Enlarge image

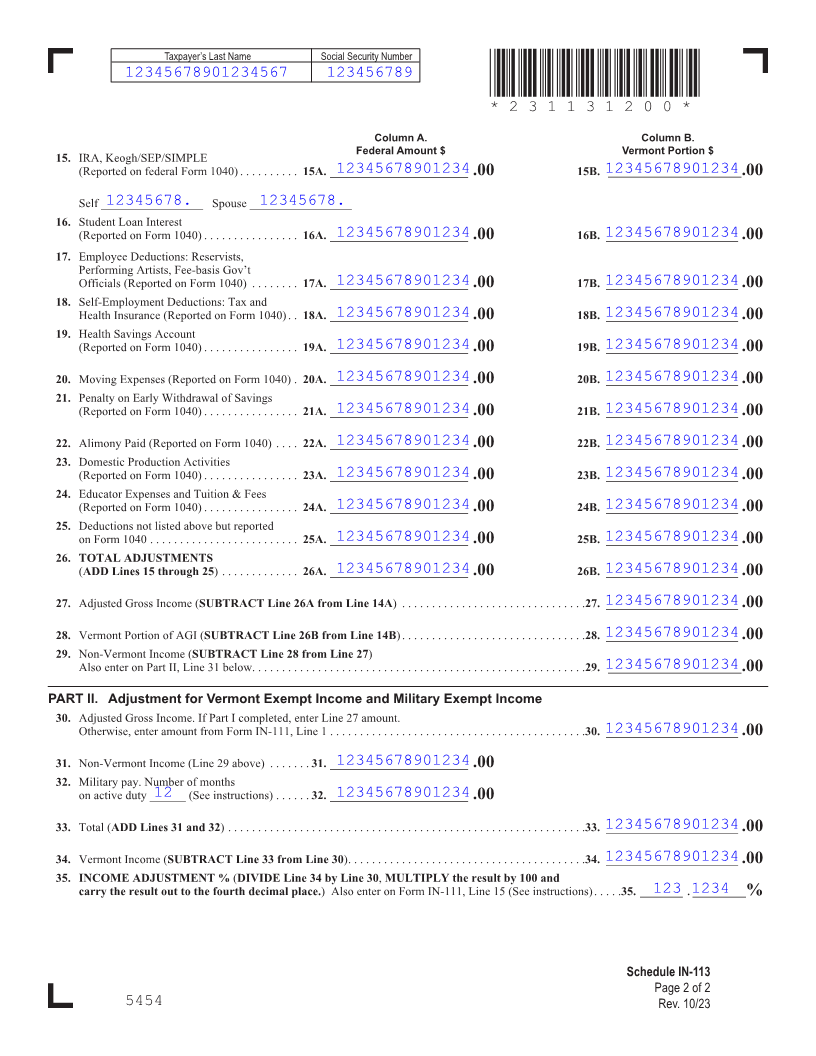

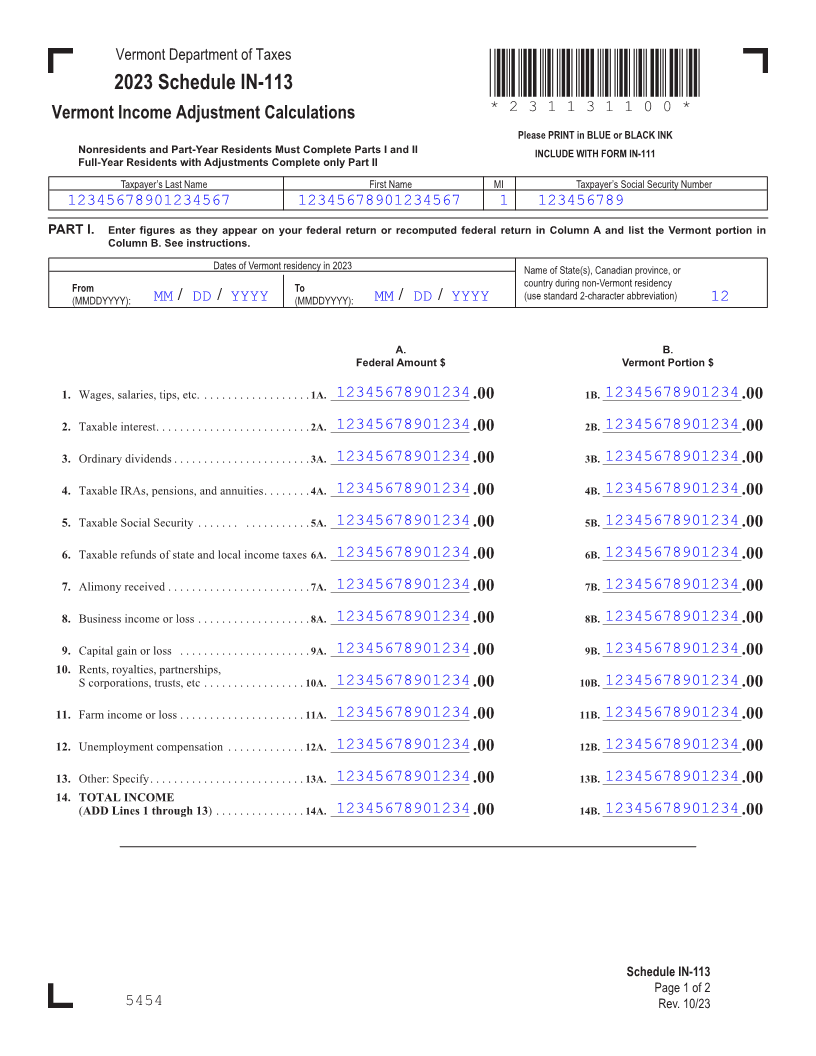

Vermont Department of Taxes

2023 Schedule IN-113 *231131100*

Vermont Income Adjustment Calculations * 23 1131100*

Please PRINT in BLUE or BLACK INK Page 25

Nonresidents and Part-Year Residents Must Complete Parts I and II INCLUDE WITH FORM IN-111

Full-Year Residents with Adjustments Complete only Part II

Taxpayer’s Last Name First Name MI Taxpayer’s Social Security Number

12345678901234567 12345678901234567 1 123456789

PART I. Enter figures as they appear on your federal return or recomputed federal return in Column A and list the Vermont portion in FORM (Place at FIRST page)

Column B. See instructions. Form pages

Dates of Vermont residency in 2023 Name of State(s), Canadian province, or

From To country during non-Vermont residency

(MMDDYYYY): MM / DD / YYYY (MMDDYYYY): MM / DD / YYYY (use standard 2-character abbreviation)12

25 - 26

A. B.

Federal Amount $ Vermont Portion $

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . .1A. __________________________12345678901234 .00 1B. __________________________12345678901234 .00

2. Taxable interest .............. . . . . . . . . . . . . 2A. __________________________12345678901234 .00 2B. __________________________12345678901234 .00

3. Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . .3A. __________________________12345678901234 .00 3B. __________________________12345678901234 .00

4. Taxable IRAs, pensions, and annuities ........ 4A. __________________________12345678901234 .00 4B. __________________________12345678901234 .00

5. Taxable Social Security ....... ........... 5A. __________________________12345678901234 .00 5B. __________________________12345678901234 .00

6. Taxable refunds of state and local income taxes 6A. __________________________12345678901234 .00 6B. __________________________12345678901234 .00

7. Alimony received ............ . . . . . . . . . . . . 7A. __________________________12345678901234 .00 7B. __________________________12345678901234 .00

8. Business income or loss . . . . . . . . . . . . . . . . . . .8A. __________________________12345678901234 .00 8B. __________________________12345678901234 .00

9. Capital gain or loss . . . . . . . . . . . . . . . . . . . . . .9A. __________________________12345678901234 .00 9B. __________________________12345678901234.00

10. Rents, royalties, partnerships,

S corporations, trusts, etc . . . . . . . . . . . . . . . . . 10A. __________________________12345678901234 .00 10B. __________________________12345678901234 .00

11. Farm income or loss . . . . . . . . . . . . . . . . . . . . .11A. __________________________12345678901234 .00 11B. __________________________12345678901234 .00

12. Unemployment compensation . . . . . . . . . . . . . 12A. __________________________12345678901234 .00 12B. __________________________12345678901234 .00

13. Other: Specify ............... . . . . . . . . . . . 13A. __________________________12345678901234 .00 13B. __________________________12345678901234 .00

14. TOTAL INCOME

(ADD Lines 1 through 13) . . . . . . . . . . . . . . . 14A. __________________________12345678901234 .00 14B. __________________________12345678901234 .00

Schedule IN-113

Page 1 of 2

5454 Rev. 10/23