Enlarge image

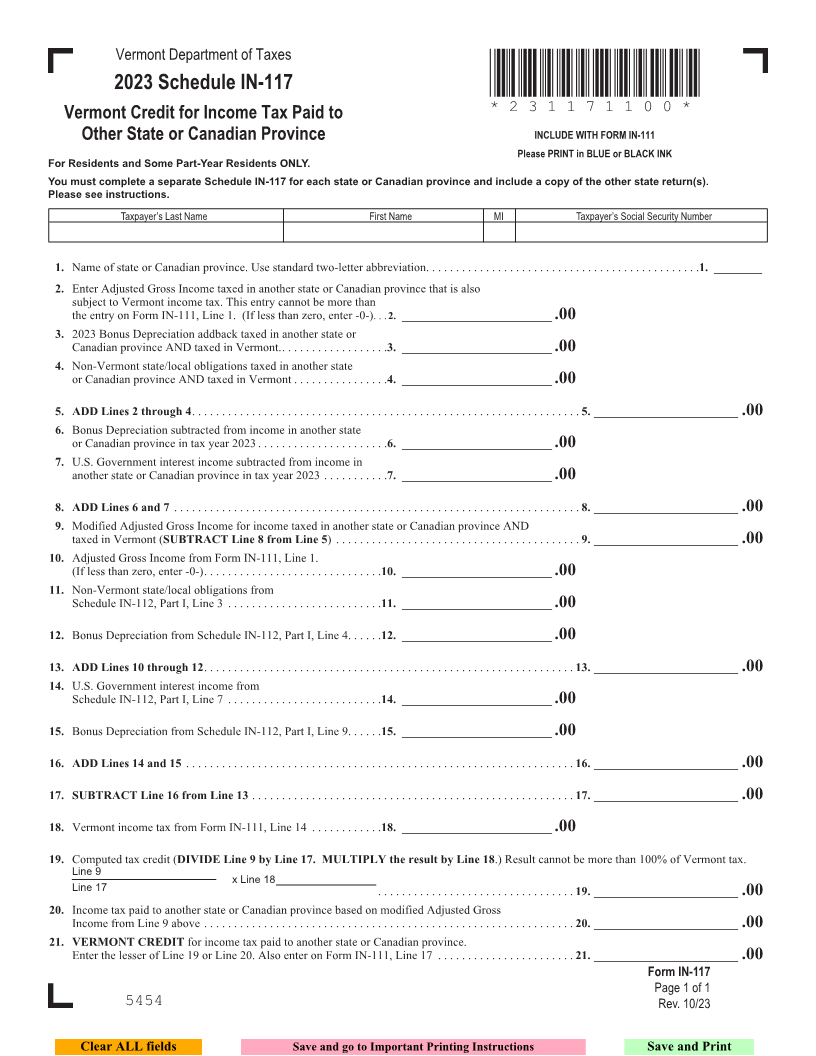

Vermont Department of Taxes

2023 Schedule IN-117 *231171100*

Vermont Credit for Income Tax Paid to *231171100*

Other State or Canadian Province INCLUDE WITH FORM IN-111 Page 3

Please PRINT in BLUE or BLACK INK

For Residents and Some Part-Year Residents ONLY.

You must complete a separate Schedule IN-117 for each state or Canadian province and include a copy of the other state return(s).

Please see instructions.

Taxpayer’s Last Name First Name MI Taxpayer’s Social Security Number

1. Name of state or Canadian province. Use standard two-letter abbreviation ..............................................1. ________

2. Enter Adjusted Gross Income taxed in another state or Canadian province that is also

subject to Vermont income tax. This entry cannot be more than

the entry on Form IN-111, Line 1. (If less than zero, enter -0-) ... 2. _________________________ .00

3. 2023 Bonus Depreciation addback taxed in another state or

Canadian province AND taxed in Vermont. ..................3. _________________________ .00

4. Non-Vermont state/local obligations taxed in another state

or Canadian province AND taxed in Vermont ................4. _________________________ .00

FORM (Place at FIRST page)

5. ADD Lines 2 through 4 .................................. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. ________________________ .00 Form pages

6. Bonus Depreciation subtracted from income in another state

or Canadian province in tax year 2023 ......................6. _________________________ .00

7. U.S. Government interest income subtracted from income in

another state or Canadian province in tax year 2023 ...........7. _________________________ .00

3 - 3

8. ADD Lines 6 and 7 ..................................... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. ________________________ .00

9. Modified Adjusted Gross Income for income taxed in another state or Canadian province AND

taxed in Vermont (SUBTRACT Line 8 from Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. ________________________ .00

10. Adjusted Gross Income from Form IN-111, Line 1.

(If less than zero, enter -0-) ..............................10. _________________________ .00

11. Non-Vermont state/local obligations from

Schedule IN-112, Part I, Line 3 ..........................11. _________________________ .00

12. Bonus Depreciation from Schedule IN-112, Part I, Line 4 ......12. _________________________ .00

13. ADD Lines 10 through 12 ................................ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. ________________________ .00

14. U.S. Government interest income from

Schedule IN-112, Part I, Line 7 ..........................14. _________________________ .00

15. Bonus Depreciation from Schedule IN-112, Part I, Line 9 ......15. _________________________ .00

16. ADD Lines 14 and 15 ................................... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16. ________________________ .00

17. SUBTRACT Line 16 from Line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17. ________________________ .00

18. Vermont income tax from Form IN-111, Line 14 ............18. _________________________ .00

19. Computed tax credit (DIVIDE Line 9 by Line 17. MULTIPLY the result by Line 18.) Result cannot be more than 100% of Vermont tax.

Line 9

x Line 18

Line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19. ________________________ .00 FORM (Place at LAST page)

20. Income tax paid to another state or Canadian province based on modified Adjusted Gross Form pages

Income from Line 9 above ................................ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20. ________________________ .00

21. VERMONT CREDIT for income tax paid to another state or Canadian province.

Enter the lesser of Line 19 or Line 20. Also enter on Form IN-111, Line 17 ....................... 21. ________________________ .00

Form IN-117

Page 1 of 1 3 - 3

5454 Rev. 10/23

Clear ALL fields Save and go to Important Printing Instructions Save and Print