Enlarge image

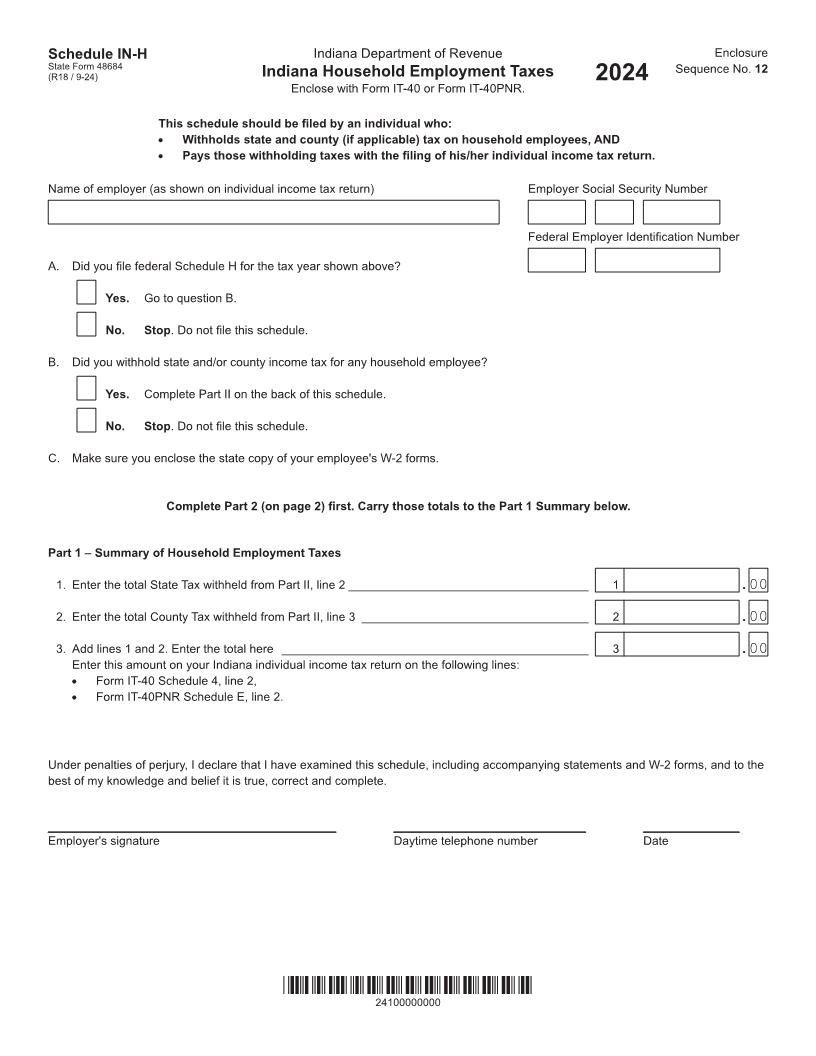

Schedule IN-H Indiana Department of Revenue Enclosure

State Form 48684

(R18 / 9-24) Indiana Household Employment Taxes Sequence No. 12

2024

Enclose with Form IT-40 or Form IT-40PNR.

This schedule should be filed by an individual who:

• Withholds state and county (if applicable) tax on household employees, AND

• Pays those withholding taxes with the filing of his/her individual income tax return.

Name of employer (as shown on individual income tax return) Employer Social Security Number

Federal Employer Identification Number

A. Did you file federal Schedule H for the tax year shown above?

Yes. Go to question B.

No. Stop. Do not file this schedule.

B. Did you withhold state and/or county income tax for any household employee?

Yes. Complete Part II on the back of this schedule.

No. Stop. Do not file this schedule.

C. Make sure you enclose the state copy of your employee's W-2 forms.

Complete Part 2 (on page 2) first. Carry those totals to the Part 1 Summary below.

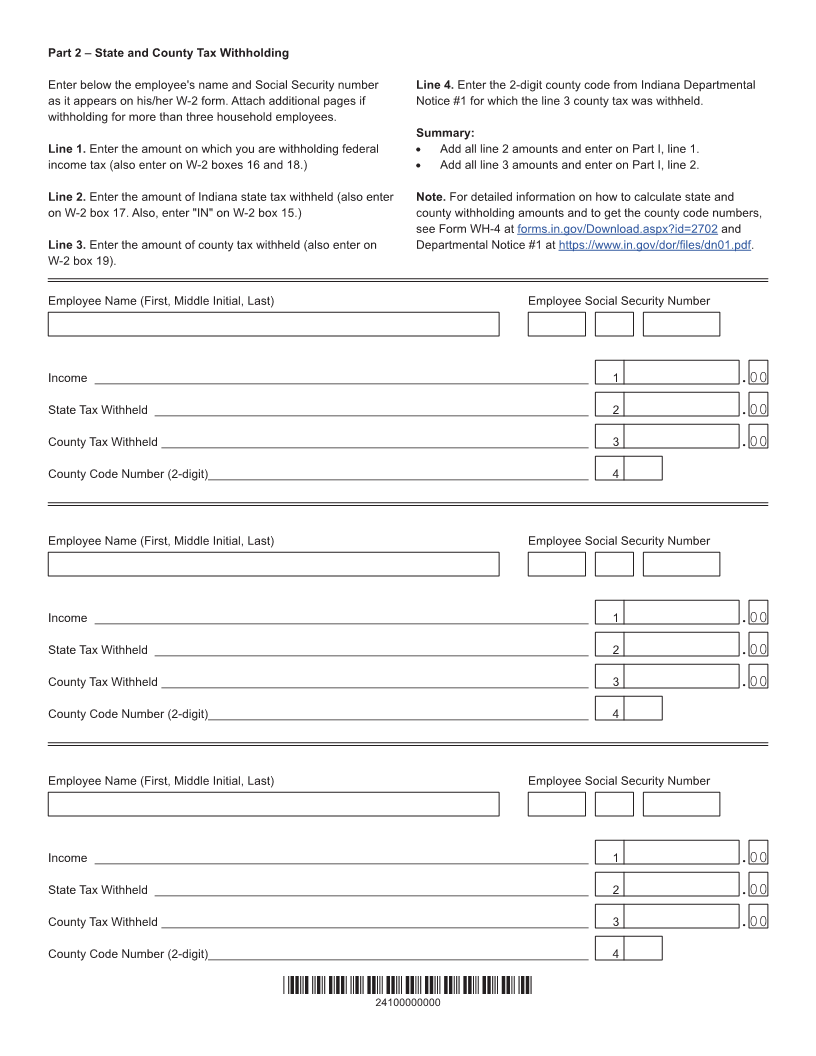

Part 1 – Summary of Household Employment Taxes

1. Enter the total State Tax withheld from Part II, line 2 ____________________________________ 1 .00

2. Enter the total County Tax withheld from Part II, line 3 __________________________________ 2 .00

3. Add lines 1 and 2. Enter the total here ______________________________________________ 3 .00

Enter this amount on your Indiana individual income tax return on the following lines:

• Form IT-40 Schedule 4, line 2,

• Form IT-40PNR Schedule E, line 2.

Under penalties of perjury, I declare that I have examined this schedule, including accompanying statements and W-2 forms, and to the

best of my knowledge and belief it is true, correct and complete.

Employer's signature Daytime telephone number Date

*24100000000*

24100000000