Enlarge image

01

00000000001111111111222222222233333333334444444444555555555566666666667777777777888888888899999999990000000000

12345678901234567890123456789012345678901234567890123456789012345678901234567890123456789012345678901234567890

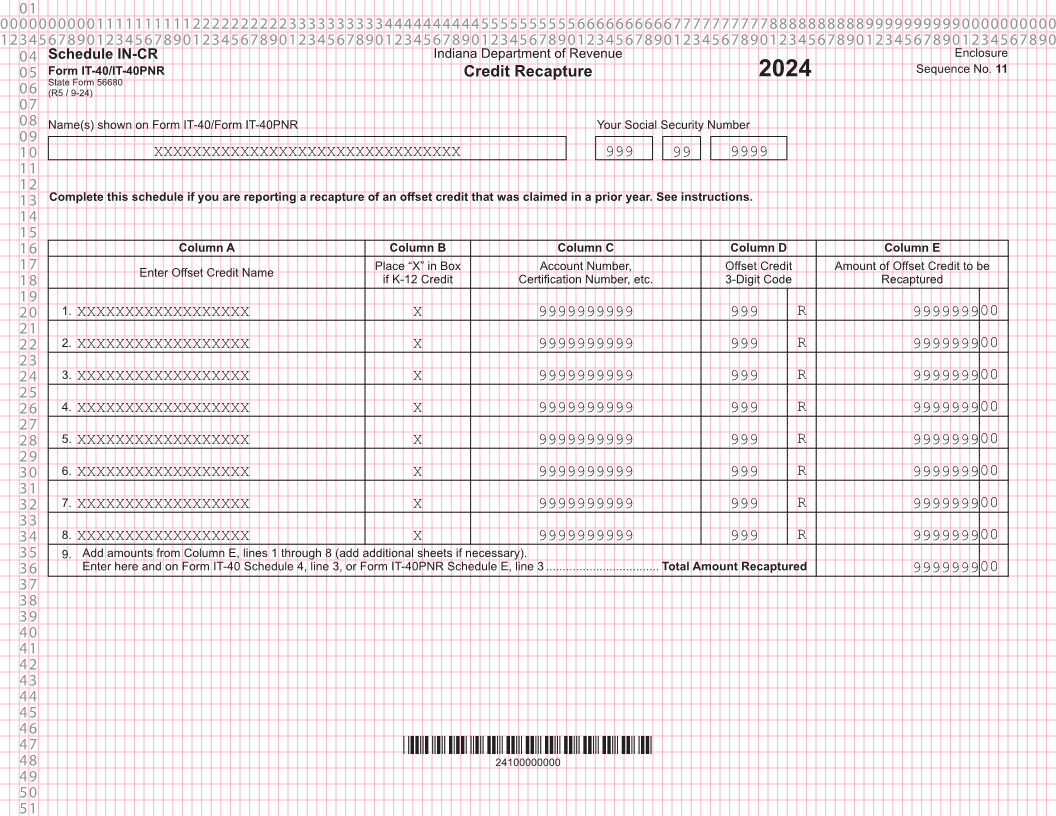

04 Schedule IN-CR Indiana Department of Revenue Enclosure

05 Form IT-40/IT-40PNR Credit Recapture Sequence No. 11

State Form 56680 2024

06 (R5 / 9-24)

07

08 Name(s) shown on Form IT-40/Form IT-40PNR Your Social Security Number

09

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

11

12

13 Complete this schedule if you are reporting a recapture of an offset credit that was claimed in a prior year. See instructions.

14

15

16 Column A Column B Column C Column D Column E

17 Place “X” in Box Account Number, Offset Credit Amount of Offset Credit to be

Enter Offset Credit Name

18 if K-12 Credit Certification Number, etc. 3-Digit Code Recaptured

19

20 1. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 999999900

21

22 2. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 999999900

23

24 3. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 999999900

25

26 4. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 999999900

27

28 5. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 999999900

29

30 6. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 999999900

31

32 7. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 999999900

33

34 8. XXXXXXXXXXXXXXXXXX X 9999999999 999 R 999999900

35 9. Add amounts from Column E, lines 1 through 8 (add additional sheets if necessary).

36 Enter here and on Form IT-40 Schedule 4, line 3, or Form IT-40PNR Schedule E, line 3 .................................. Total Amount Recaptured 999999900

37

38

39

40

41

42

43

44

45

46

47 *24100000000*

48 24100000000

49

50

51