Enlarge image

Schedule IN-OCC Indiana Department of Revenue Enclosure

State Form 55629 Sequence No. 25

(R10 / 9-24) Other Certified Credits 2024

Name shown on Form IT-40/IT-40PNR Your Social Security Number

Name shown on IT-20/IT-20NP/IT-65/IT-20S/FIT-20/IT-41 Federal Employer Identification Number

Complete Part A if you are reporting any of the following credits: Attainable Homeownership Credit, Attainable Homeownership Credit - Composite, EDGE-NR Credit; EDGE-NR

Credit -Composite; Film and Media Production Credit; Film and Medial Production Credit - Composite; Foster Care Donation Credit; Foster Care Donation Credit - Composite;

Headquarters Relocation Credit; Headquarters Relocation Credit - Composite Hoosier Business Investment Credit; Health Reimbursement Arrangement Credit, Historic

Rehabilitation Credit, Historic Rehabilitation Credit - Composite, Hoosier Business Investment Credit - Composite; Hoosier Business Investment Credit - Logistics; Hoosier Business

Investment Credit - Logistics - Composite; Natural Gas Commercial Vehicle Credit; Natural Gas Commercial Vehicle Credit - Composite; Physician Practice Ownership Credit,

Redevelopment Tax Credit; Redevelopment Tax Credit - Composite; School Scholarship Credit; School Scholarship Credit - Composite; Venture Capital Investment Credit; Venture

Capital Investment Credit - Composite; VCI - Qualified Indiana Investment Fund; VCI - Qualified Indiana Investment Fund - Composite.

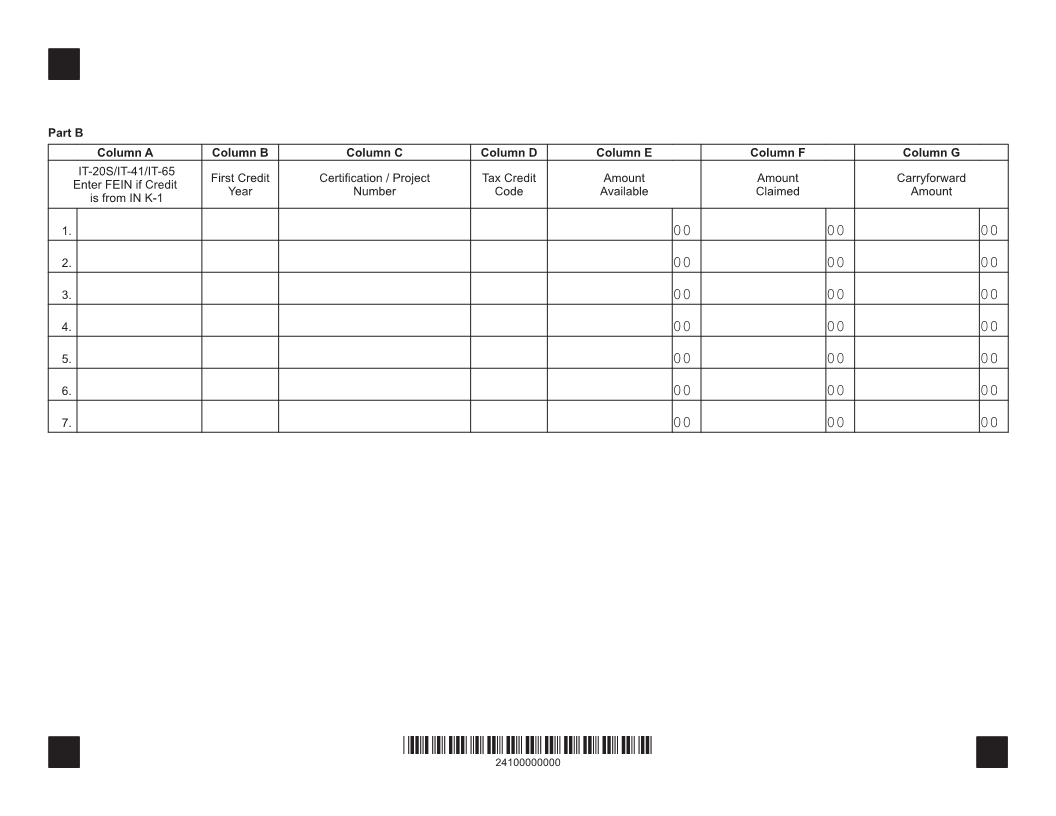

Part A

Column A Column B Column C Column D Column E Column F Column G

IT-20S/IT-41/IT-65

Certification Certification / Project Tax Credit Amount Amount Carryforward

Enter FEIN if Credit

Year Number Code Available Claimed Amount

is from IN K-1

1. 00 1. 00 00

2. 00 2. 00 00

3. 00 3. 00 00

4. 00 4. 00 00

5. 00 5. 00 00

6. 00 6. 00 00

7. 00 7. 00 00

8. Add amounts from column F, line 1 - 7, and enter the total here. Carry to the

appropriate line on: Schedule 6; Schedule G; Form IT-20; Form IT-20NP; Form IT-41; or

Form FIT-20 (Form IT-65 and Form IT-20S filers must see special reporting instructions) ................................Total 8. 00

*21524111694*

21524111694