 Canadian province and also subject to 19

12345678901234Vermont tax .......................................... 2. ____________________________ .00

20 20

21 3. 2023 Bonus Depreciation add back taxed in another state 21

12345678901234or Canadian province AND taxed in Vermont ................ 3. ____________________________ .00

22 22

23 4. Non-Vermont state/local obligations taxed in another state 23

12345678901234or Canadian province AND taxed in Vermont ................ 4. ____________________________ .00

24 24

25 12345678901234 25 FORM (Place at FIRST page)

5. Add Lines 2 through 4. If negative, enter -0- .................................................. 5. __________________________.00

26 26 Form pages

27 6. Bonus Depreciation subtracted from income in another 27

12345678901234state or Canadian province in TY 2023 ..................... 6. ____________________________ .00

28 28

29 29

12345678901234 7. U.S. Government interest income .......................... 7. ____________________________ .00

30 30

31 31

12345678901234 8. Add Lines 6 and 7 ........................................................................ 8. __________________________.00 3 - 3

32 32

33 9. Modified total income for income taxed in another state or Canadian province AND taxed in Vermont 33

12345678901234(Line 5 minus Line 8) ..................................................................... 9. __________________________.00

34 34

35 35

12345678901234 10. Total income (from federal Form 1041, Line 9) ..............10. ____________________________ .00

36 36

37 11. Non-Vermont state/local obligations from 37

12345678901234Form FIT-161, Line 2a ................................. 11. ____________________________ .00

38 38

39 39

12345678901234 12. Bonus Depreciation from Form FIT-161, Line 2b ............ 12. ____________________________ .00

40 40

41 41

12345678901234 13. Add Lines 10 through 12. If negative, enter -0- ............................................... 13. __________________________.00

42 42

43 43

12345678901234 14. U.S. Government interest income from Form FIT-161, Line 4a . 14. ____________________________ .00

44 44

45 45

12345678901234 15. Bonus Depreciation from Form FIT-161, Line 4c ............ 15. ____________________________ .00

46 46

47 47

12345678901234 16. Add Lines 14 and 15 ..................................................................... 16. __________________________.00

48 48

49 49

12345678901234 17. Line 13 minus Line 16 ................................................................... 17. __________________________.00

50 50

51 51

12345678901234 18. Vermont income tax from Form FIT-161, Line 6 ............. 18. _________________________.00

52 52

53 53 FORM (Place at LAST page)

19. Computed tax credit (Divide Line 9 by Line 17, and multiply result by Line 18.) Result cannot be more than 100% of Vermont tax. Form pages

54 Line 9 1234567890 1234567890 54

x Line 18

55 Line 17 1234567890 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .19. 12345678901234______________________ .00 55

56 56

57 20. Income tax paid to another state or Canadian province based on modified adjusted gross 57

12345678901234income from Line 9 above ................................ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20. ______________________ .00

58 58

59 21. VERMONT CREDIT for income tax paid to another state or Canadian province. 59

3 - 3

12345678901234Enter the lesser of Line 19 or Line 20. Also enter on Form FIT-161, Line 12 ......................... 21. ______________________ .00

60 60

61 Schedule FIT-167 61

62 Page 1 of 1 62

63 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 54541 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66