Enlarge image

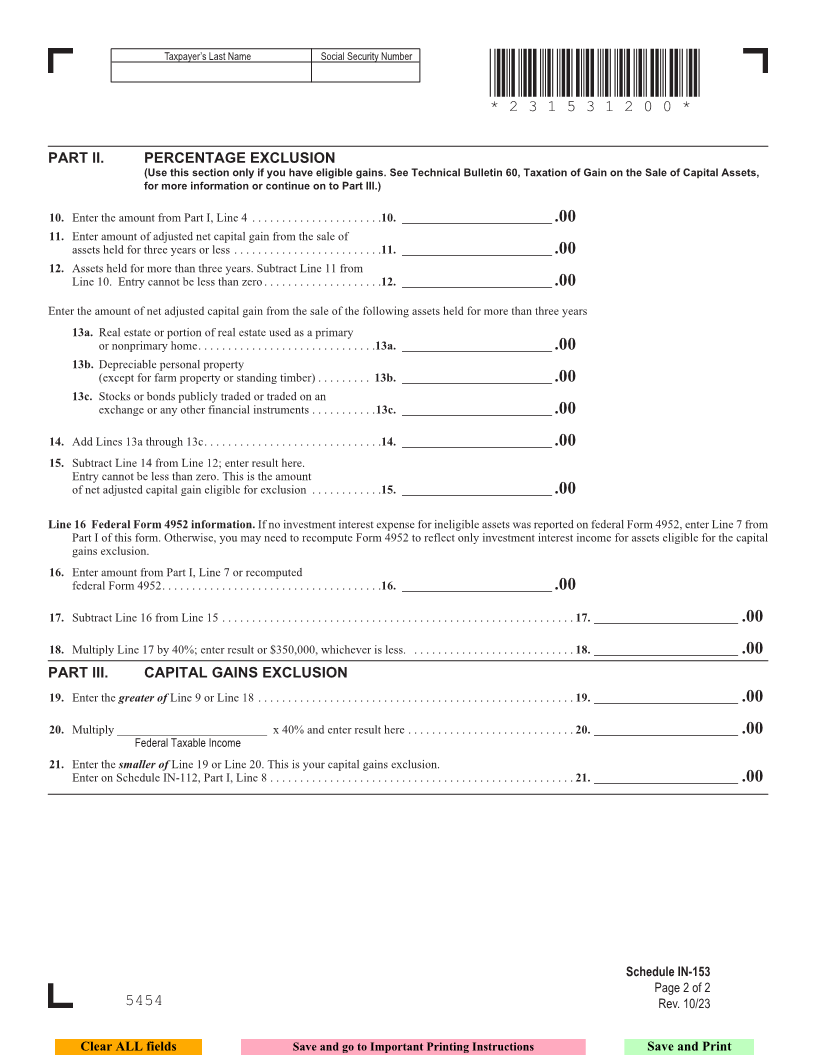

Vermont Department of Taxes

2023 Schedule IN-153 *231531100*

Vermont Capital Gains Exclusion *231531100*

Page 3

Calculation INCLUDE WITH FORM IN-111

Please PRINT in BLUE or BLACK INK

Taxpayer’s Last Name First Name MI Taxpayer’s Social Security Number

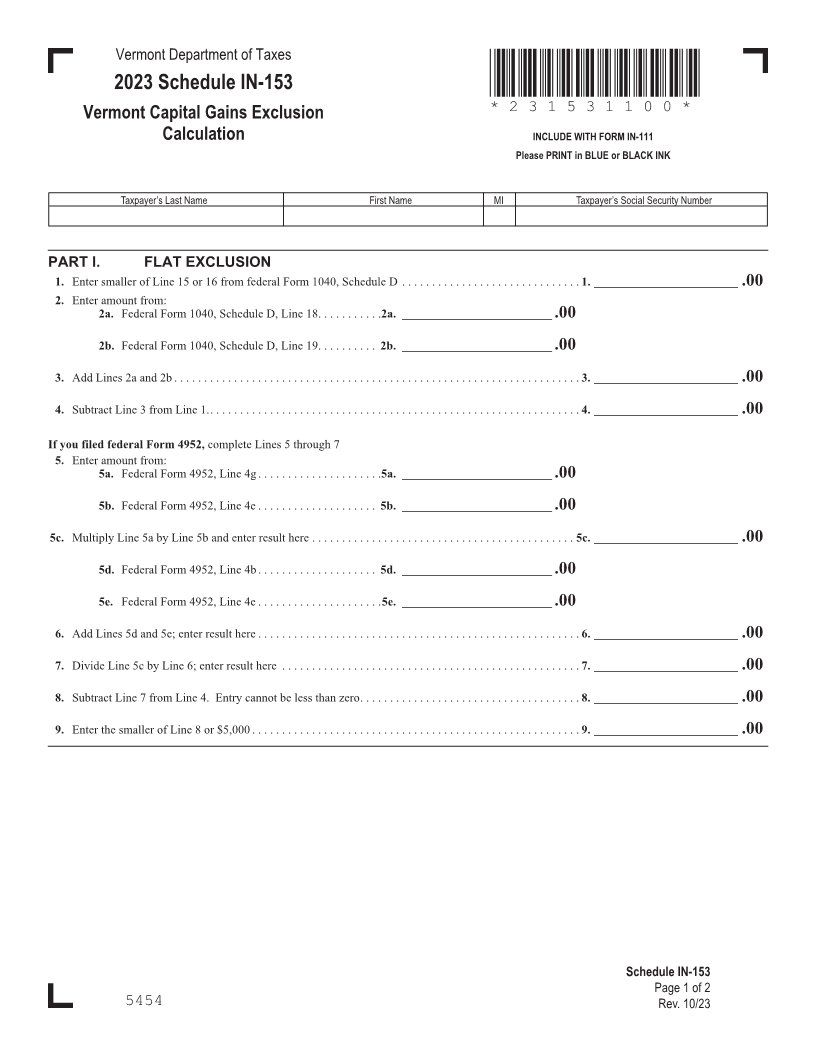

PART I. FLAT EXCLUSION

1. Enter smaller of Line 15 or 16 from federal Form 1040, Schedule D . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. ________________________ .00

2. Enter amount from:

2a. Federal Form 1040, Schedule D, Line 18 . . . . . . . . . . .2a. _________________________ .00

2b. Federal Form 1040, Schedule D, Line 19 . . . . . . . . . . 2b. _________________________ .00

3. Add Lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. ________________________ .00

FORM (Place at FIRST page)

4. Subtract Line 3 from Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. ________________________ .00 Form pages

If you filed federal Form 4952, complete Lines 5 through 7

5. Enter amount from:

5a. Federal Form 4952, Line 4g . . . . . . . . . . . . . . . . . . . . .5a. _________________________ .00

3 - 4

5b. Federal Form 4952, Line 4e . . . . . . . . . . . . . . . . . . . . 5b. _________________________ .00

5c. Multiply Line 5a by Line 5b and enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5c. ________________________ .00

5d. Federal Form 4952, Line 4b . . . . . . . . . . . . . . . . . . . . 5d. _________________________ .00

5e. Federal Form 4952, Line 4e . . . . . . . . . . . . . . . . . . . . .5e. _________________________ .00

6. Add Lines 5d and 5e; enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. ________________________ .00

7. Divide Line 5c by Line 6; enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. ________________________ .00

8. Subtract Line 7 from Line 4 . Entry cannot be less than zero . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. ________________________ .00

9. Enter the smaller of Line 8 or $5,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. ________________________ .00

Schedule IN-153

Page 1 of 2

5454 Rev. 10/23