Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

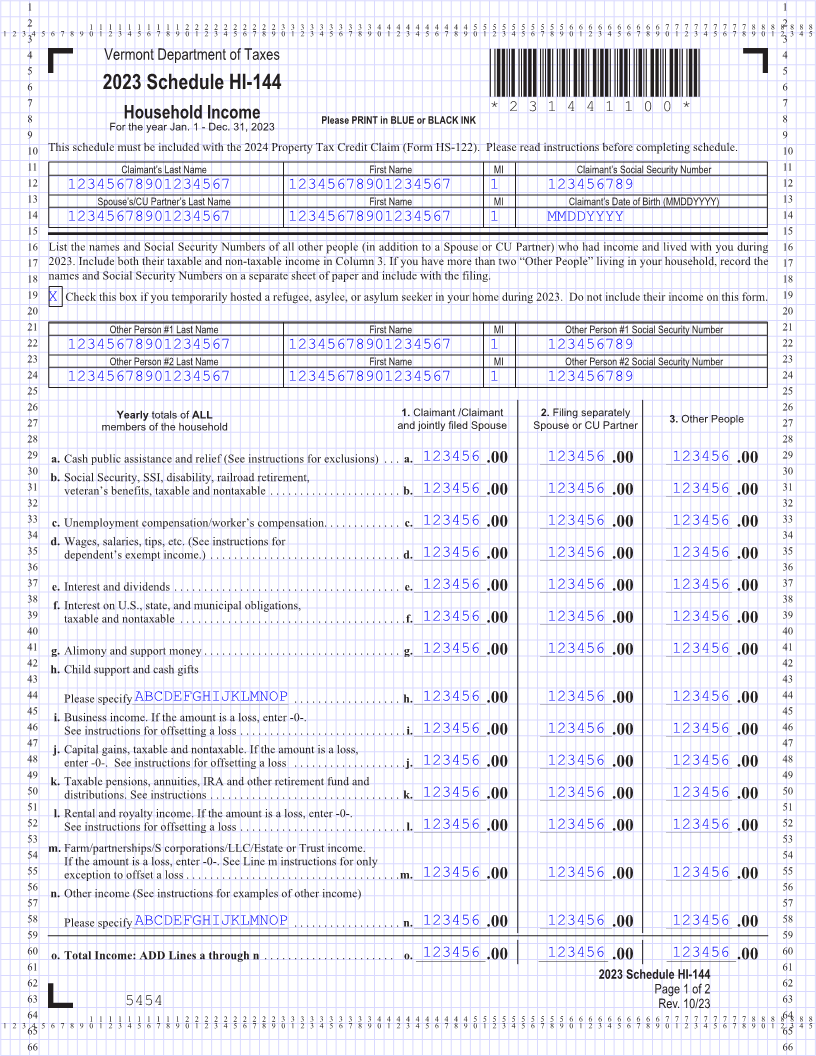

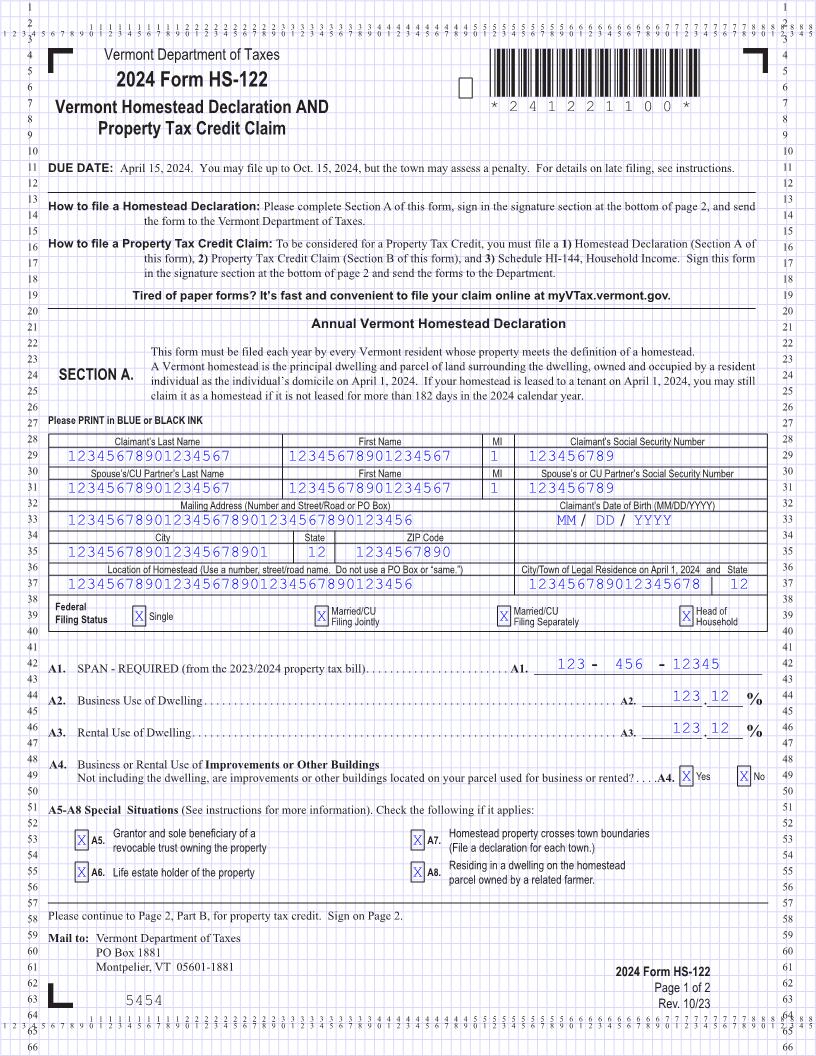

4 Vermont Department of Taxes 4

5 5

6 2024 Form HS-122 *241221100* 6

7 7

Vermont Homestead Declaration AND * 24 1221100*

8 Property Tax Credit Claim 8 Page 29

9 9

10 10

11 DUE DATE: April 15, 2024 . You may file up to Oct . 15, 2024, but the town may assess a penalty . For details on late filing, see instructions . 11

12 12

13 13

How to file a Homestead Declaration: Please complete Section A of this form, sign in the signature section at the bottom of page 2, and send

14 14

the form to the Vermont Department of Taxes .

15 15 FORM (Place at FIRST page)

16 How to file a Property Tax Credit Claim: To be considered for a Property Tax Credit, you must file a 1) Homestead Declaration (Section A of 16 Form pages

17 this form), 2) Property Tax Credit Claim (Section B of this form), and 3) Schedule HI-144, Household Income . Sign this form 17

18 in the signature section at the bottom of page 2 and send the forms to the Department . 18

19 Tired of paper forms? It’s fast and convenient to file your claim online at myVTax.vermont.gov. 19

20 20

21 Annual Vermont Homestead Declaration 21

29 - 30

22 22

23 This form must be filed each year by every Vermont resident whose property meets the definition of a homestead . 23

A Vermont homestead is the principal dwelling and parcel of land surrounding the dwelling, owned and occupied by a resident

24 SECTION A. 24

individual as the individual’s domicile on April 1, 2024 . If your homestead is leased to a tenant on April 1, 2024, you may still

25 claim it as a homestead if it is not leased for more than 182 days in the 2024 calendar year . 25

26 26

27 Please PRINT in BLUE or BLACK INK 27

28 Claimant’s Last Name First Name MI Claimant’s Social Security Number 28

29 29

12345678901234567 12345678901234567 1 123456789

30 Spouse’s/CU Partner’s Last Name First Name MI Spouse’s or CU Partner’s Social Security Number 30

31 31

12345678901234567 12345678901234567 1 123456789

32 Mailing Address (Number and Street/Road or PO Box) Claimant’s Date of Birth (MM/DD/YYYY) 32

33 123456789012345678901234567890123456 MM / DD / YYYY 33

34 City State ZIP Code 34

35 35

123456789012345678901 12 1234567890

36 Location of Homestead (Use a number, street/road name. Do not use a PO Box or “same.”) City/Town of Legal Residence on April 1, 2024 and State 36

37 37

123456789012345678901234567890123456 123456789012345678 12

38 Federal 38

Filing Jointly Filing Separately Household

39 Filing Status X Single X Married/CU X Married/CU XHead of 39

40 40

41 41

A1.

42 SPAN - REQUIRED (from the 2023/2024 property tax bill) . . . . . . . . . . . . . . . . . . . . . . . .A1. ______________________________________123 - 456 - 12345 42

43 43

A2.

44 Business Use of Dwelling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A2.. . __________123.______12% 44

45 45

A3.

46 Rental Use of Dwelling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A3.. . __________123.______12% 46

47 47

48 Business or Rental Use of Improvements or Other Buildings 48

A4.

49 Not including the dwelling, are improvements or other buildings located on your parcel used for business or rented? . . . A4.. X Yes X No 49

50 50

51 A5-A8 Special Situations (See instructions for more information) . Check the following if it applies: 51

52 52

53 X A5. Grantor and sole beneficiary of a X A7. Homestead property crosses town boundaries 53

54 revocable trust owning the property (File a declaration for each town.) 54

55 X A6. Life estate holder of the property X A8. Residing in a dwelling on the homestead 55

56 parcel owned by a related farmer. 56

57 57

58 Please continue to Page 2, Part B, for property tax credit . Sign on Page 2 . 58

59 Mail to: Vermont Department of Taxes 59

60 PO Box 1881 60

61 Montpelier, VT 05601-1881 2024 Form HS-122 61

62 Page 1 of 2 62

63 5454 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66