Enlarge image

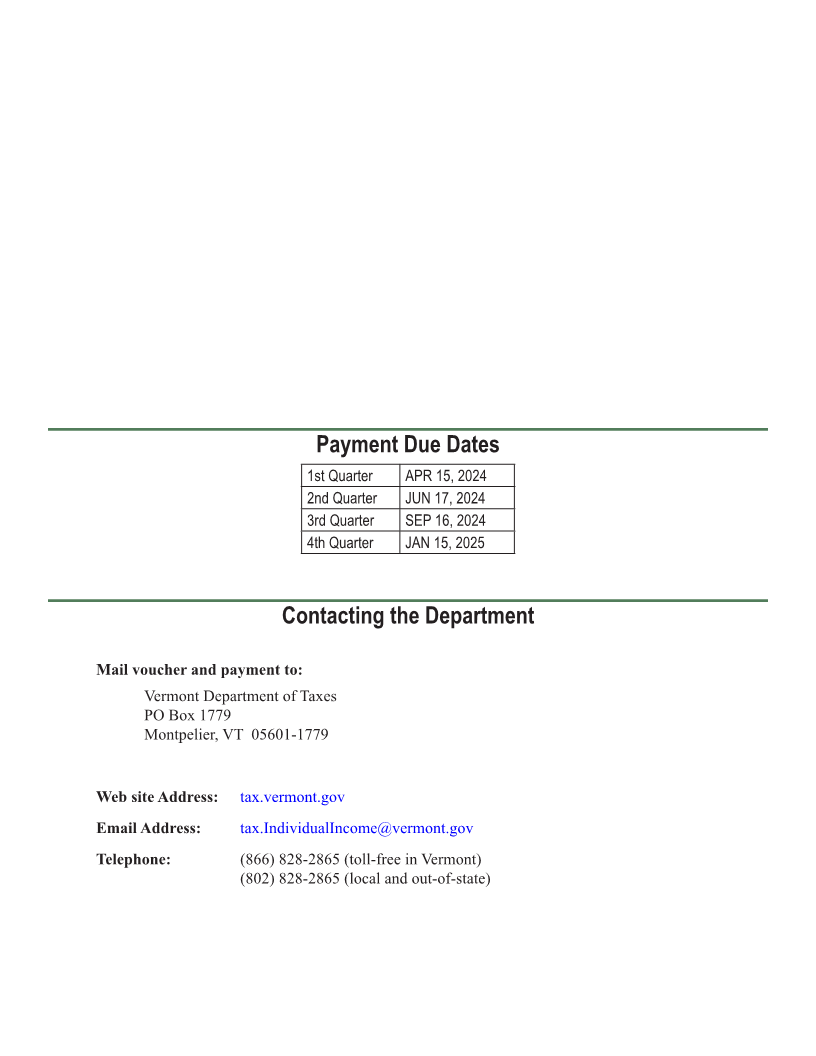

Vermont Department of Taxes

DEPT

Form IN-114 USE *241141100*

ONLY

Vermont Individual Income Estimated *241141100*

Tax Payment Voucher Please PRINT in BLUE or BLACK INK Page 3

Taxpayer’s Last Name First Name MI Taxpayer’s Social Security Number

Spouse’s/CU Partner’s Last Name First Name MI Spouse’s or CU Partner’s Social Security Number

Mailing Address (Number and Street/Road or PO Box) Tax Year

2024

City State ZIP Code or Postal Code

Amount of

Foreign Country (if not United States) this payment ...... __________________________ .00

Form IN-114

5454 Rev.10/21Rev.10/23

Clear ALL fields Save and go to Important Printing Instructions Save and Print FORM (Place at FIRST page)

Form pages

Did you know? You can make your estimated income tax payment online using ACH

Pay your income debit or your credit card . Visit us on the web at myVTax.vermont.gov and select

taxes online “Make a Payment” to get started .

3 - 4

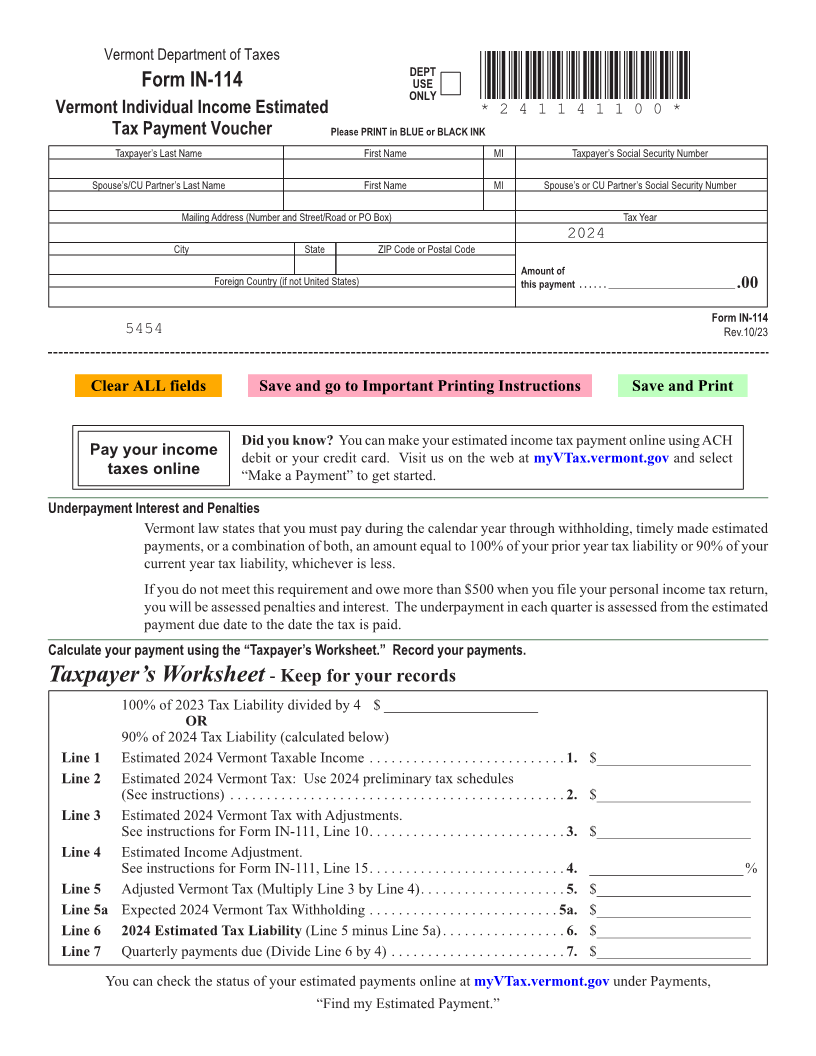

Underpayment Interest and Penalties

Vermont law states that you must pay during the calendar year through withholding, timely made estimated

payments, or a combination of both, an amount equal to 100% of your prior year tax liability or 90% of your

current year tax liability, whichever is less .

If you do not meet this requirement and owe more than $500 when you file your personal income tax return,

you will be assessed penalties and interest . The underpayment in each quarter is assessed from the estimated

payment due date to the date the tax is paid .

Calculate your payment using the “Taxpayer’s Worksheet.” Record your payments.

Taxpayer’s Worksheet - Keep for your records

100% of 2023 Tax Liability divided by 4 $ _____________________

OR

90% of 2024 Tax Liability (calculated below)

Line 1 Estimated 2024 Vermont Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . . 1.. $_____________________

Line 2 Estimated 2024 Vermont Tax: Use 2024 preliminary tax schedules

(See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $_____________________

Line 3 Estimated 2024 Vermont Tax with Adjustments .

See instructions for Form IN-111, Line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . 3.. $_____________________

Line 4 Estimated Income Adjustment .

See instructions for Form IN-111, Line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . 4.. _____________________%

Line 5 Adjusted Vermont Tax (Multiply Line 3 by Line 4) . . . . . . . . . . . . . . . . . . . . 5. $_____________________

Line 5a Expected 2024 Vermont Tax Withholding . . . . . . . . . . . . . . . . . . . . . . . . . . 5a. $_____________________

Line 6 2024 Estimated Tax Liability (Line 5 minus Line 5a) . . . . . . . . . . . . . . . . . 6. $_____________________

Line 7 Quarterly payments due (Divide Line 6 by 4) . . . . . . . . . . . . . . . . . . . . . . . . 7. $_____________________

You can check the status of your estimated payments online at myVTax.vermont.gov under Payments,

“Find my Estimated Payment .”