Enlarge image

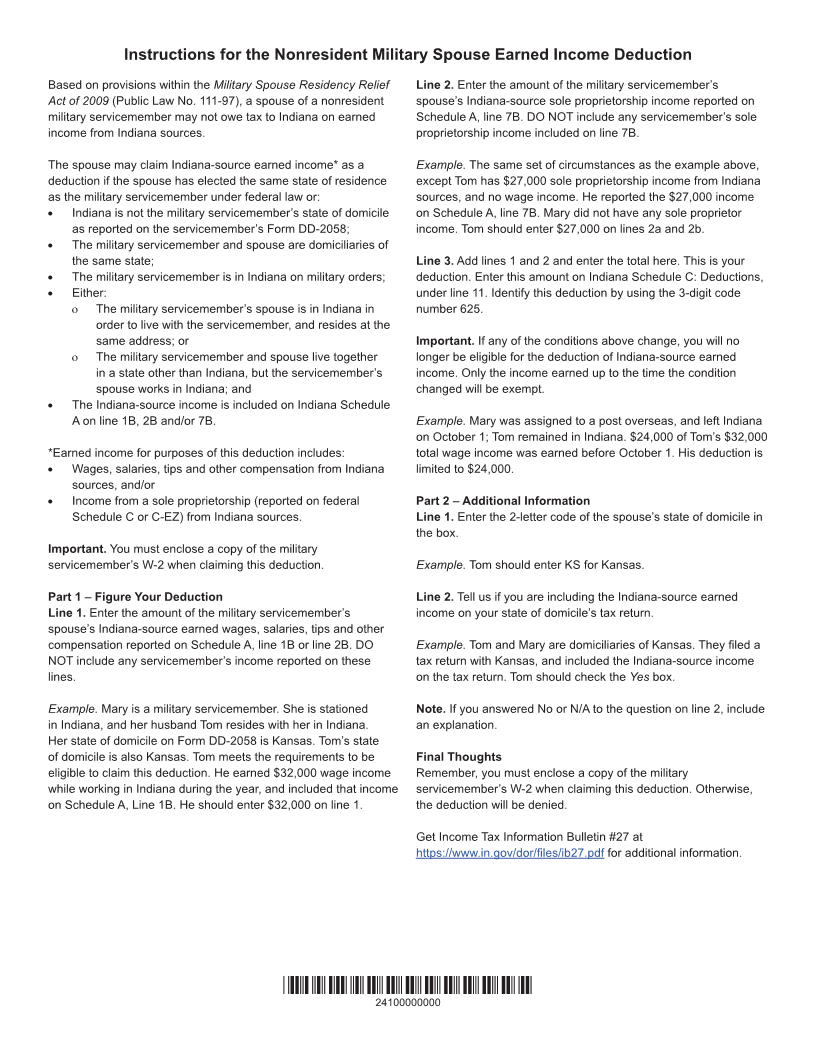

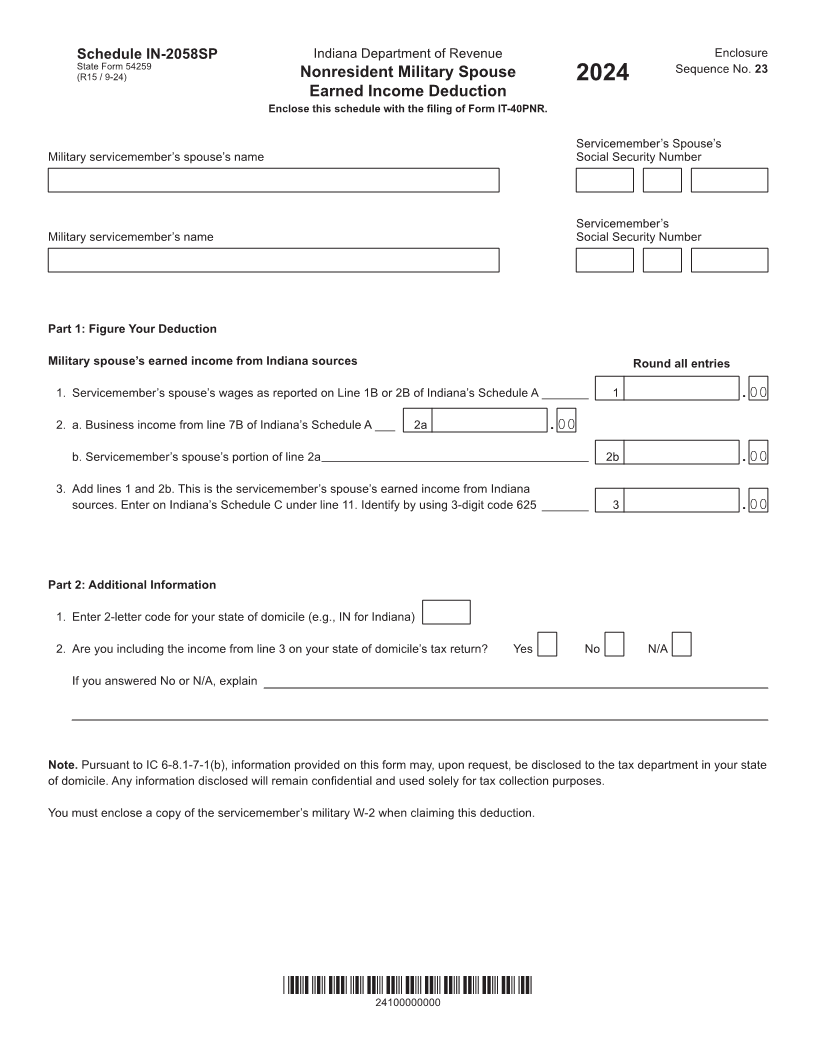

Schedule IN-2058SP Indiana Department of Revenue Enclosure

State Form 54259 Sequence No. 23

(R15 / 9-24) Nonresident Military Spouse 2024

Earned Income Deduction

Enclose this schedule with the filing of Form IT-40PNR.

Servicemember’s Spouse’s

Military servicemember’s spouse’s name Social Security Number

Servicemember’s

Military servicemember’s name Social Security Number

Part 1: Figure Your Deduction

Military spouse’s earned income from Indiana sources Round all entries

1. Servicemember’s spouse’s wages as reported on Line 1B or 2B of Indiana’s Schedule A _______ 1 .00

2. a. Business income from line 7B of Indiana’s Schedule A ___ 2a .00

b. Servicemember’s spouse’s portion of line 2a ________________________________________ 2b .00

3. Add lines 1 and 2b. This is the servicemember’s spouse’s earned income from Indiana

sources. Enter on Indiana’s Schedule C under line 11. Identify by using 3-digit code 625 _______ 3 .00

Part 2: Additional Information

1. Enter 2-letter code for your state of domicile (e.g., IN for Indiana)

2. Are you including the income from line 3 on your state of domicile’s tax return? Yes No N/A

If you answered No or N/A, explain

Note. Pursuant to IC 6-8.1-7-1(b), information provided on this form may, upon request, be disclosed to the tax department in your state

of domicile. Any information disclosed will remain confidential and used solely for tax collection purposes.

You must enclose a copy of the servicemember’s military W-2 when claiming this deduction.

*24100000000*

24100000000