Enlarge image

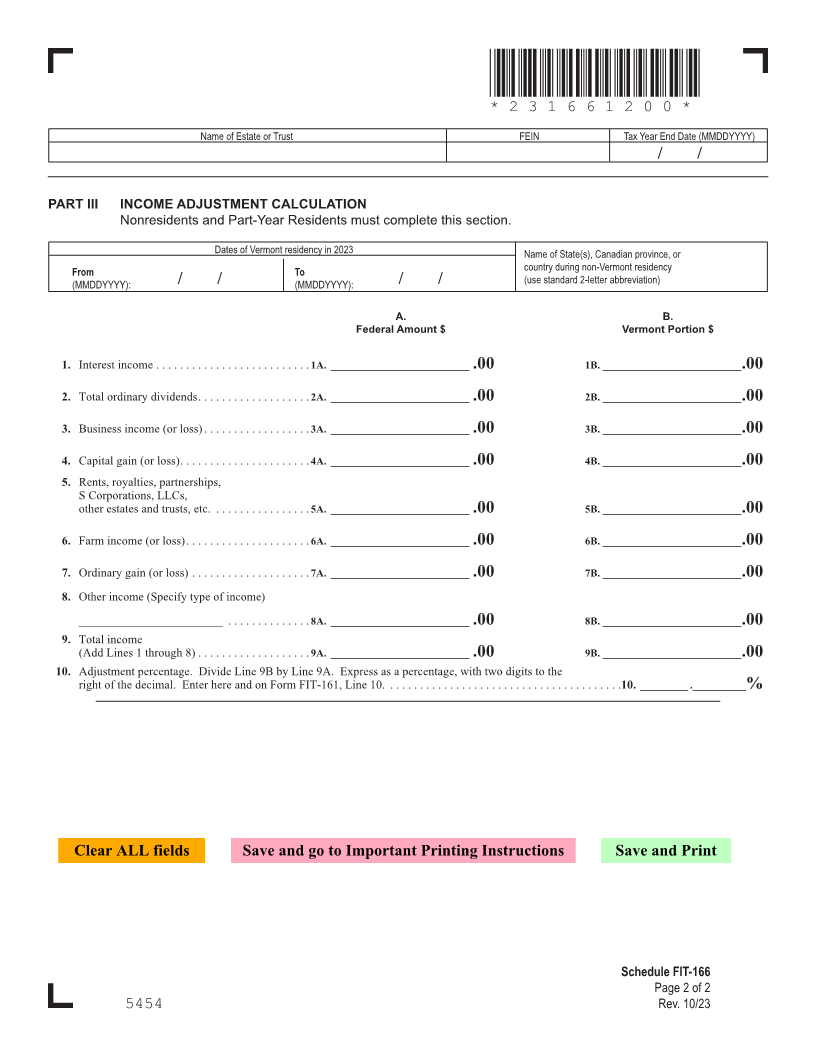

Vermont Department of Taxes

2023 Schedule FIT-166 *231661100*

Vermont Income Adjustments and *231661100*

Page 3

Tax Computations for Fiduciaries Attach to Form FIT-161

Name of Estate or Trust FEIN Tax Year End Date (MMDDYYYY)

/ // /

PART I Taxable Municipal Bond Income

1. Total interest and dividend income from all state and local obligations exempt from

federal tax (See Line-by-Line Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.. ______________________.00

2. Interest and dividend income from Vermont state and local obligations included in Line 1 . . . . . . . . . . . . . 2.. ______________________ .00

3. Income from non-Vermont state and local obligations to be added to Vermont taxable income .

(Subtract Line 2 from Line 1, but not less than zero .) Enter here and on Form FIT-161, Line 2a . . . . . . . . 3.. ______________________ .00

4. If all municipal bond income was distributed, check here so that it does not get added back on Form FIT-161, Line 2a .

FORM (Place at FIRST page)

PART II ADDITIONS AND SUBTRACTIONS TO TAX Form pages

1. Additions to Vermont Tax

1a. Tax on lump-sum distributions

(from federal Forms 4972 and 5329) . . . . . . . . . . . . . . . . . . . . . .1a. ______________________ .00

1b. Recapture of federal investment credit

(from federal Form 4255) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b. ______________________ .00 3 - 4

1c. Total additions (Add Lines 1a and 1b; then, multiply by 24%) .

Enter here and on Form FIT-161, Line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1c. ______________________ .00

2 Subtractions from Vermont tax

2a. Investment tax credit - Vermont-based only

(from federal Form 3468) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2a. ______________________ .00

2b. Multiply Line 2a by 24% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b. ______________________ .00

2c. Research & Development Credit, 32 V .S .A . § 5930d . . . . . . . . . 2c. ______________________ .00

2d. Charitable Housing Credit, 32 V .S .A § 5830c . . . . . . . . . . . . . . 2d. ______________________ .00

2e. Total subtractions from Vermont tax (Add Lines 2b, 2c, and 2d)

Enter here and on Form FIT-161, Line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2e. ______________________ .00

Clear ALL fields Save and go to Important Printing Instructions Save and Print

Schedule FIT-166

Page 1 of 2

5454 Rev. 10/23