Enlarge image

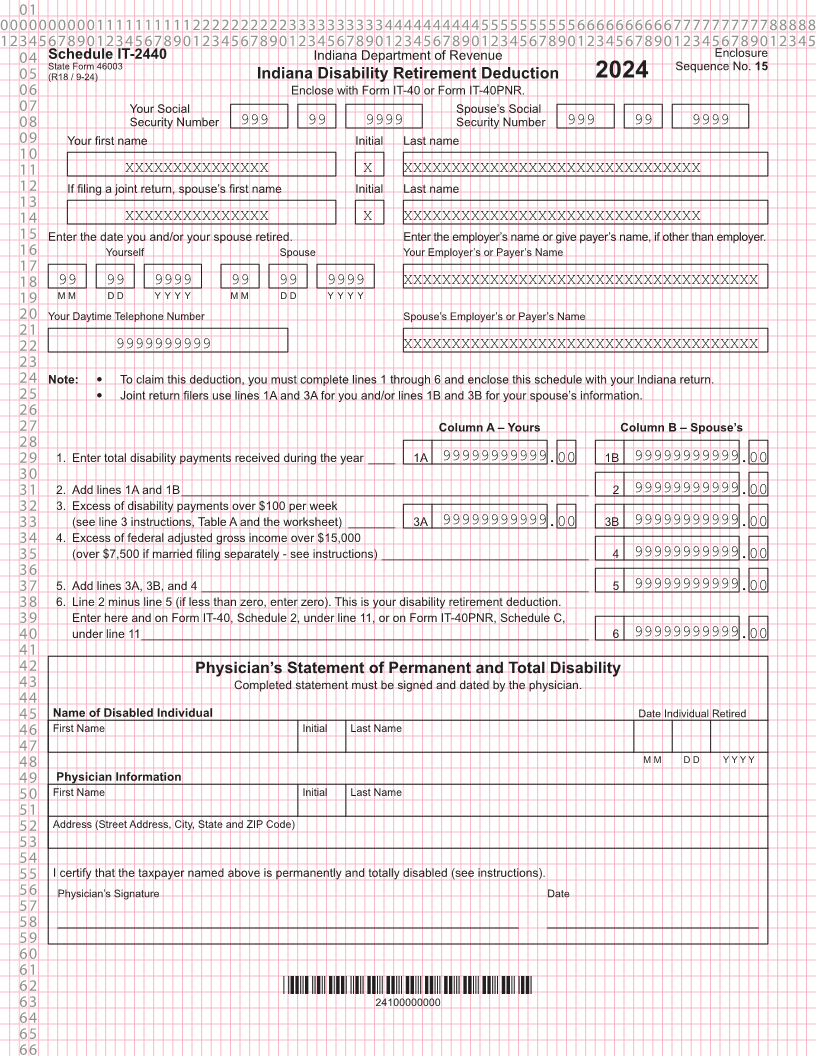

01 0000000000111111111122222222223333333333444444444455555555556666666666777777777788888 1234567890123456789012345678901234567890123456789012345678901234567890123456789012345 04 Schedule IT-2440 Indiana Department of Revenue Enclosure State Form 46003 Sequence No. 15 05 (R18 / 9-24) Indiana Disability Retirement Deduction 2024 06 Enclose with Form IT-40 or Form IT-40PNR. 07 Your Social Spouse’s Social 08 Security Number 999 99 9999 Security Number 999 99 9999 09 Your first name Initial Last name 10 11 XXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 12 If filing a joint return, spouse’s first name Initial Last name 13 14 XXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 15 Enter the date you and/or your spouse retired. Enter the employer’s name or give payer’s name, if other than employer. 16 Yourself Spouse Your Employer’s or Payer’s Name 17 18 99 99 9999 99 99 9999 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 19 M M D D Y Y Y Y M M D D Y Y Y Y 20 Your Daytime Telephone Number Spouse’s Employer’s or Payer’s Name 21 22 9999999999 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 23 24 Note: y To claim this deduction, you must complete lines 1 through 6 and enclose this schedule with your Indiana return. 25 y Joint return filers use lines 1A and 3A for you and/or lines 1B and 3B for your spouse’s information. 26 27 Column A – Yours Column B – Spouse’s 28 29 1. Enter total disability payments received during the year ____ 1A 99999999999.00 1B 99999999999.00 30 31 2. Add lines 1A and 1B _____________________________________________________________ 2 99999999999.00 32 3. Excess of disability payments over $100 per week 33 (see line 3 instructions, Table A and the worksheet) _______ 3A 99999999999.00 3B 99999999999.00 34 4. Excess of federal adjusted gross income over $15,000 35 (over $7,500 if married filing separately - see instructions) _______________________________ 4 99999999999.00 36 37 5. Add lines 3A, 3B, and 4 __________________________________________________________ 5 99999999999.00 38 6. Line 2 minus line 5 (if less than zero, enter zero). This is your disability retirement deduction. 39 Enter here and on Form IT-40, Schedule 2, under line 11, or on Form IT-40PNR, Schedule C, 40 under line 11 ___________________________________________________________________ 6 99999999999.00 41 42 Physician’s Statement of Permanent and Total Disability 43 Completed statement must be signed and dated by the physician. 44 45 Name of Disabled Individual Date Individual Retired 46 First Name Initial Last Name 47 48 M M D D Y Y Y Y 49 Physician Information 50 First Name Initial Last Name 51 52 Address (Street Address, City, State and ZIP Code) 53 54 55 I certify that the taxpayer named above is permanently and totally disabled (see instructions). 56 Physician’s Signature Date 57 58 59 60 61 62 *24100000000* 63 24100000000 64 65 66