Enlarge image

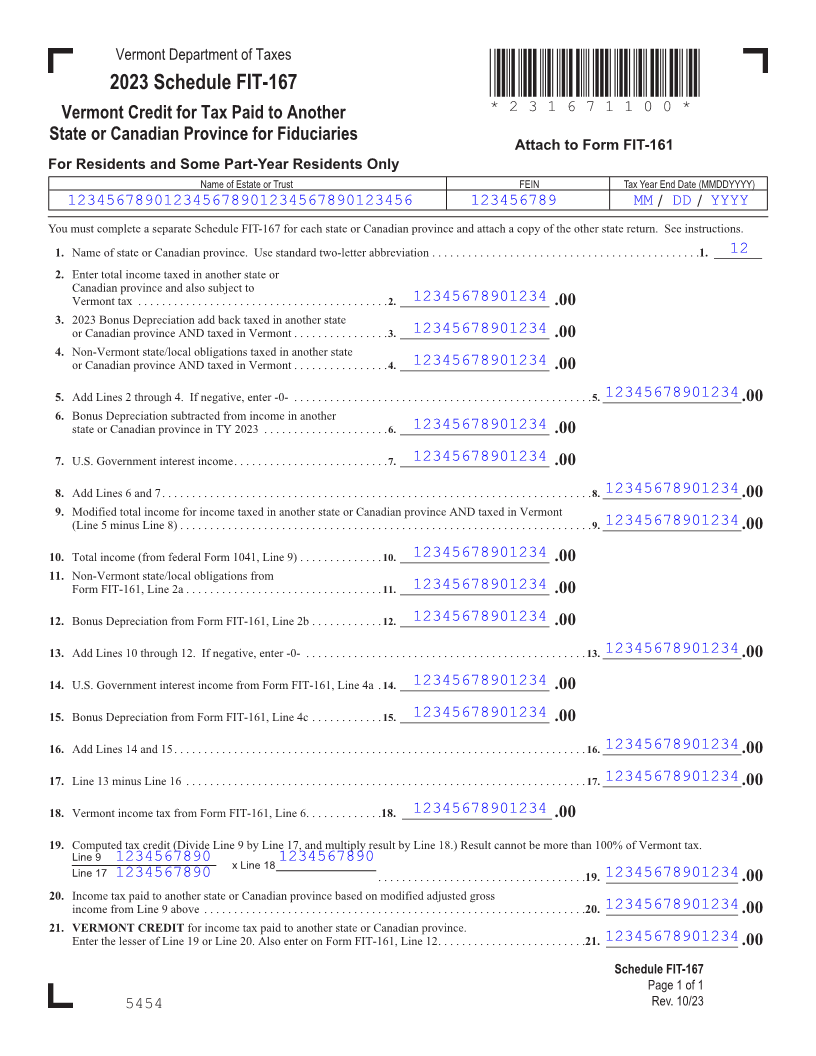

Vermont Department of Taxes

2023 Schedule FIT-167 *231671100*

Vermont Credit for Tax Paid to Another *231671100*

Page 3

State or Canadian Province for Fiduciaries

Attach to Form FIT-161

For Residents and Some Part-Year Residents Only

Name of Estate or Trust FEIN Tax Year End Date (MMDDYYYY)

123456789012345678901234567890123456 123456789 MM / DD / YYYY

You must complete a separate Schedule FIT-167 for each state or Canadian province and attach a copy of the other state return. See instructions.

12 1. Name of state or Canadian province. Use standard two-letter abbreviation .............................................1. ________

2. Enter total income taxed in another state or

Canadian province and also subject to

12345678901234Vermont tax ..........................................2. ____________________________ .00

3. 2023 Bonus Depreciation add back taxed in another state

12345678901234or Canadian province AND taxed in Vermont ................3. ____________________________ .00

4. Non-Vermont state/local obligations taxed in another state

12345678901234or Canadian province AND taxed in Vermont ................4. ____________________________ .00

12345678901234 5. Add Lines 2 through 4. If negative, enter -0- ..................................................5. __________________________.00 FORM (Place atFIRST page)

Form pages

6. Bonus Depreciation subtracted from income in another

12345678901234state or Canadian province in TY 2023 .....................6. ____________________________ .00

12345678901234 7. U.S. Government interest income ..........................7. ____________________________ .00

12345678901234 8. Add Lines 6 and 7 ........................................................................8. __________________________.00 3 - 3

9. Modified total income for income taxed in another state or Canadian province AND taxed in Vermont

12345678901234(Line 5 minus Line 8) .....................................................................9. __________________________.00

12345678901234 10. Total income (from federal Form 1041, Line 9) ..............10. ____________________________ .00

11. Non-Vermont state/local obligations from

12345678901234Form FIT-161, Line 2a ................................. 11. ____________________________ .00

12345678901234 12. Bonus Depreciation from Form FIT-161, Line 2b ............ 12. ____________________________ .00

12345678901234 13. Add Lines 10 through 12. If negative, enter -0- ............................................... 13. __________________________.00

12345678901234 14. U.S. Government interest income from Form FIT-161, Line 4a . 14. ____________________________ .00

12345678901234 15. Bonus Depreciation from Form FIT-161, Line 4c ............ 15. ____________________________ .00

12345678901234 16. Add Lines 14 and 15 ..................................................................... 16. __________________________.00

12345678901234 17. Line 13 minus Line 16 ................................................................... 17. __________________________.00

12345678901234 18. Vermont income tax from Form FIT-161, Line 6 .............18. _________________________.00

FORM (Place at LAST page)

19. Computed tax credit (Divide Line 9 by Line 17, and multiply result by Line 18.) Result cannot be more than 100% of Vermont tax. Form pages

Line 9 1234567890 1234567890

x Line 18

Line 17 1234567890 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .19. 12345678901234______________________ .00

20. Income tax paid to another state or Canadian province based on modified adjusted gross

12345678901234income from Line 9 above ................................ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20. ______________________ .00

21. VERMONT CREDIT for income tax paid to another state or Canadian province.

3 - 3

12345678901234Enter the lesser of Line 19 or Line 20. Also enter on Form FIT-161, Line 12 .........................21. ______________________ .00

Schedule FIT-167

Page 1 of 1

Rev. 10/23

5454