Enlarge image

Vermont Department of Taxes

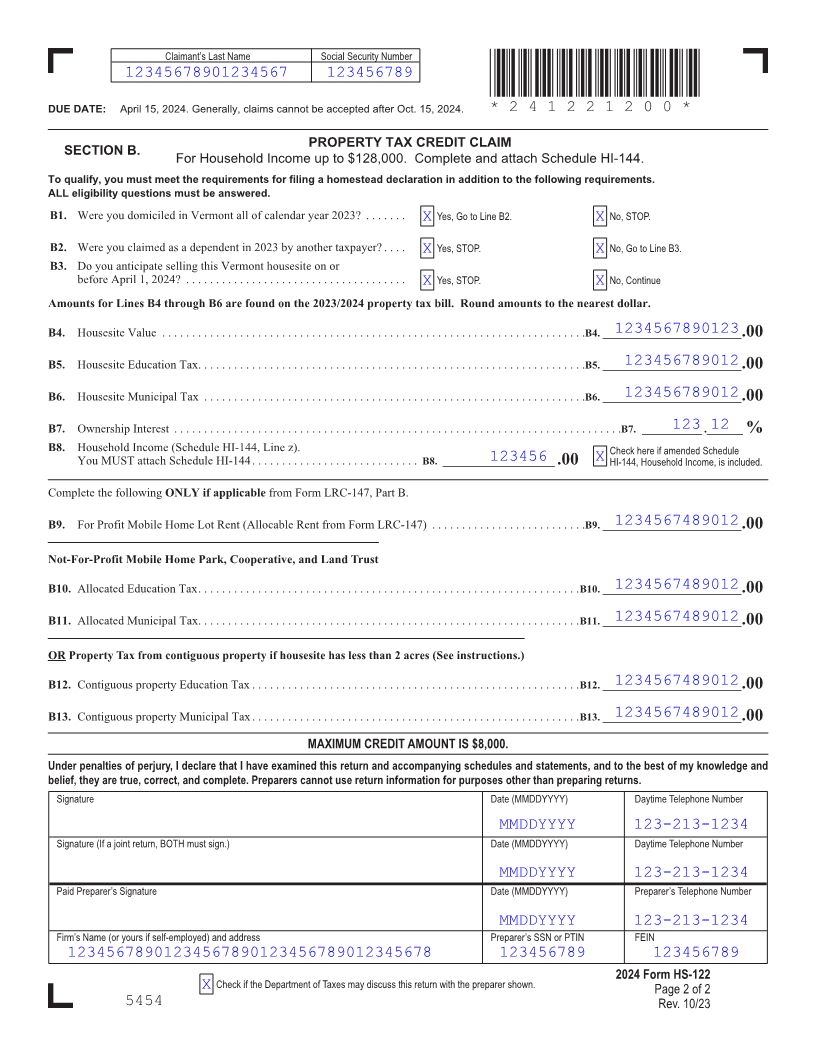

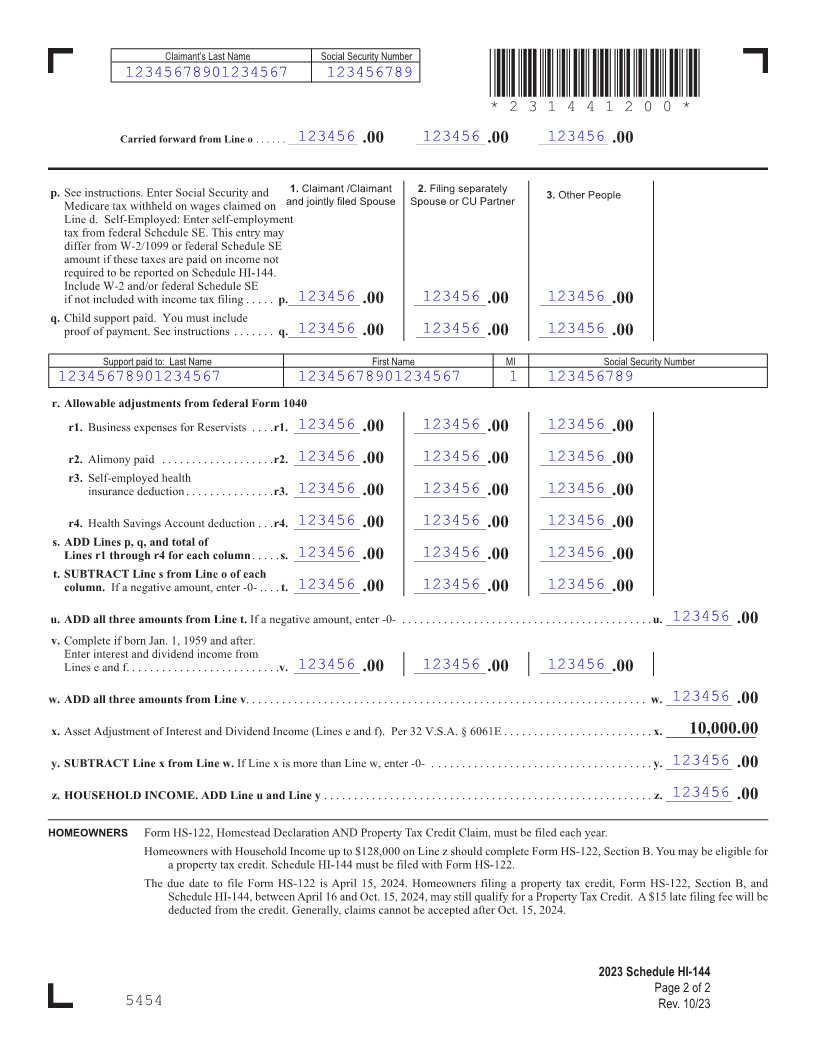

2024 Form HS-122 *241221100*

Vermont Homestead Declaration AND * 24 1221100*

Property Tax Credit Claim Page 29

DUE DATE: April 15, 2024 . You may file up to Oct . 15, 2024, but the town may assess a penalty . For details on late filing, see instructions .

How to file a Homestead Declaration: Please complete Section A of this form, sign in the signature section at the bottom of page 2, and send

the form to the Vermont Department of Taxes .

FORM (Place at FIRST page)

How to file a Property Tax Credit Claim: To be considered for a Property Tax Credit, you must file a 1) Homestead Declaration (Section A of Form pages

this form), 2) Property Tax Credit Claim (Section B of this form), and 3) Schedule HI-144, Household Income . Sign this form

in the signature section at the bottom of page 2 and send the forms to the Department .

Tired of paper forms? It’s fast and convenient to file your claim online at myVTax.vermont.gov.

Annual Vermont Homestead Declaration

29 - 30

This form must be filed each year by every Vermont resident whose property meets the definition of a homestead .

A Vermont homestead is the principal dwelling and parcel of land surrounding the dwelling, owned and occupied by a resident

SECTION A. individual as the individual’s domicile on April 1, 2024 . If your homestead is leased to a tenant on April 1, 2024, you may still

claim it as a homestead if it is not leased for more than 182 days in the 2024 calendar year .

Please PRINT in BLUE or BLACK INK

Claimant’s Last Name First Name MI Claimant’s Social Security Number

12345678901234567 12345678901234567 1 123456789

Spouse’s/CU Partner’s Last Name First Name MI Spouse’s or CU Partner’s Social Security Number

12345678901234567 12345678901234567 1 123456789

Mailing Address (Number and Street/Road or PO Box) Claimant’s Date of Birth (MM/DD/YYYY)

123456789012345678901234567890123456 MM / DD / YYYY

City State ZIP Code

123456789012345678901 12 1234567890

Location of Homestead (Use a number, street/road name. Do not use a PO Box or “same.”) City/Town of Legal Residence on April 1, 2024 and State

123456789012345678901234567890123456 123456789012345678 12

Federal

Filing Jointly Filing Separately Household

Filing Status X Single X Married/CU X Married/CU XHead of

A1. SPAN - REQUIRED (from the 2023/2024 property tax bill) . . . . . . . . . . . . . . . . . . . . . . . .A1. ______________________________________123 - 456 - 12345

A2. Business Use of Dwelling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A2.. . __________123.______12%

A3. Rental Use of Dwelling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A3.. . __________123.______12%

A4. Business or Rental Use of Improvements or Other Buildings

Not including the dwelling, are improvements or other buildings located on your parcel used for business or rented? . . . A4.. X Yes X No

A5-A8 Special Situations (See instructions for more information) . Check the following if it applies:

X A5. Grantor and sole beneficiary of a X A7. Homestead property crosses town boundaries

revocable trust owning the property (File a declaration for each town.)

X A6. Life estate holder of the property X A8. Residing in a dwelling on the homestead

parcel owned by a related farmer.

Please continue to Page 2, Part B, for property tax credit . Sign on Page 2 .

Mail to: Vermont Department of Taxes

PO Box 1881

Montpelier, VT 05601-1881 2024 Form HS-122

Page 1 of 2

5454 Rev. 10/23