Enlarge image

Schedule IN-ABLE Indiana Department of Revenue Enclosure

Form IT-40/IT-40PNR Indiana’s ABLE 529A Sequence No. 11

State Form 57379 2024

(9-24) Savings Plan Credit

Name(s) shown on Form IT-40/Form IT-40PNR Your Social Security Number

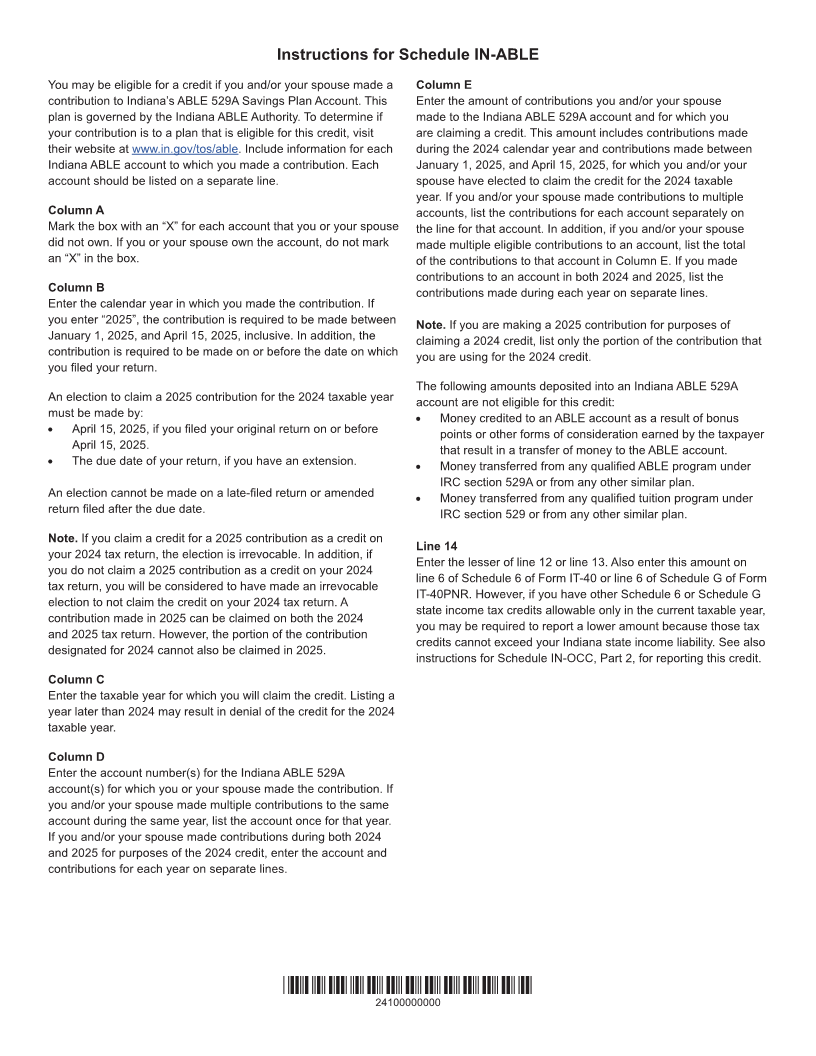

Enter information about contributions made by you and/or your spouse to Indiana’s ABLE 529A Savings Plan(s) during 2024.

Column A Column B Column C Column D Column E

Place “X” in box ABLE Contributions.

Year of Tax Year

if you or your Enter the amount contributed

Contribution Claimed Enter Account Number

spouse do not this year to the Indiana

(YYYY) (YYYY)

own the account. ABLE Savings Plan.

1. 00

2. 00

3. 00

4. 00

5. 00

6. 00

7. 00

8. 00

9. 00

10. Add lines 1E through 9E ........................................................................................................... 00

11. Multiply line 10 by .20 ............................................................................................................... 00

12. Enter the lesser of the amount on line 11, or 500 ..................................................................... 00

13. Enter the amount from Form IT-40 or Form IT-40PNR, line 8 .................................................. 00

14. Allowable credit. Enter the lesser of line 12 or line 13. Also enter under line 6 of Schedule 6

(if filing Form IT-40), or under line 6 of Schedule G (if filing Form IT-40PNR) ...... Total Credit 00

*18124111694*

18124111694