Enlarge image

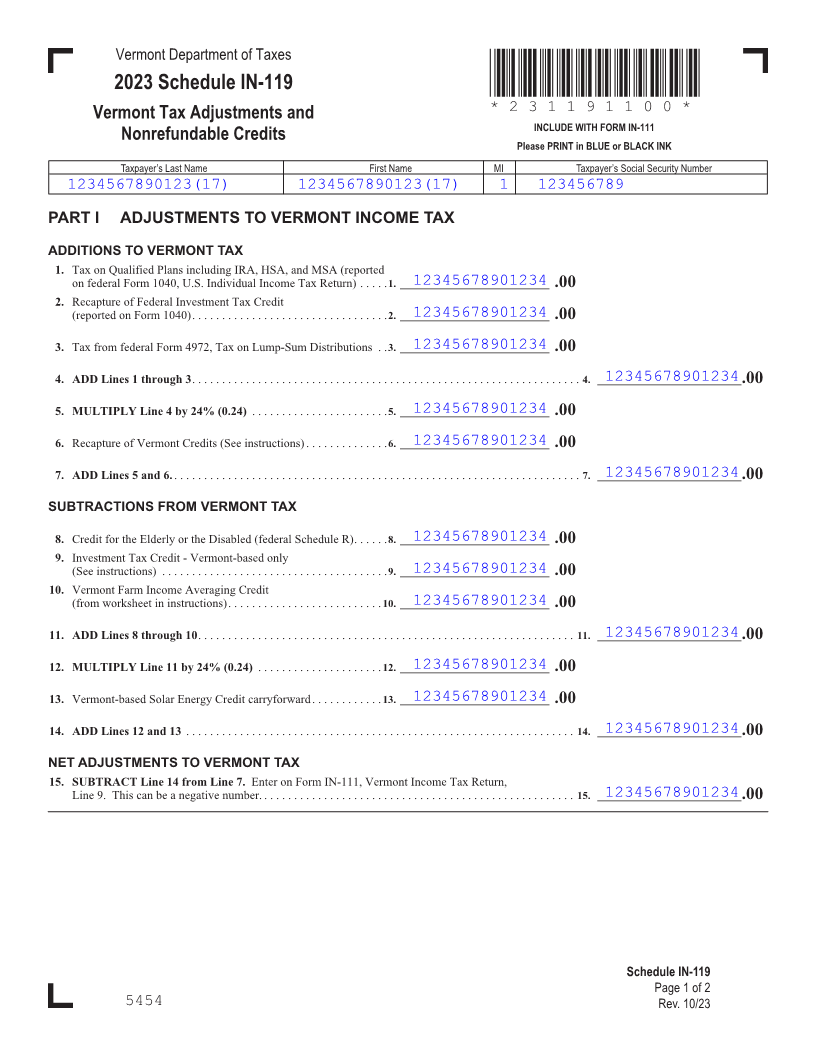

Vermont Department of Taxes

2023 Schedule IN-119 *231191100*

Vermont Tax Adjustments and *231191100*

INCLUDE WITH FORM IN-111 Page 5

Nonrefundable Credits

Please PRINT in BLUE or BLACK INK

Taxpayer’s Last Name First Name MI Taxpayer’s Social Security Number

1234567890123(17) 1234567890123(17) 1 123456789

PART I ADJUSTMENTS TO VERMONT INCOME TAX

ADDITIONS TO VERMONT TAX

1. Tax on Qualified Plans including IRA, HSA, and MSA (reported

12345678901234on federal Form 1040, U.S. Individual Income Tax Return) .....1. ____________________________ .00

2. Recapture of Federal Investment Tax Credit

12345678901234(reported on Form 1040) .................................2. ____________________________ .00

12345678901234 3. Tax from federal Form 4972, Tax on Lump-Sum Distributions ..3. ____________________________ .00

12345678901234 4. ADD Lines 1 through 3 .................................. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. ___________________________ .00

FORM (Place at FIRST page)

123456789012345. MULTIPLY Line 4 by 24% (0.24) .......................5. ____________________________ .00 Form pages

12345678901234 6. Recapture of Vermont Credits (See instructions) ..............6. ____________________________ .00

12345678901234 7. ADD Lines 5 and 6. ..................................... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. ___________________________ .00

5 - 6

SUBTRACTIONS FROM VERMONT TAX

12345678901234 8. Credit for the Elderly or the Disabled (federal Schedule R) ......8. ____________________________ .00

9. Investment Tax Credit - Vermont-based only

12345678901234(See instructions) ......................................9. ____________________________ .00

10. Vermont Farm Income Averaging Credit

12345678901234(from worksheet in instructions) .......................... 10. ____________________________ .00

12345678901234 11. ADD Lines 8 through 10 ................................. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. ___________________________ .00

1234567890123412. MULTIPLY Line 11 by 24% (0.24) .....................12. ____________________________ .00

12345678901234 13. Vermont-based Solar Energy Credit carryforward ............ 13. ____________________________ .00

12345678901234 14. ADD Lines 12 and 13 ................................... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. ___________________________ .00

NET ADJUSTMENTS TO VERMONT TAX

15. SUBTRACT Line 14 from Line 7. Enter on Form IN-111, Vermont Income Tax Return,

12345678901234Line 9. This can be a negative number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15. ___________________________.00

Schedule IN-119

Page 1 of 2

5454 Rev. 10/23