- 6 -

Enlarge image

|

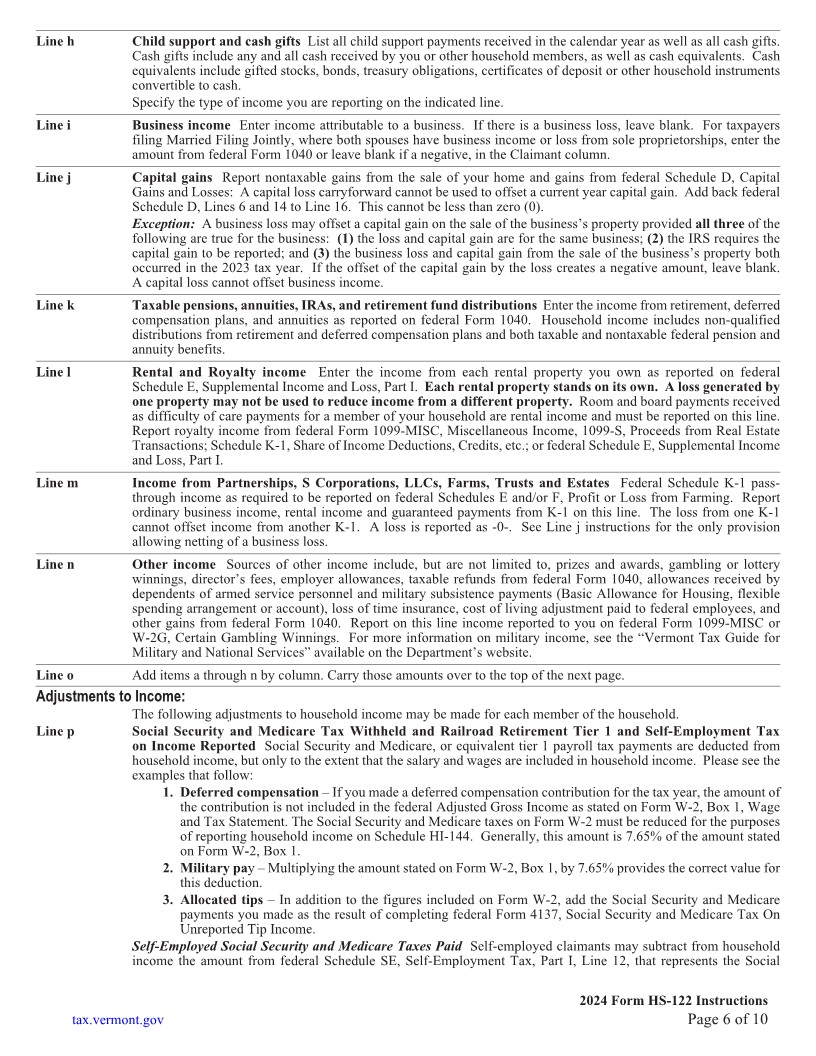

Line h Child support and cash gifts List all child support payments received in the calendar year as well as all cash gifts.

Cash gifts include any and all cash received by you or other household members, as well as cash equivalents. Cash

equivalents include gifted stocks, bonds, treasury obligations, certificates of deposit or other household instruments

convertible to cash.

Specify the type of income you are reporting on the indicated line.

Line i Business income Enter income attributable to a business. If there is a business loss, leave blank. For taxpayers Page 6

filing Married Filing Jointly, where both spouses have business income or loss from sole proprietorships, enter the

amount from federal Form 1040 or leave blank if a negative, in the Claimant column.

Line j Capital gains Report nontaxable gains from the sale of your home and gains from federal Schedule D, Capital

Gains and Losses: A capital loss carryforward cannot be used to offset a current year capital gain. Add back federal

Schedule D, Lines 6 and 14 to Line 16. This cannot be less than zero (0).

Exception: A business loss may offset a capital gain on the sale of the business’s property provided all three of the

following are true for the business: (1) the loss and capital gain are for the same business; (2) the IRS requires the

capital gain to be reported; and (3) the business loss and capital gain from the sale of the business’s property both

occurred in the 2023 tax year. If the offset of the capital gain by the loss creates a negative amount, leave blank.

A capital loss cannot offset business income.

Line k Taxable pensions, annuities, IRAs, and retirement fund distributions Enter the income from retirement, deferred

compensation plans, and annuities as reported on federal Form 1040. Household income includes non-qualified

distributions from retirement and deferred compensation plans and both taxable and nontaxable federal pension and

annuity benefits.

Line l Rental and Royalty income Enter the income from each rental property you own as reported on federal

Schedule E, Supplemental Income and Loss, Part I. Each rental property stands on its own. A loss generated by

one property may not be used to reduce income from a different property. Room and board payments received

as difficulty of care payments for a member of your household are rental income and must be reported on this line.

Report royalty income from federal Form 1099-MISC, Miscellaneous Income, 1099-S, Proceeds from Real Estate

Transactions; Schedule K-1, Share of Income Deductions, Credits, etc.; or federal Schedule E, Supplemental Income

and Loss, Part I.

Line m Income from Partnerships, S Corporations, LLCs, Farms, Trusts and Estates Federal Schedule K-1 pass-

through income as required to be reported on federal Schedules E and/or F, Profit or Loss from Farming. Report

ordinary business income, rental income and guaranteed payments from K-1 on this line. The loss from one K-1

cannot offset income from another K-1. A loss is reported as -0-. See Line j instructions for the only provision

allowing netting of a business loss.

Line n Other income Sources of other income include, but are not limited to, prizes and awards, gambling or lottery

winnings, director’s fees, employer allowances, taxable refunds from federal Form 1040, allowances received by

dependents of armed service personnel and military subsistence payments (Basic Allowance for Housing, flexible

spending arrangement or account), loss of time insurance, cost of living adjustment paid to federal employees, and

other gains from federal Form 1040. Report on this line income reported to you on federal Form 1099-MISC or

W-2G, Certain Gambling Winnings. For more information on military income, see the “Vermont Tax Guide for

Military and National Services” available on the Department’s website.

Line o Add items a through n by column. Carry those amounts over to the top of the next page.

Adjustments to Income:

The following adjustments to household income may be made for each member of the household.

Line p Social Security and Medicare Tax Withheld and Railroad Retirement Tier 1 and Self-Employment Tax

on Income Reported Social Security and Medicare, or equivalent tier 1 payroll tax payments are deducted from

household income, but only to the extent that the salary and wages are included in household income. Please see the

examples that follow:

1. Deferred compensation – If you made a deferred compensation contribution for the tax year, the amount of

the contribution is not included in the federal Adjusted Gross Income as stated on Form W-2, Box 1, Wage

and Tax Statement. The Social Security and Medicare taxes on Form W-2 must be reduced for the purposes

of reporting household income on Schedule HI-144. Generally, this amount is 7.65% of the amount stated

on Form W-2, Box 1.

2. Military pay – Multiplying the amount stated on Form W-2, Box 1, by 7.65% provides the correct value for

this deduction.

3. Allocated tips – In addition to the figures included on Form W-2, add the Social Security and Medicare

payments you made as the result of completing federal Form 4137, Social Security and Medicare Tax On

Unreported Tip Income.

Self-Employed Social Security and Medicare Taxes Paid Self-employed claimants may subtract from household

income the amount from federal Schedule SE, Self-Employment Tax, Part I, Line 12, that represents the Social

2024 Form HS-122 Instructions

tax.vermont.gov Page 6 of 10

|