Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

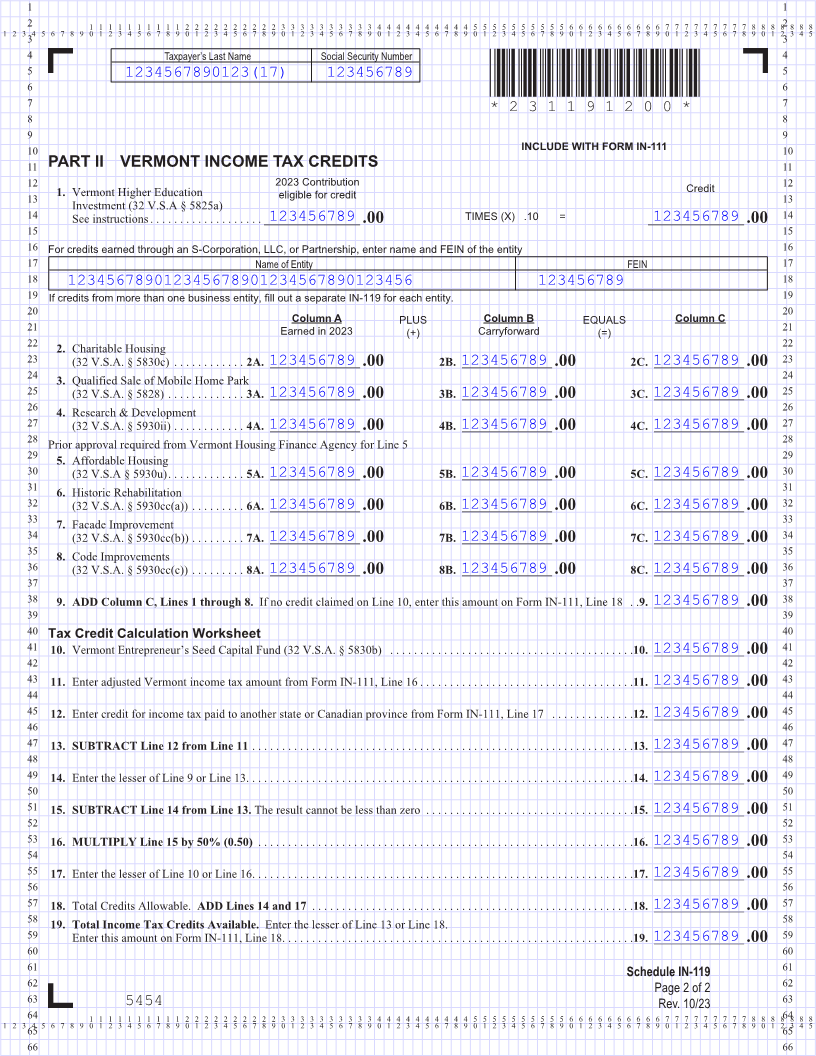

4 Vermont Department of Taxes 4

5 5

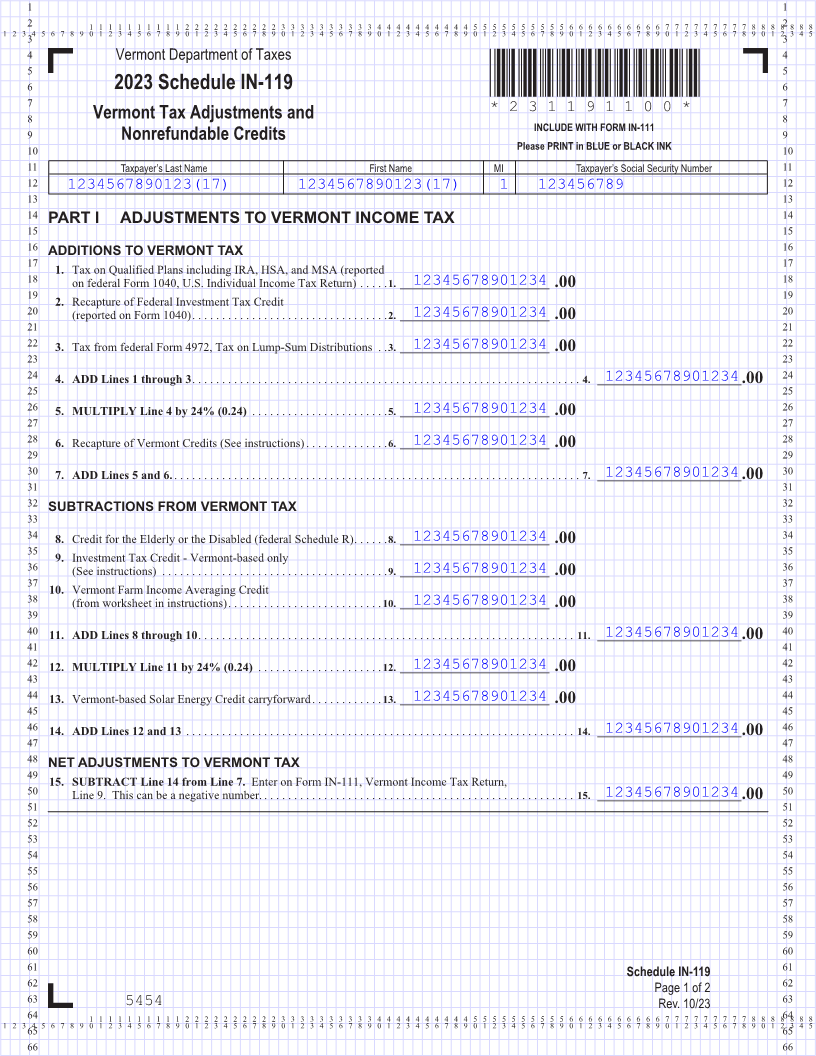

6 2023 Schedule IN-119 *231191100* 6

7 7

Vermont Tax Adjustments and *231191100*

8 INCLUDE WITH FORM IN-111 8 Page 5

9 Nonrefundable Credits 9

10 Please PRINT in BLUE or BLACK INK 10

11 Taxpayer’s Last Name First Name MI Taxpayer’s Social Security Number 11

12 12

1234567890123(17) 1234567890123(17) 1 123456789

13 13

14 14

PART I ADJUSTMENTS TO VERMONT INCOME TAX

15 15

16 ADDITIONS TO VERMONT TAX 16

17 17

1. Tax on Qualified Plans including IRA, HSA, and MSA (reported

18 12345678901234on federal Form 1040, U.S. Individual Income Tax Return) ..... 1. ____________________________ .00 18

19 19

2. Recapture of Federal Investment Tax Credit

20 12345678901234(reported on Form 1040) ................................. 2. ____________________________ .00 20

21 21

22 3. 12345678901234Tax from federal Form 4972, Tax on Lump-Sum Distributions .. 3. ____________________________ .00 22

23 23

24 123456789012344. ADD Lines 1 through 3 .................................. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. ___________________________ .00 24

25 25 FORM (Place at FIRST page)

26 123456789012345. MULTIPLY Line 4 by 24% (0.24) ....................... 5. ____________________________ .00 26 Form pages

27 27

28 6. 12345678901234Recapture of Vermont Credits (See instructions) .............. 6. ____________________________ .00 28

29 29

30 123456789012347. ADD Lines 5 and 6. ..................................... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. ___________________________ .00 30

31 31

5 - 6

32 SUBTRACTIONS FROM VERMONT TAX 32

33 33

34 8. 12345678901234Credit for the Elderly or the Disabled (federal Schedule R) ......8. ____________________________ .00 34

35 35

9. Investment Tax Credit - Vermont-based only

36 12345678901234(See instructions) ...................................... 9. ____________________________ .00 36

37 37

10. Vermont Farm Income Averaging Credit

38 12345678901234(from worksheet in instructions) .......................... 10. ____________________________ .00 38

39 39

40 1234567890123411. ADD Lines 8 through 10 ................................. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. ___________________________ .00 40

41 41

42 1234567890123412. MULTIPLY Line 11 by 24% (0.24) .....................12. ____________________________ .00 42

43 43

44 13. 12345678901234Vermont-based Solar Energy Credit carryforward ............ 13. ____________________________ .00 44

45 45

46 1234567890123414. ADD Lines 12 and 13 ................................... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. ___________________________ .00 46

47 47

48 NET ADJUSTMENTS TO VERMONT TAX 48

49 49

15. SUBTRACT Line 14 from Line 7. Enter on Form IN-111, Vermont Income Tax Return,

50 12345678901234Line 9. This can be a negative number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15. ___________________________.00 50

51 51

52 52

53 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 Schedule IN-119 61

62 Page 1 of 2 62

63 5454 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66