Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

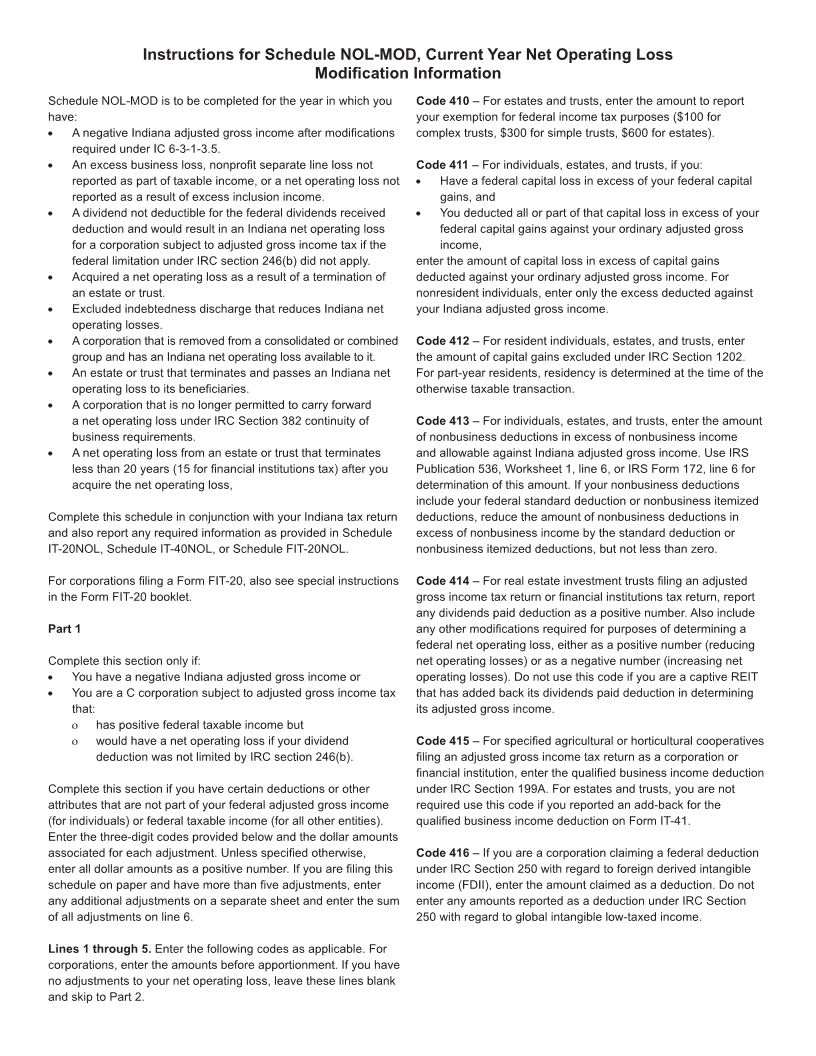

04 Schedule Indiana Department of Revenue Enclosure

05 NOL-MOD Current Year Net Operating Loss Sequence No. 12

State Form 57441

06 (9-24) Modification Information

07

08 Loss Year Ending 99 99 9999

09 Federal Employer Identification Number or

10 Name of Taxpayer Social Security Number

11

12 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 9999999999

13

14 Part 1 – Required Federal Modifications for NOLs Round all entries

15

16 1. Enter the modification code and amount (see instructions) ___________ Code No. 9999 1 99999999999.00

17

18 2. Enter the modification code and amount (see instructions) ___________ Code No. 9999 2 99999999999.00

19

20 3. Enter the modification code and amount (see instructions) ___________ Code No. 9999 3 99999999999.00

21

22 4. Enter the modification code and amount (see instructions) ___________ Code No. 9999 4 99999999999.00

23

24 5. Enter the modification code and amount (see instructions) ___________ Code No. 9999 5 99999999999.00

25

26 6. Enter the total of lines 1 through 5. For IT-40, IT-40PNR, and IT-41, skip line 7 and enter

27 this amount on line 8. Also enter this on IT-20NOL, line 3, if applicable (see instructions) _______ 6 99999999999.00

28

29 7. For FIT-20, IT-20, and IT-20NP only, enter your Indiana apportionment percentage ___________ 7 99.9999 %

30

31 8. Enter line 6 times line 7. Also include this on IT-40NOL, line 3, if applicable _________________ 8 99999999999.00

32

33 Part 2 – Separately Stated Net Operating Losses

34

35 9. Enter the code for the specified loss _____________________________ Code No. 9999

36

37 Enter this as a negative number. Also enter this number on IT-40NOL, line 5, if applicable 9 99999999999.00

38

39 10. Enter the modification code ____________________________________ Code No. 9999

40

41 Enter Indiana modifications for the loss on line 9. See instructions. _______________________ 10 99999999999.00

42

43 11. Enter the sum of line 9 and line 10. For IT-40/IT-40PNR/IT-41, skip line 12 and

44 enter this amount on line 13 ______________________________________________________ 11 99999999999.00

45

46 12. For FIT-20, IT-20, and IT-20NP only, enter your Indiana apportionment percentage ___________ 12 99.9999 %

47

48 13. Enter line 11 times line 12. Also include this on IT-20NOL, line 10, if applicable ______________ 13 99999999999.00

49

50 14. Enter as a negative number any Indiana NOL from current year trust/estate termination _______ 14 99999999999.00

51

52 a. Year 9999 Federal Employer Identification Number 9999999999

53

54 b. Year 9999 Federal Employer Identification Number 9999999999

55

56 15. Enter the amount from line 14 claimed in the current year as a negative number _____________ 15 99999999999.00

57

58 16. Enter line 14 minus line 15. Enter this number on IT-40NOL, line 5, and as part of IT-20NOL,

59 line 10, whichever is applicable ___________________________________________________ 16 99999999999.00

60

61

62 *18224111694*

63 18224111694

64

65

66