Enlarge image

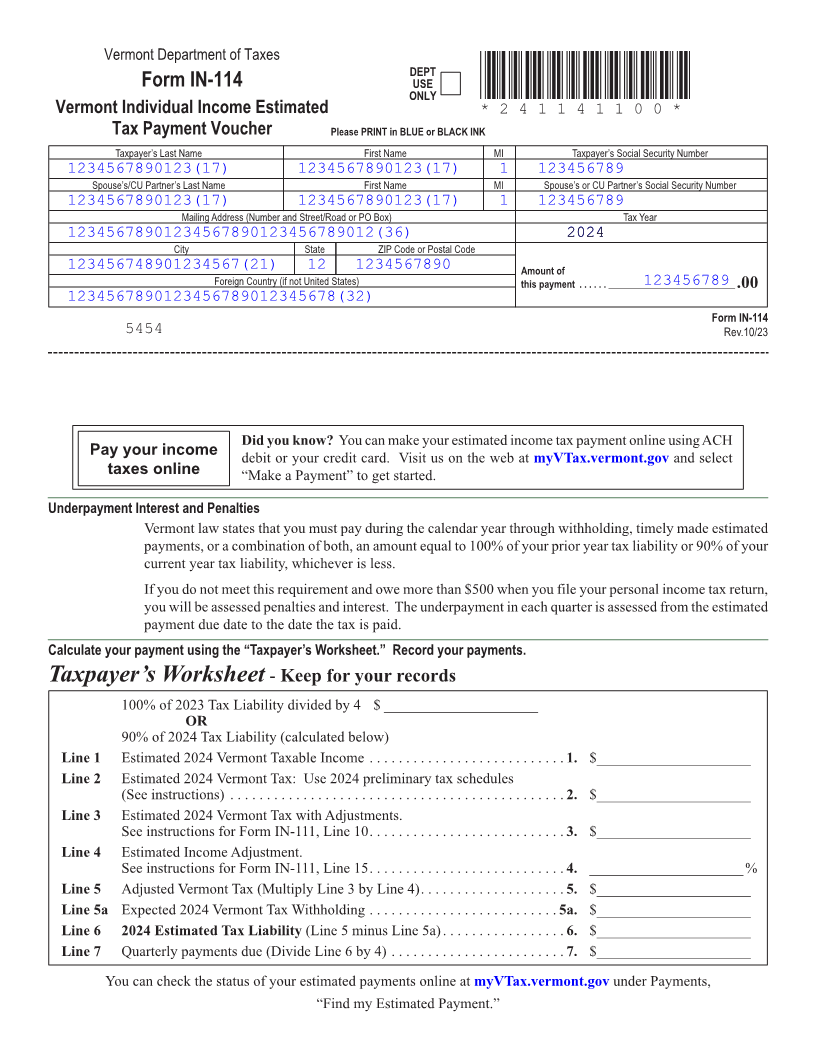

Vermont Department of Taxes

DEPT

Form IN-114 USE *241141100*

ONLY

Vermont Individual Income Estimated *241141100*

Tax Payment Voucher Please PRINT in BLUE or BLACK INK Page 3

Taxpayer’s Last Name First Name MI Taxpayer’s Social Security Number

1234567890123(17) 1234567890123(17) 1 123456789

Spouse’s/CU Partner’s Last Name First Name MI Spouse’s or CU Partner’s Social Security Number

1234567890123(17) 1234567890123(17) 1 123456789

Mailing Address (Number and Street/Road or PO Box) Tax Year

12345678901234567890123456789012(36) 20242024

City State ZIP Code or Postal Code

123456748901234567(21) 12 1234567890 Amount of

123456789 Foreign Country (if not United States) this payment ...... __________________________ .00

1234567890123456789012345678(32)

Form IN-114

5454 Rev.10/21Rev.10/23

FORM (Place at FIRST page)

Form pages

Did you know? You can make your estimated income tax payment online using ACH

Pay your income debit or your credit card . Visit us on the web at myVTax.vermont.gov and select

taxes online “Make a Payment” to get started .

3 - 4

Underpayment Interest and Penalties

Vermont law states that you must pay during the calendar year through withholding, timely made estimated

payments, or a combination of both, an amount equal to 100% of your prior year tax liability or 90% of your

current year tax liability, whichever is less .

If you do not meet this requirement and owe more than $500 when you file your personal income tax return,

you will be assessed penalties and interest . The underpayment in each quarter is assessed from the estimated

payment due date to the date the tax is paid .

Calculate your payment using the “Taxpayer’s Worksheet.” Record your payments.

Taxpayer’s Worksheet - Keep for your records

100% of 2023 Tax Liability divided by 4 $ _____________________

OR

90% of 2024 Tax Liability (calculated below)

Line 1 Estimated 2024 Vermont Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . . 1.. $_____________________

Line 2 Estimated 2024 Vermont Tax: Use 2024 preliminary tax schedules

(See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $_____________________

Line 3 Estimated 2024 Vermont Tax with Adjustments .

See instructions for Form IN-111, Line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . 3.. $_____________________

Line 4 Estimated Income Adjustment .

See instructions for Form IN-111, Line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . 4.. _____________________%

Line 5 Adjusted Vermont Tax (Multiply Line 3 by Line 4) . . . . . . . . . . . . . . . . . . . . 5. $_____________________

Line 5a Expected 2024 Vermont Tax Withholding . . . . . . . . . . . . . . . . . . . . . . . . . . 5a. $_____________________

Line 6 2024 Estimated Tax Liability (Line 5 minus Line 5a) . . . . . . . . . . . . . . . . . 6. $_____________________

Line 7 Quarterly payments due (Divide Line 6 by 4) . . . . . . . . . . . . . . . . . . . . . . . . 7. $_____________________

You can check the status of your estimated payments online at myVTax.vermont.gov under Payments,

“Find my Estimated Payment .”