Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

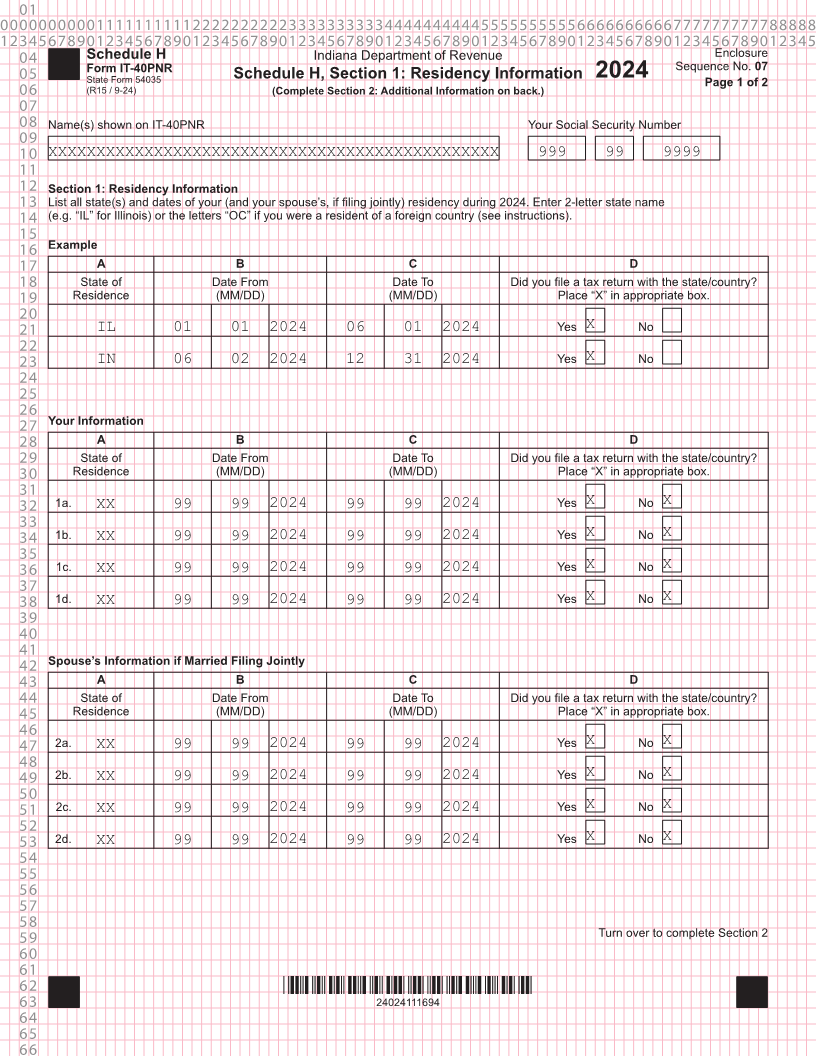

04 Schedule H Indiana Department of Revenue Enclosure

Form IT-40PNR Sequence No. 07

05 State Form 54035 Schedule H, Section 1: Residency Information 2024 Page 1 of 2

06 (R15 / 9-24) (Complete Section 2: Additional Information on back.)

07

08 Name(s) shown on IT-40PNR Your Social Security Number

09

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

11

12 Section 1: Residency Information

13 List all state(s) and dates of your (and your spouse’s, if filing jointly) residency during 2024. Enter 2-letter state name

14 (e.g. “IL” for Illinois) or the letters “OC” if you were a resident of a foreign country (see instructions).

15

16 Example

17 A B C D

18 State of Date From Date To Did you file a tax return with the state/country?

19 Residence (MM/DD) (MM/DD) Place “X” in appropriate box.

20

21 IL 01 01 2024 06 01 2024 Yes X No

22

23 IN 06 02 2024 12 31 2024 Yes X No

24

25

26

27 Your Information

28 A B C D

29 State of Date From Date To Did you file a tax return with the state/country?

30 Residence (MM/DD) (MM/DD) Place “X” in appropriate box.

31

32 1a. XX 99 99 2024 99 99 2024 Yes X No X

33

34 1b. XX 99 99 2024 99 99 2024 Yes X No X

35

36 1c. XX 99 99 2024 99 99 2024 Yes X No X

37

38 1d. XX 99 99 2024 99 99 2024 Yes X No X

39

40

41

42 Spouse’s Information if Married Filing Jointly

43 A B C D

44 State of Date From Date To Did you file a tax return with the state/country?

45 Residence (MM/DD) (MM/DD) Place “X” in appropriate box.

46

47 2a. XX 99 99 2024 99 99 2024 Yes X No X

48

49 2b. XX 99 99 2024 99 99 2024 Yes X No X

50

51 2c. XX 99 99 2024 99 99 2024 Yes X No X

52

53 2d. XX 99 99 2024 99 99 2024 Yes X No X

54

55

56

57

58

59 Turn over to complete Section 2

60

61

62 *24024111694*

63 24024111694

64

65

66