Enlarge image

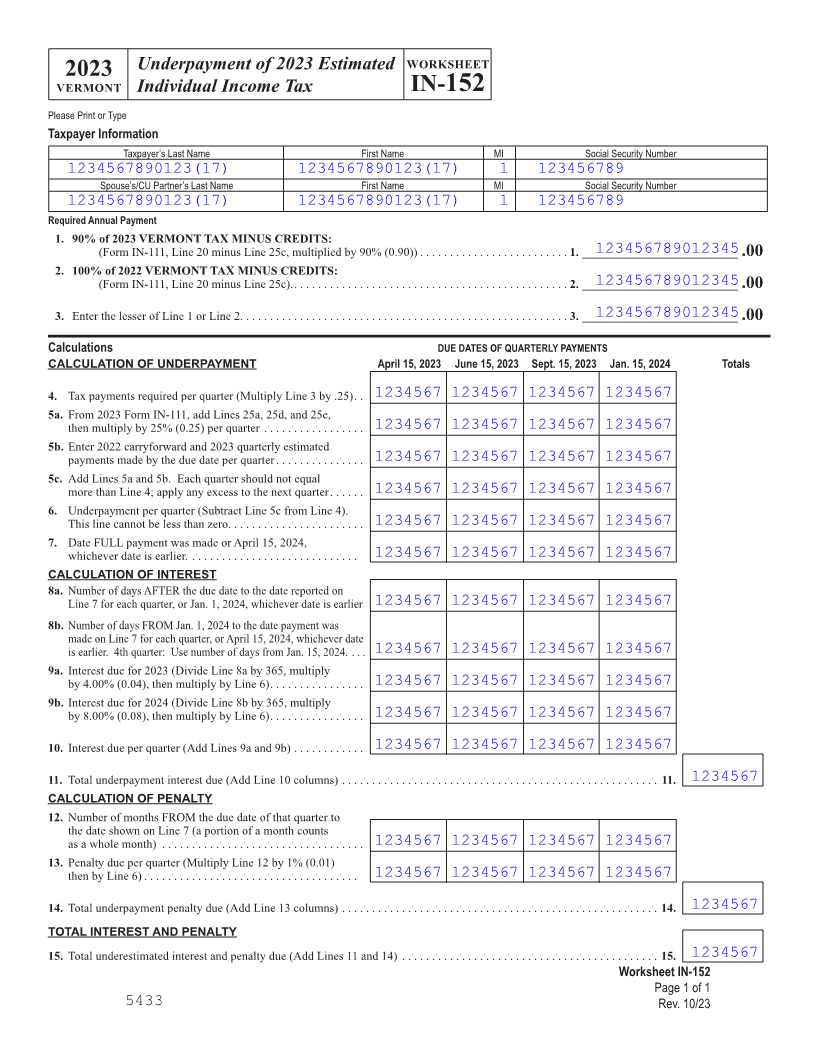

Underpayment of 2023 Estimated WORKSHEET

2023

VERMONT Individual Income Tax IN-152

Please Print or Type

Taxpayer Information Page 1

Taxpayer’s Last Name First Name MI Social Security Number

1234567890123(17) 1234567890123(17) 1 123456789

Spouse’s/CU Partner’s Last Name First Name MI Social Security Number

1234567890123(17) 1234567890123(17) 1 123456789

Required Annual Payment

1. 90% of 2023 VERMONT TAX MINUS CREDITS:

123456789012345 (Form IN-111, Line 20 minus Line 25c, multiplied by 90% (0.90)) . . . . . . . . . . . . . . . . . . . . . . . . .1. __________________________.00

2. 100% of 2022 VERMONT TAX MINUS CREDITS:

123456789012345 (Form IN-111, Line 20 minus Line 25c). ................................. . . . . . . . . . . . . . 2. __________________________.00

123456789012345 3. Enter the lesser of Line 1 or Line 2. ......................................... . . . . . . . . . . . . . 3. __________________________.00

Calculations DUE DATES OF QUARTERLY PAYMENTS

CALCULATION OF UNDERPAYMENT April 15, 2023 June 15, 2023 Sept. 15, 2023 Jan. 15, 2024 Totals

4. Tax payments required per quarter (Multiply Line 3 by .25) ..1234567 1234567 1234567 1234567

5a. From 2023 Form IN-111, add Lines 25a, 25d, and 25e,

then multiply by 25% (0.25) per quarter ................. 1234567 1234567 1234567 1234567

IN-152

5b. Enter 2022 carryforward and 2023 quarterly estimated

payments made by the due date per quarter ............... 1234567 1234567 1234567 1234567

5c. Add Lines 5a and 5b. Each quarter should not equal

more than Line 4; apply any excess to the next quarter ...... 1234567 1234567 1234567 1234567

6. Underpayment per quarter (Subtract Line 5c from Line 4). 1 - 1

This line cannot be less than zero. ...................... 1234567 1234567 1234567 1234567

7. Date FULL payment was made or April 15, 2024,

whichever date is earlier. ............................ 1234567 1234567 1234567 1234567

CALCULATION OF INTEREST

8a. Number of days AFTER the due date to the date reported on

Line 7 for each quarter, or Jan. 1, 2024, whichever date is earlier1234567 1234567 1234567 1234567

8b. Number of days FROM Jan. 1, 2024 to the date payment was

made on Line 7 for each quarter, or April 15, 2024, whichever date

is earlier. 4th quarter: Use number of days from Jan. 15, 2024.1234567... 1234567 1234567 1234567

9a. Interest due for 2023 (Divide Line 8a by 365, multiply

by 4.00% (0.04), then multiply by Line 6) ................ 1234567 1234567 1234567 1234567

9b. Interest due for 2024 (Divide Line 8b by 365, multiply

by 8.00% (0.08), then multiply by Line 6) ................ 1234567 1234567 1234567 1234567

10. Interest due per quarter (Add Lines 9a and 9b) ............1234567 1234567 1234567 1234567

123456711. Total underpayment interest due (Add Line 10 columns) ..................................................... 11.

CALCULATION OF PENALTY

12. Number of months FROM the due date of that quarter to

the date shown on Line 7 (a portion of a month counts

as a whole month) .................................. 1234567 1234567 1234567 1234567

13. Penalty due per quarter (Multiply Line 12 by 1% (0.01)

then by Line 6) .................................... 1234567 1234567 1234567 1234567

123456714. Total underpayment penalty due (Add Line 13 columns) ..................................................... 14.

TOTAL INTEREST AND PENALTY

123456715. Total underestimated interest and penalty due (Add Lines 11 and 14) ........................................... 15.

Worksheet IN-152

Page 1 of 1

5433 Rev. 10/23