Enlarge image

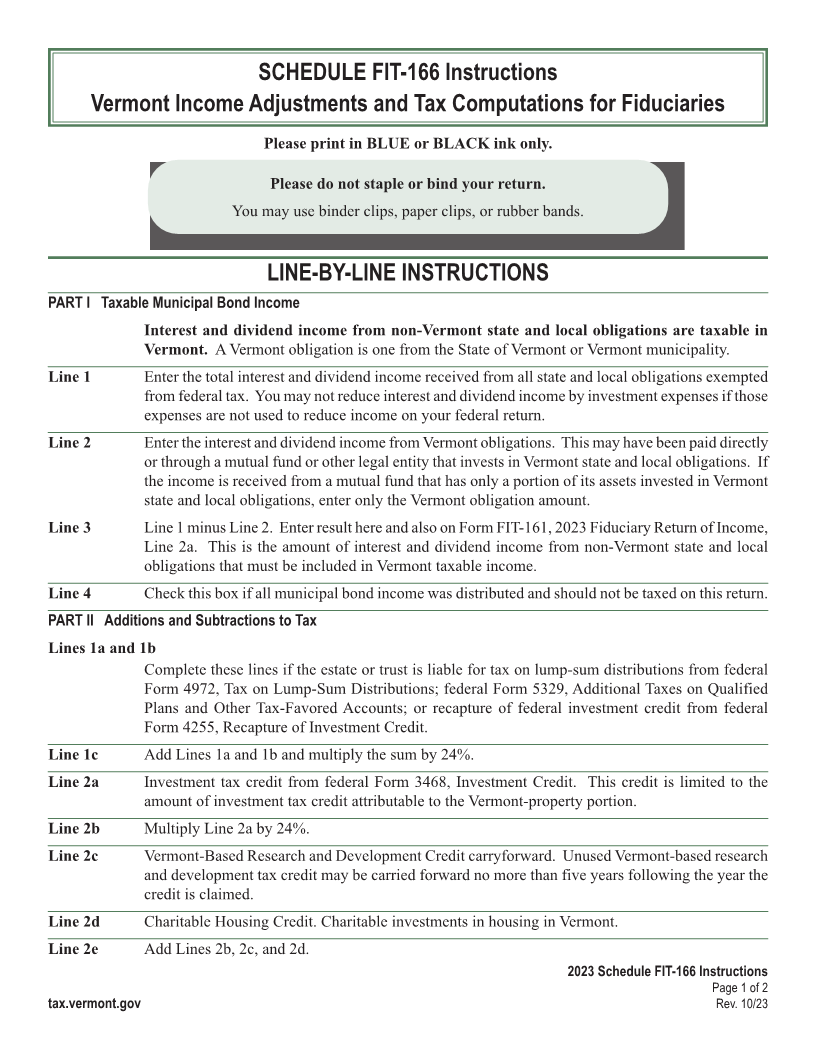

SCHEDULE FIT-166 Instructions

Vermont Income Adjustments and Tax Computations for Fiduciaries

Page 1

Please print in BLUE or BLACK ink only.

Please do not staple or bind your return.

You may use binder clips, paper clips, or rubber bands.

LINE-BY-LINE INSTRUCTIONS

PART I Taxable Municipal Bond Income

Interest and dividend income from non-Vermont state and local obligations are taxable in

Vermont. A Vermont obligation is one from the State of Vermont or Vermont municipality.

Line 1 Enter the total interest and dividend income received from all state and local obligations exempted

from federal tax. You may not reduce interest and dividend income by investment expenses if those INSTR (Place at FIRST page)

Instr. pages

expenses are not used to reduce income on your federal return.

Line 2 Enter the interest and dividend income from Vermont obligations. This may have been paid directly

or through a mutual fund or other legal entity that invests in Vermont state and local obligations. If

the income is received from a mutual fund that has only a portion of its assets invested in Vermont

1 - 2

state and local obligations, enter only the Vermont obligation amount.

Line 3 Line 1 minus Line 2. Enter result here and also on Form FIT-161, 2023 Fiduciary Return of Income,

Line 2a. This is the amount of interest and dividend income from non-Vermont state and local

obligations that must be included in Vermont taxable income.

Line 4 Check this box if all municipal bond income was distributed and should not be taxed on this return.

PART II Additions and Subtractions to Tax

Lines 1a and 1b

Complete these lines if the estate or trust is liable for tax on lump-sum distributions from federal

Form 4972, Tax on Lump-Sum Distributions; federal Form 5329, Additional Taxes on Qualified

Plans and Other Tax-Favored Accounts; or recapture of federal investment credit from federal

Form 4255, Recapture of Investment Credit.

Line 1c Add Lines 1a and 1b and multiply the sum by 24%.

Line 2a Investment tax credit from federal Form 3468, Investment Credit. This credit is limited to the

amount of investment tax credit attributable to the Vermont-property portion.

Line 2b Multiply Line 2a by 24%.

Line 2c Vermont-Based Research and Development Credit carryforward. Unused Vermont-based research

and development tax credit may be carried forward no more than five years following the year the

credit is claimed.

Line 2d Charitable Housing Credit. Charitable investments in housing in Vermont.

Line 2e Add Lines 2b, 2c, and 2d.

2023 Schedule FIT-166 Instructions

Page 1 of 2

tax.vermont.gov Rev. 10/23