Enlarge image

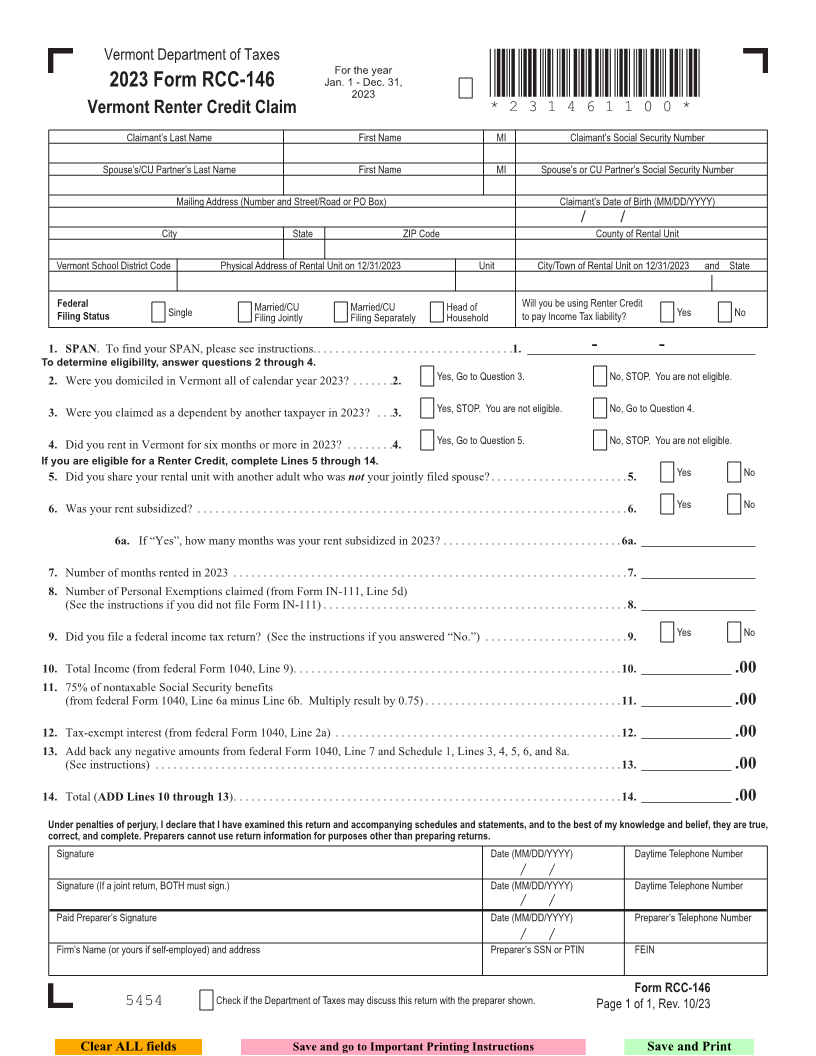

Vermont Department of Taxes

For the year

Jan. 1 - Dec. 31,

2023 Form RCC-146 2023 *231461100*

Vermont Renter Credit Claim *231461100*

Page 27

Claimant’s Last Name First Name MI Claimant’s Social Security Number

Spouse’s/CU Partner’s Last Name First Name MI Spouse’s or CU Partner’s Social Security Number

Mailing Address (Number and Street/Road or PO Box) Claimant’s Date of Birth (MM/DD/YYYY)

/ /

City State ZIP Code County of Rental Unit FORM (Place at FIRST page)

Form pages

Vermont School District Code Physical Address of Rental Unit on 12/31/2023 Unit City/Town of Rental Unit on 12/31/2023 and State

Federal Will you be using Renter Credit

Filing Status Single Married/CU Married/CU Head of to pay Income Tax liability? Yes No

Filing Jointly Filing Separately Household

27 - 27

1. SPAN . To find your SPAN, please see instructions. ................................. 1. ______________________________________- -

To determine eligibility, answer questions 2 through 4.

2. Were you domiciled in Vermont all of calendar year 2023? .......2. Yes, Go to Question 3. No, STOP. You are not eligible.

3. Were you claimed as a dependent by another taxpayer in 2023? ...3. Yes, STOP. You are not eligible. No, Go to Question 4.

4. Did you rent in Vermont for six months or more in 2023? ........4. Yes, Go to Question 5. No, STOP. You are not eligible.

If you are eligible for a Renter Credit, complete Lines 5 through 14.

5. Did you share your rental unit with another adult who was not your jointly filed spouse? ....................... 5. Yes No

6. Was your rent subsidized? ........................................................................ 6. Yes No

6a. If “Yes”, how many months was your rent subsidized in 2023? .............................. 6a. ___________________

7. Number of months rented in 2023 .................................................................. 7. ___________________

8. Number of Personal Exemptions claimed (from Form IN-111, Line 5d)

(See the instructions if you did not file Form IN-111) ................................................... 8. ___________________

9. Did you file a federal income tax return? (See the instructions if you answered “No.”) ........................ 9. Yes No

10. Total Income (from federal Form 1040, Line 9) ....................................................... 10. _______________ .00

11. 75% of nontaxable Social Security benefits

(from federal Form 1040, Line 6a minus Line 6b. Multiply result by 0.75) ................................. 11. _______________ .00

12. Tax-exempt interest (from federal Form 1040, Line 2a) ................................................ 12. _______________ .00

13. Add back any negative amounts from federal Form 1040, Line 7 and Schedule 1, Lines 3, 4, 5, 6, and 8a.

(See instructions) .............................................................................. 13. _______________ .00

14. Total (ADD Lines 10 through 13) ................................................................. 14. _______________ .00

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true,

correct, and complete. Preparers cannot use return information for purposes other than preparing returns.

Signature Date (MM/DD/YYYY) Daytime Telephone Number

/ /

Signature (If a joint return, BOTH must sign.) Date (MM/DD/YYYY) Daytime Telephone Number FORM (Place at LAST page)

/ / Form pages

Paid Preparer’s Signature Date (MM/DD/YYYY) Preparer’s Telephone Number

/ /

Firm’s Name (or yours if self-employed) and address Preparer’s SSN or PTIN FEIN

Form RCC-146 27 - 27

5454 Check if the Department of Taxes may discuss this return with the preparer shown. Page 1 of 1, Rev. 10/23

Clear ALL fields Save and go to Important Printing Instructions Save and Print