Enlarge image

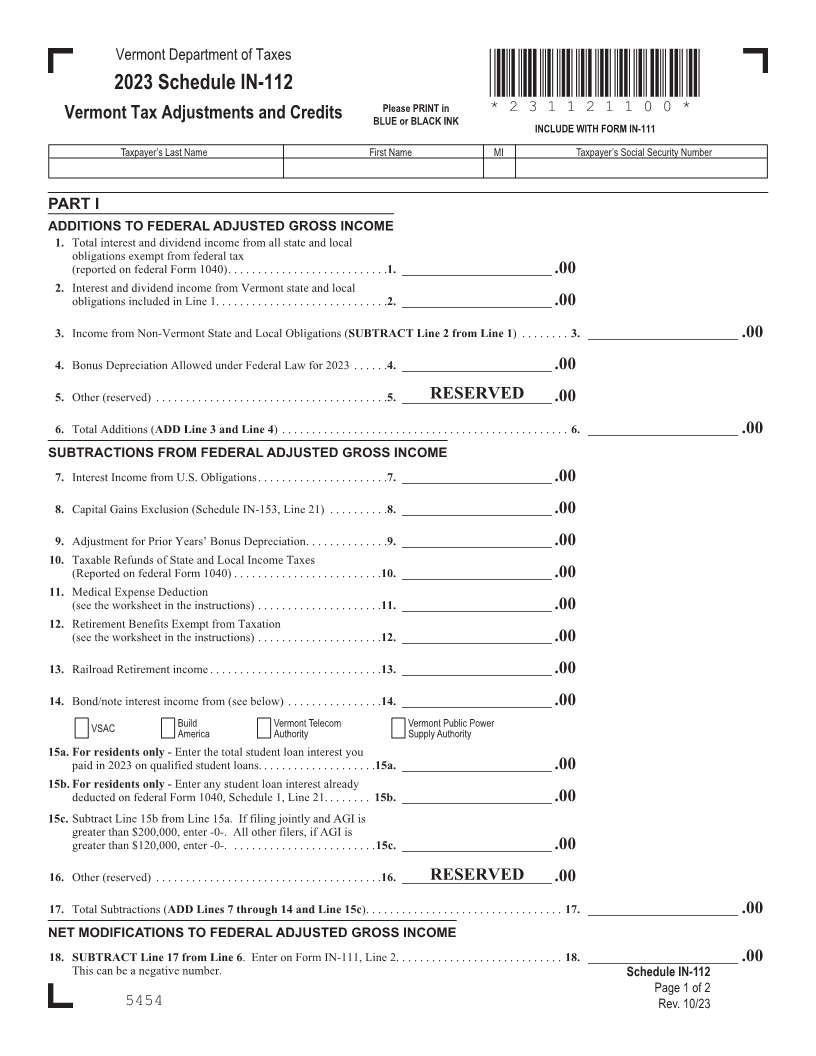

Vermont Department of Taxes

2023 Schedule IN-112 *231121100*

Please PRINT in *231121100*

Vermont Tax Adjustments and Credits BLUE or BLACK INK

INCLUDE WITH FORM IN-111 Page 23

Taxpayer’s Last Name First Name MI Taxpayer’s Social Security Number

PART I

ADDITIONS TO FEDERAL ADJUSTED GROSS INCOME FORM (Place at FIRST page)

1. Total interest and dividend income from all state and local Form pages

obligations exempt from federal tax

(reported on federal Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . .1. _________________________ .00

2. Interest and dividend income from Vermont state and local

obligations included in Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2. _________________________ .00

3. Income from Non-Vermont State and Local Obligations (SUBTRACT Line 2 from Line 1) . . . . . . . . 3. _________________________ .00 23 - 24

4. Bonus Depreciation Allowed under Federal Law for 2023 . . . . . .4. _________________________ .00

5. Other (reserved) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. ._________________________RESERVED .00

6. Total Additions (ADD Line 3 and Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. _________________________ .00

SUBTRACTIONS FROM FEDERAL ADJUSTED GROSS INCOME

7. Interest Income from U .S . Obligations . . . . . . . . . . . . . . . . . . . . . .7. _________________________ .00

8. Capital Gains Exclusion (Schedule IN-153, Line 21) . . . . . . . . . .8. _________________________ .00

9. Adjustment for Prior Years’ Bonus Depreciation . . . . . . . . . . . . . .9. _________________________ .00

10. Taxable Refunds of State and Local Income Taxes

(Reported on federal Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . .10. _________________________ .00

11. Medical Expense Deduction

(see the worksheet in the instructions) . . . . . . . . . . . . . . . . . . . . .11. _________________________ .00

12. Retirement Benefits Exempt from Taxation

(see the worksheet in the instructions) . . . . . . . . . . . . . . . . . . . . .12. _________________________ .00

13. Railroad Retirement income . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13. _________________________ .00

14. Bond/note interest income from (see below) . . . . . . . . . . . . . . . .14. _________________________ .00

VSAC Build Vermont Telecom Vermont Public Power

America Authority Supply Authority

15a. For residents only -Enter the total student loan interest you

paid in 2023 on qualified student loans . . . . . . . . . . . . . . . . . . . .15a. _________________________ .00

15b. For residents only -Enter any student loan interest already

deducted on federal Form 1040, Schedule 1, Line 21 . . . . . . . . 15b. _________________________ .00

15c. Subtract Line 15b from Line 15a . If filing jointly and AGI is

greater than $200,000, enter -0- . All other filers, if AGI is

greater than $120,000, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . .15c. _________________________ .00

16. Other (reserved) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16. . _________________________RESERVED .00

17. Total Subtractions (ADD Lines 7 through 14 and Line 15c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17. _________________________ .00

NET MODIFICATIONS TO FEDERAL ADJUSTED GROSS INCOME

18. SUBTRACT Line 17 from Line 6 . Enter on Form IN-111, Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18. _________________________ .00

This can be a negative number . Schedule IN-112

Page 1 of 2

5454 Rev. 10/23