Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 DEPT 3

4 Vermont Department of Taxes USE FILE YOUR RETURN 4

5 ONLY ELECTRONICALLY FOR A 5

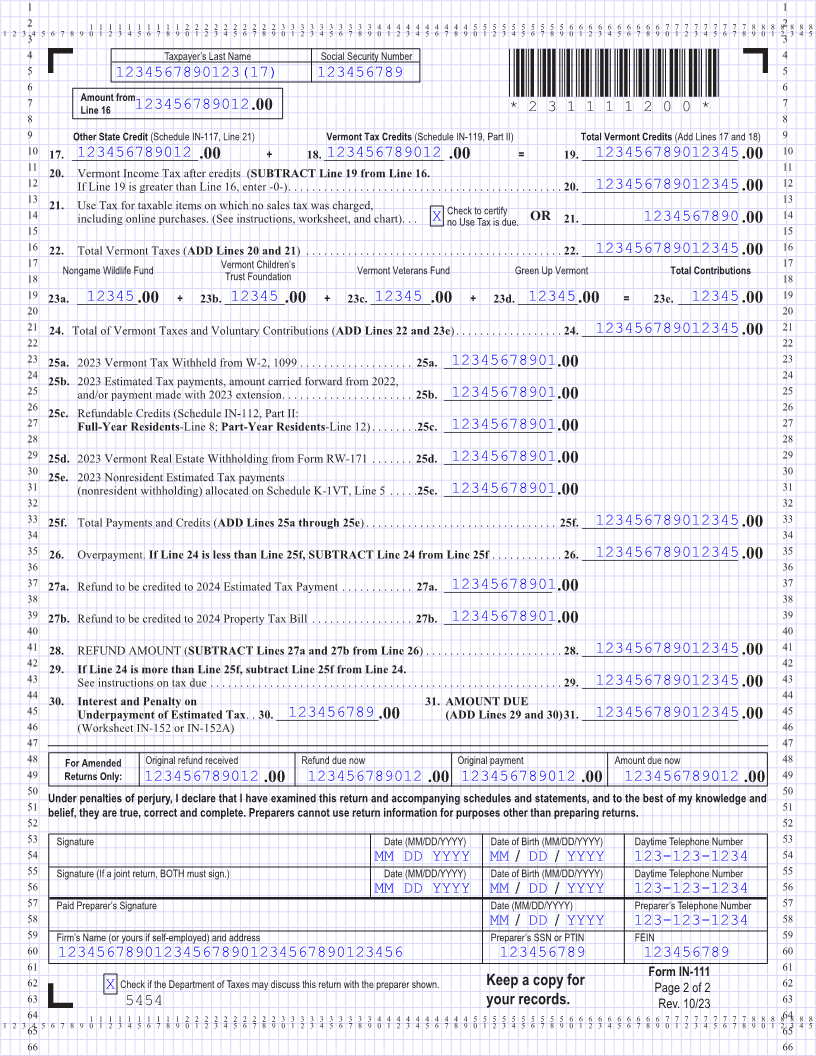

6 2023 Form IN-111 *231111100* FASTER REFUND. GO TO 6

7 TAX.VERMONT.GOV FOR 7

Vermont Income Tax Return * 23 1111100* MORE INFORMATION.

8 Please PRINT in BLUE or BLACK INK 8 Page 19

9 9

10 Taxpayer’s Last Name First Name MI Social Security Number 10

11 Check if 11

1234567890123(17) 1234567890123(17) 1 123456789 X Deceased

12 Spouse’s/CU Partner’s Last Name First Name MI Social Security Number 12

13 Check if 13

1234567890123(17) 1234567890123(17) 1 123456789 X Deceased

14 Mailing Address (Number and Street/Road or PO Box) 911/Physical Street Address on 12/31/2023 14

15 1234567890123456789012345678 12345678901234567890123(27) 15 FORM (Place at FIRST page)

16 City State ZIP Code or Foreign Postal Code Foreign Country 16 Form pages

17 17

123456748901234567(21) 12 1234567890 123456789012345678(22)

18 Vermont School District Code Check all AMENDED CANNABIS RECOMPUTED EXTENDED 18

19 Enter Healthcare Coverage Code With Recomputed 19

20 123 1 (See instructions for code options) that apply X Return X Federal Return X Return XReturn 20

21 Filing Status and Single Married/CU Filing Jointly Married/CU Filing Head of Household Qualifying Widow(er) 21

Standard Deduction X ($7,000) X ($14,050) X Separately ($7,000) X ($10,550) X ($14,050) 19 - 20

22 Vermont Residency Status as of 12/31/2023 (check one) RESIDENT PART-YEAR 22

23 X X RESIDENT X NONRESIDENT 23

24 24

25 25

26 1234567890123451. Federal Adjusted Gross Income (federal Form 1040, Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. . __________________________. . . .00 26

27 27

28 1234567890123452. Net Modifications to Federal AGI (Schedule IN-112, Part I, Line 18) . . . . . . . . . . . . . . . . . . . . . . . 2. . __________________________. . . .00 28

29 29

30 1234567890123453. Federal AGI with Modifications (ADD Lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. . . __________________________. . . .00 30

31 31

32 1234567890123454. 2023 Vermont Standard Deduction from filing status section above . . . . . . . . . . . . . . . . . . . . . . . . . 4. . __________________________. . . .00 32

33 Please see instructions if you or your spouse checked any standard 33

deduction boxes on federal Form 1040, page 1 .

34 5. Personal Exemptions: 34

35 5b. Enter "1" for your jointly filed 5c. Enter number of OTHER 35

36 5a. Enter "1" for yourself if no one spouse or CU partner if no one can dependents claimed on 5d. Total Exemptions 36

can claim you as a dependent (ADD Lines 5a through 5c)

37 claim them as a dependent federal Form 1040 37

38 5a. ________ 1 + 5b. ________ 1 + 5c. ________ 12 = 5d. __________ 12 38

39 39

40 1234567890123455e. MULTIPLY Line 5d by $4,850 (2023 Personal Exemption) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5e. . . __________________________. . .00 40

41 41

42 1234567890123456. ADD Lines 4 and 5e . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. . . __________________________. . . .00 42

43 43

44 1234567890123457. Vermont Taxable Income (SUBTRACT Line 6 from Line 3. If less than zero, enter -0-) . . . . . . . . . . 7. . __________________________.00 44

45 45

46 8. 123456789012345Vermont Income Tax from tax table or tax rate schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. . . __________________________. . . .00 46

47 (If Line 1 is greater than $150,000, see instructions) 47

48 9. 123456789012345Net Adjustment to Vermont Tax (Schedule IN-119, Part I, Line 15) . . . . . . . . . . . . . . . . . . . . . . . . 9. . . __________________________. . . .00 48

49 49

50 12345678901234510. Vermont Income Tax with Adjustment (ADD Lines 8 and 9. If less than zero, enter -0-) . . . . . . . . . .10. __________________________.00 50

51 51

52 11. Tax-Deductible Charitable Contribution 12. Multiply Line 11 by 5% (0.05) 13. Charitable Contribution 52

(See instructions) Deduction (Enter the lesser

53 12345678 ___________ .00 ___________12345678 .00 of Line 12 or $1,000) ...... 13. __________________________123456789012345 .00 53

54 54

55 14. 123456789012345Vermont Income Tax (Line 10 MINUS Line 13. If less than zero, enter -0-) . . . . . . . . . . . . . . . . . . 14. . __________________________.00 55

56 56

57 15. Income Adjustment (Schedule IN-113, Line 35, or 100 .0000%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15. . . _______.100.0000_________% 57

58 58

59 16. 123456789012345Adjusted Vermont Income Tax (MULTIPLY Line 14 by Line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.. _____________________________.00 59

60 60

61 Form IN-111 61

62 Amount Due Page 1 of 2 62

63 1234567890123455454 (from Line 31) .00 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66