Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

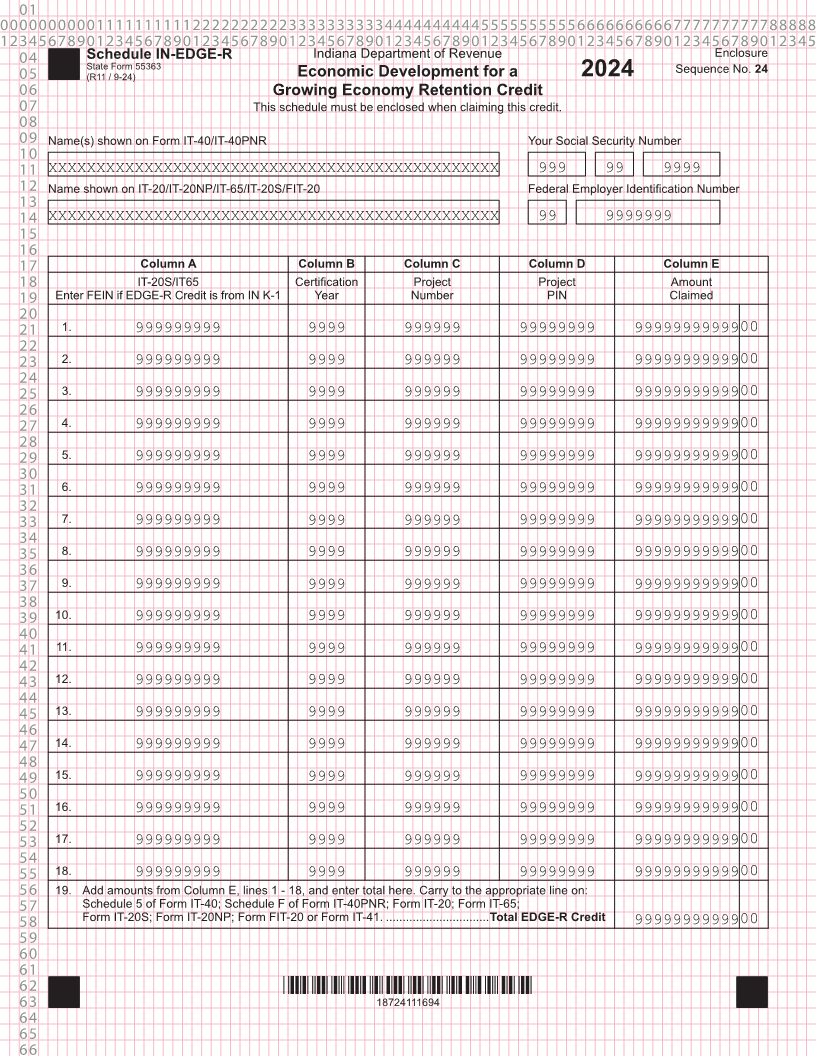

04 Schedule IN-EDGE-R Indiana Department of Revenue Enclosure

State Form 55363 Sequence No. 24

05 (R11 / 9-24) Economic Development for a 2024

06 Growing Economy Retention Credit

07 This schedule must be enclosed when claiming this credit.

08

09 Name(s) shown on Form IT-40/IT-40PNR Your Social Security Number

10

11 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

12 Name shown on IT-20/IT-20NP/IT-65/IT-20S/FIT-20 Federal Employer Identification Number

13

14 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99 9999999

15

16

17 Column A Column B Column C Column D Column E

18 IT-20S/IT65 Certification Project Project Amount

19 Enter FEIN if EDGE-R Credit is from IN K-1 Year Number PIN Claimed

20

21 1. 999999999 9999 999999 99999999 9999999999900

22

23 2. 999999999 9999 999999 99999999 9999999999900

24

25 3. 999999999 9999 999999 99999999 9999999999900

26

27 4. 999999999 9999 999999 99999999 9999999999900

28

29 5. 999999999 9999 999999 99999999 9999999999900

30

31 6. 999999999 9999 999999 99999999 9999999999900

32

33 7. 999999999 9999 999999 99999999 9999999999900

34

35 8. 999999999 9999 999999 99999999 9999999999900

36

37 9. 999999999 9999 999999 99999999 9999999999900

38

39 10. 999999999 9999 999999 99999999 9999999999900

40

41 11. 999999999 9999 999999 99999999 9999999999900

42

43 12. 999999999 9999 999999 99999999 9999999999900

44

45 13. 999999999 9999 999999 99999999 9999999999900

46

47 14. 999999999 9999 999999 99999999 9999999999900

48

49 15. 999999999 9999 999999 99999999 9999999999900

50

51 16. 999999999 9999 999999 99999999 9999999999900

52

53 17. 999999999 9999 999999 99999999 9999999999900

54

55 18. 999999999 9999 999999 99999999 9999999999900

56 19. Add amounts from Column E, lines 1 - 18, and enter total here. Carry to the appropriate line on:

57 Schedule 5 of Form IT-40; Schedule F of Form IT-40PNR; Form IT-20; Form IT-65;

58 Form IT-20S; Form IT-20NP; Form FIT-20 or Form IT-41. ...............................Total EDGE-R Credit 9999999999900

59

60

61

62 *18724111694*

63 18724111694

64

65

66