Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

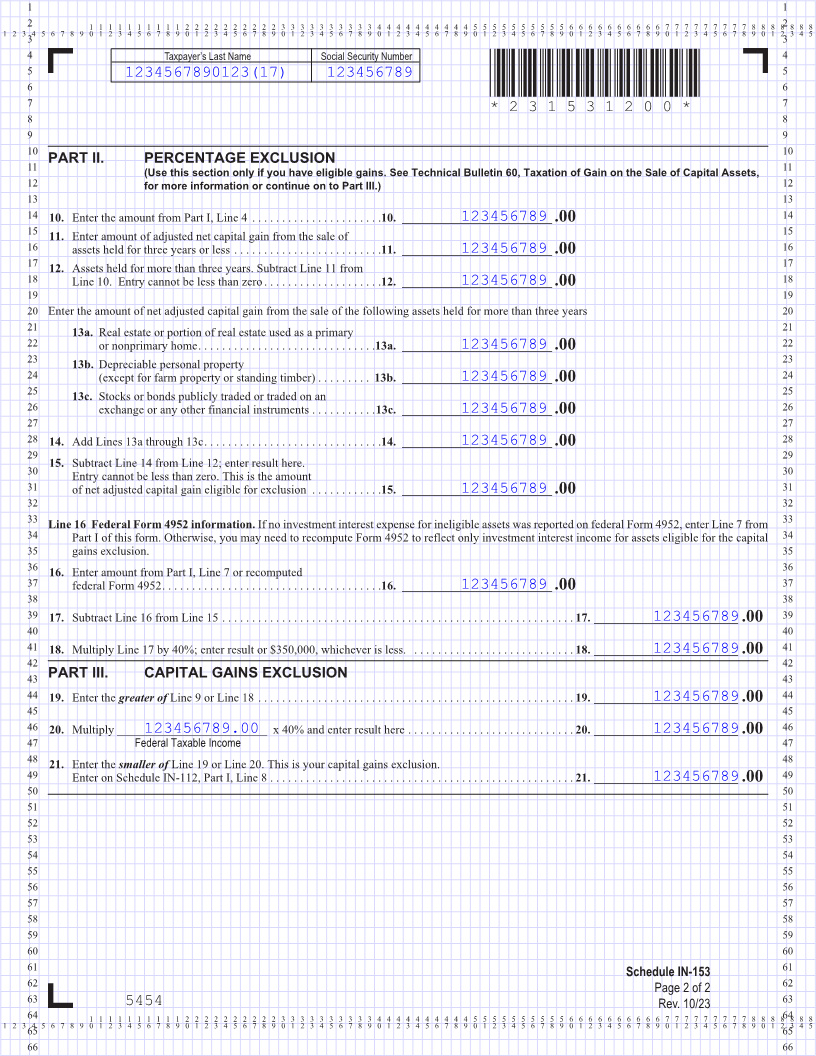

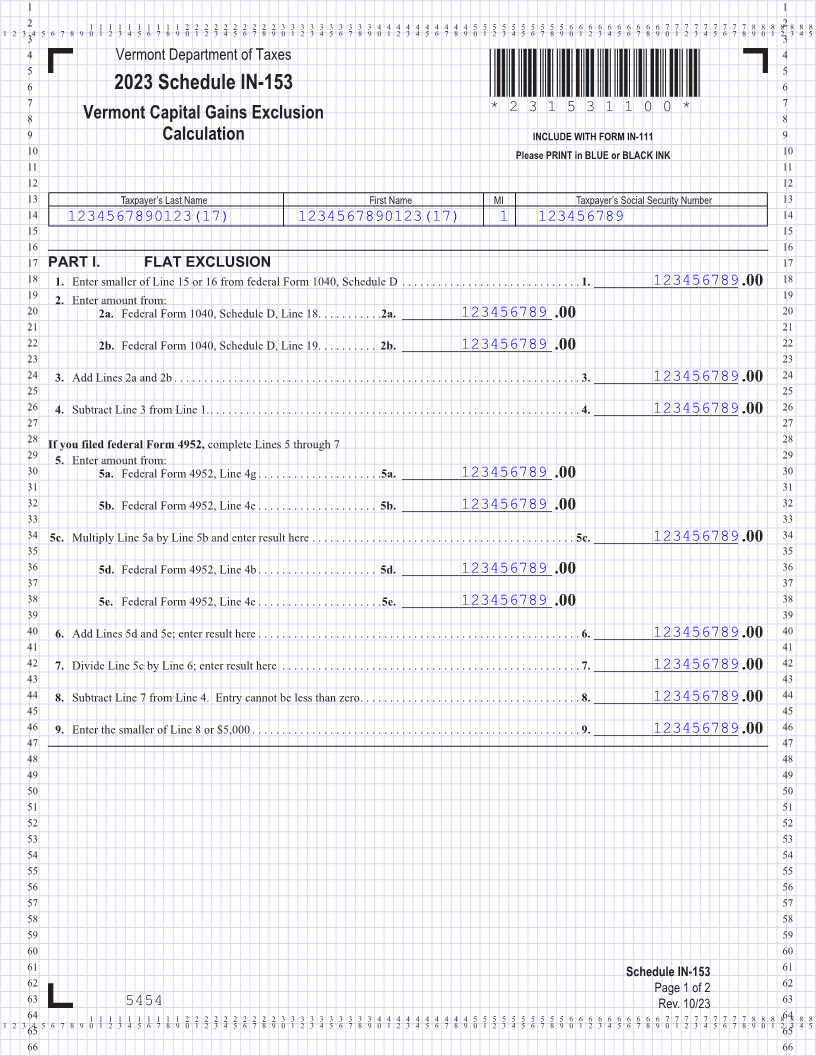

4 Vermont Department of Taxes 4

5 5

6 2023 Schedule IN-153 *231531100* 6

7 7

Vermont Capital Gains Exclusion *231531100*

8 8 Page 3

9 Calculation INCLUDE WITH FORM IN-111 9

10 Please PRINT in BLUE or BLACK INK 10

11 11

12 12

13 Taxpayer’s Last Name First Name MI Taxpayer’s Social Security Number 13

14 14

1234567890123(17) 1234567890123(17) 1 123456789

15 15

16 16

17 PART I. FLAT EXCLUSION 17

18 1. 123456789Enter smaller of Line 15 or 16 from federal Form 1040, Schedule D . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1. ________________________.00 18

19 2. Enter amount from: 19

20 123456789 2a. Federal Form 1040, Schedule D, Line 18 . . . . . . . . . . 2a. . _________________________.00 20

21 21

22 123456789 2b. Federal Form 1040, Schedule D, Line 19 . . . . . . . . . .2b. _________________________.00 22

23 23

24 3. 123456789Add Lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. . . ________________________. . . . . . . . . .00 24

25 25 FORM (Place at FIRST page)

26 4. 123456789Subtract Line 3 from Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. . . ________________________. . . . . . . . . .00 26 Form pages

27 27

28 If you filed federal Form 4952, complete Lines 5 through 7 28

29 5. Enter amount from: 29

30 123456789 5a. Federal Form 4952, Line 4g . . . . . . . . . . . . . . . . . . . . 5a. ._________________________.00 30

31 31

3 - 4

32 1234567895b. Federal Form 4952, Line 4e . . . . . . . . . . . . . . . . . . . .5b. _________________________.00 32

33 33

34 5c. 123456789 Multiply Line 5a by Line 5b and enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5c. . . ________________________. . . . . . . . . . . . .00 34

35 35

36 1234567895d. Federal Form 4952, Line 4b . . . . . . . . . . . . . . . . . . . .5d. _________________________.00 36

37 37

38 123456789 5e. Federal Form 4952, Line 4e . . . . . . . . . . . . . . . . . . . . 5e. ._________________________.00 38

39 39

40 6. 123456789Add Lines 5d and 5e; enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. . . ________________________. . . . . . . . . . . . . . . ..00 40

41 41

42 7. 123456789Divide Line 5c by Line 6; enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. . . ________________________. . . . . . . . . . . . . . . .00 42

43 43

44 8. 123456789Subtract Line 7 from Line 4 . Entry cannot be less than zero . . . . . . . . . . . . . . . . . . . . . . . . 8. . . ________________________. . . . . . . . . . . .00 44

45 45

46 9. 123456789Enter the smaller of Line 8 or $5,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. . ________________________. . . . . . . . . . . . . . . . .00. 46

47 47

48 48

49 49

50 50

51 51

52 52

53 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 Schedule IN-153 61

62 Page 1 of 2 62

63 5454 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66