- 17 -

Enlarge image

|

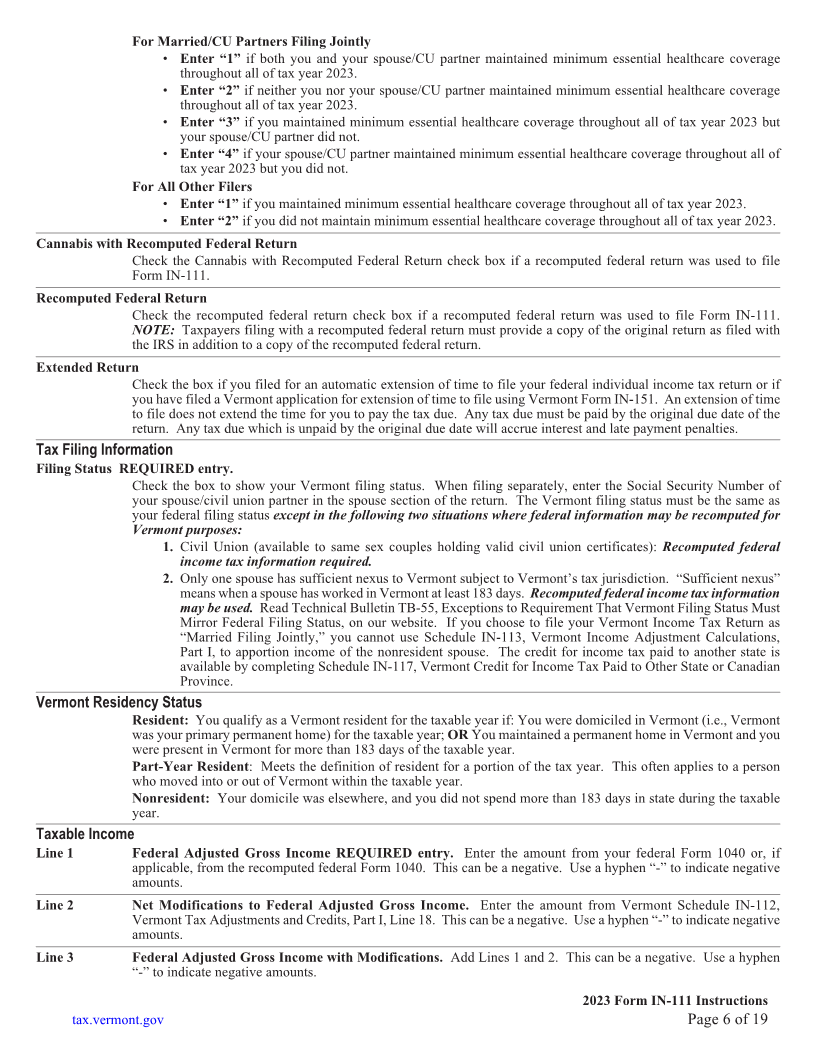

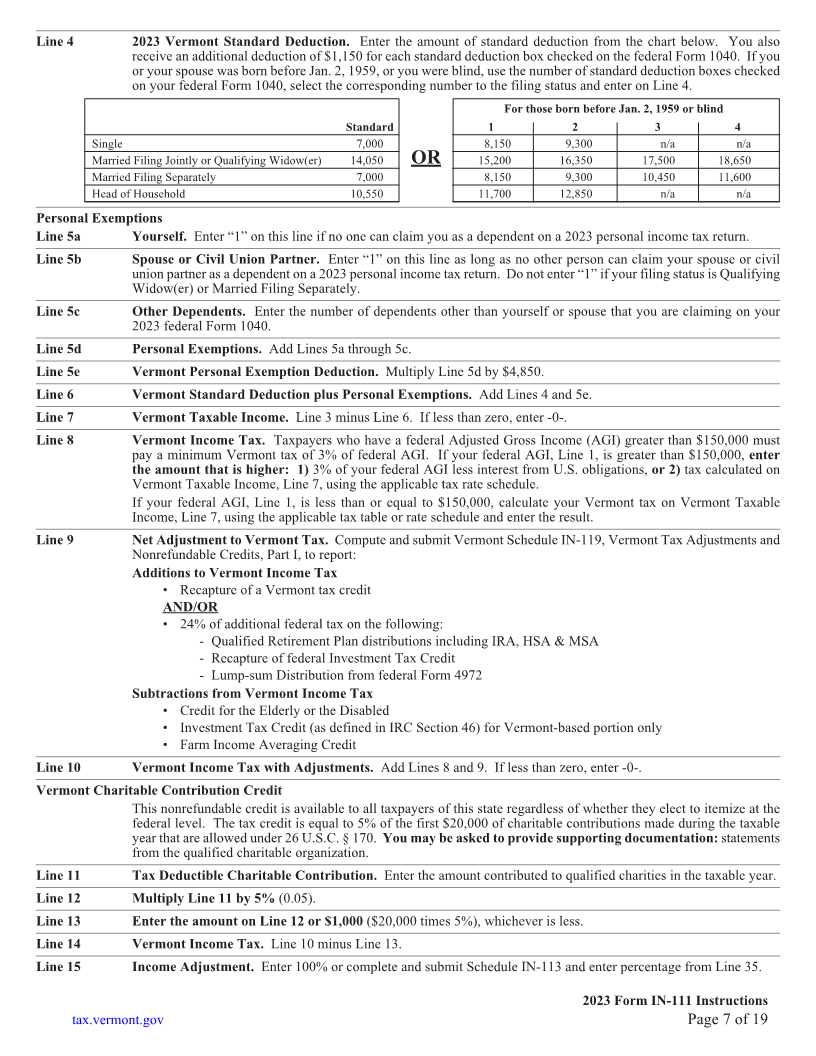

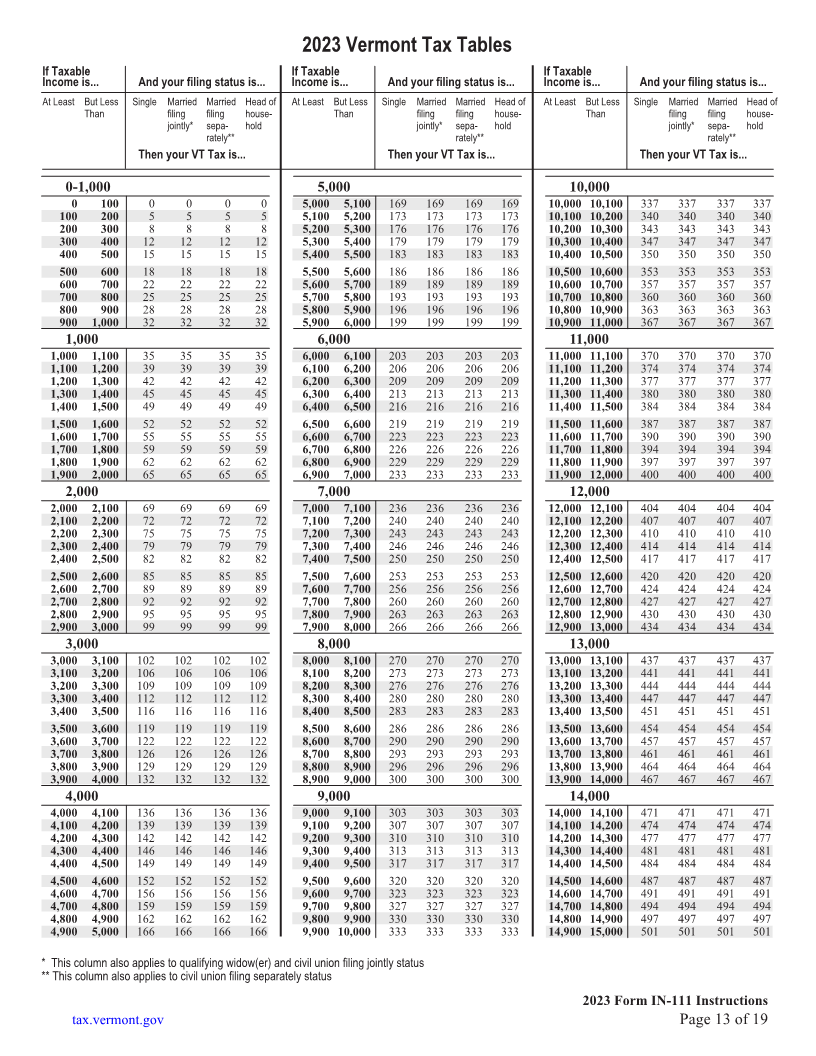

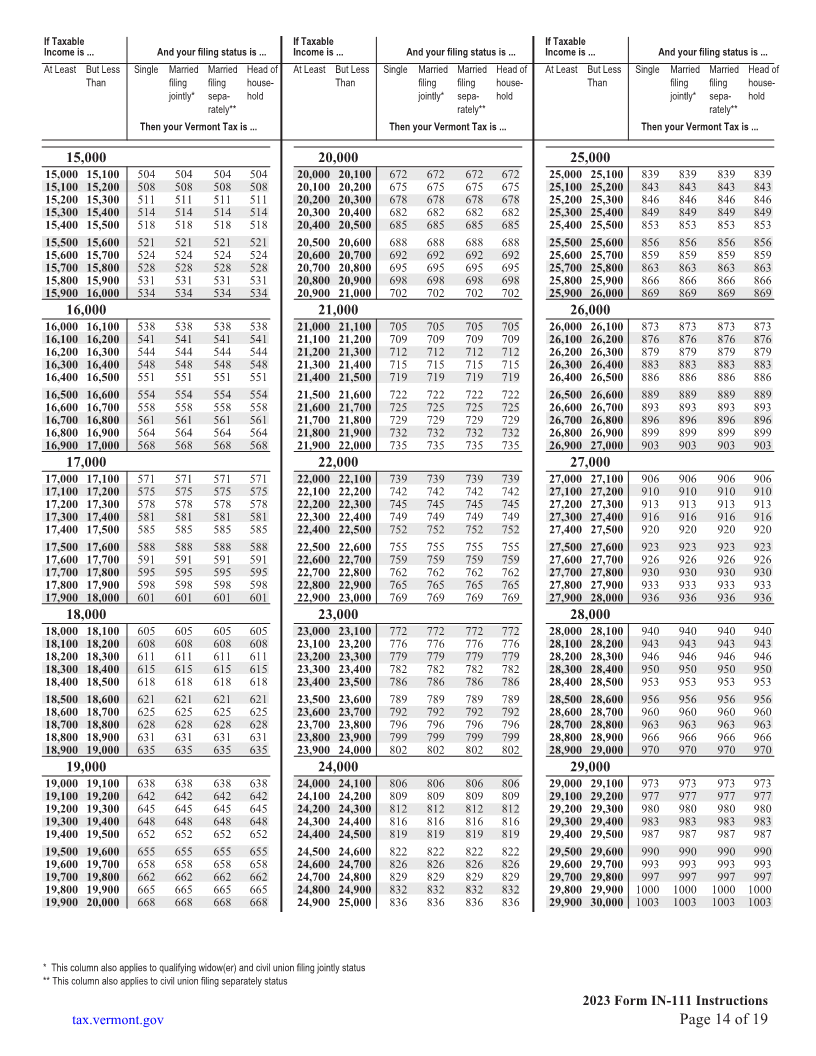

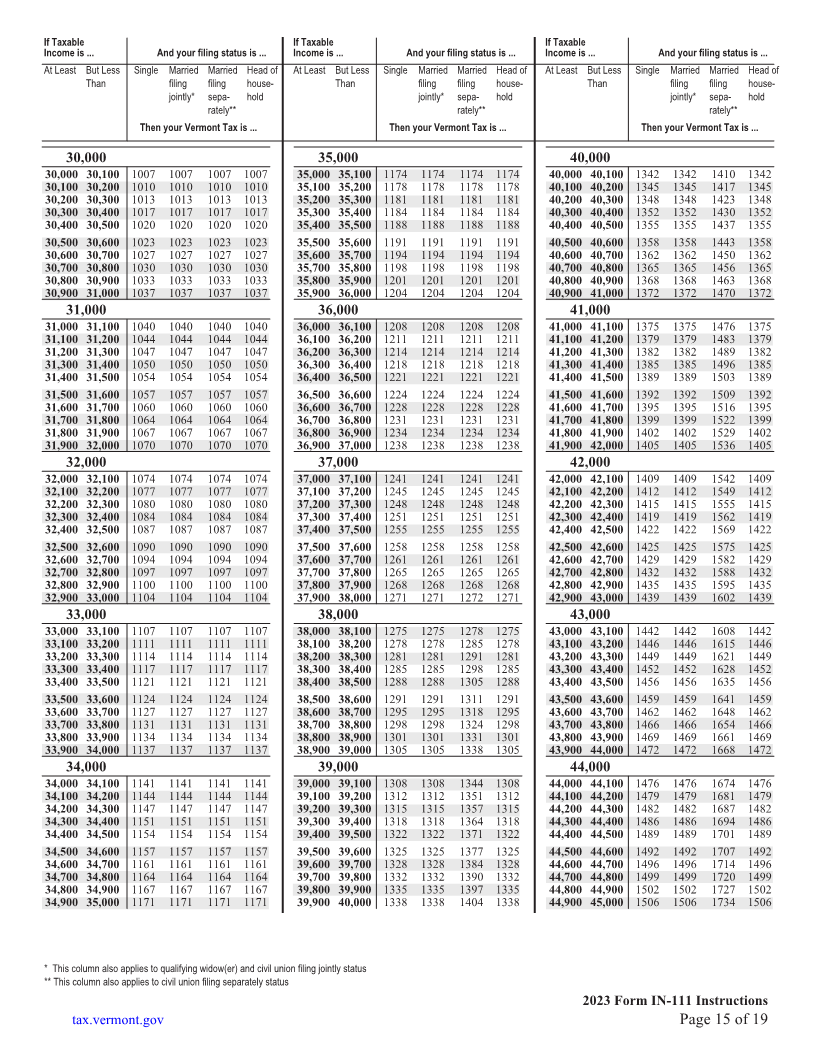

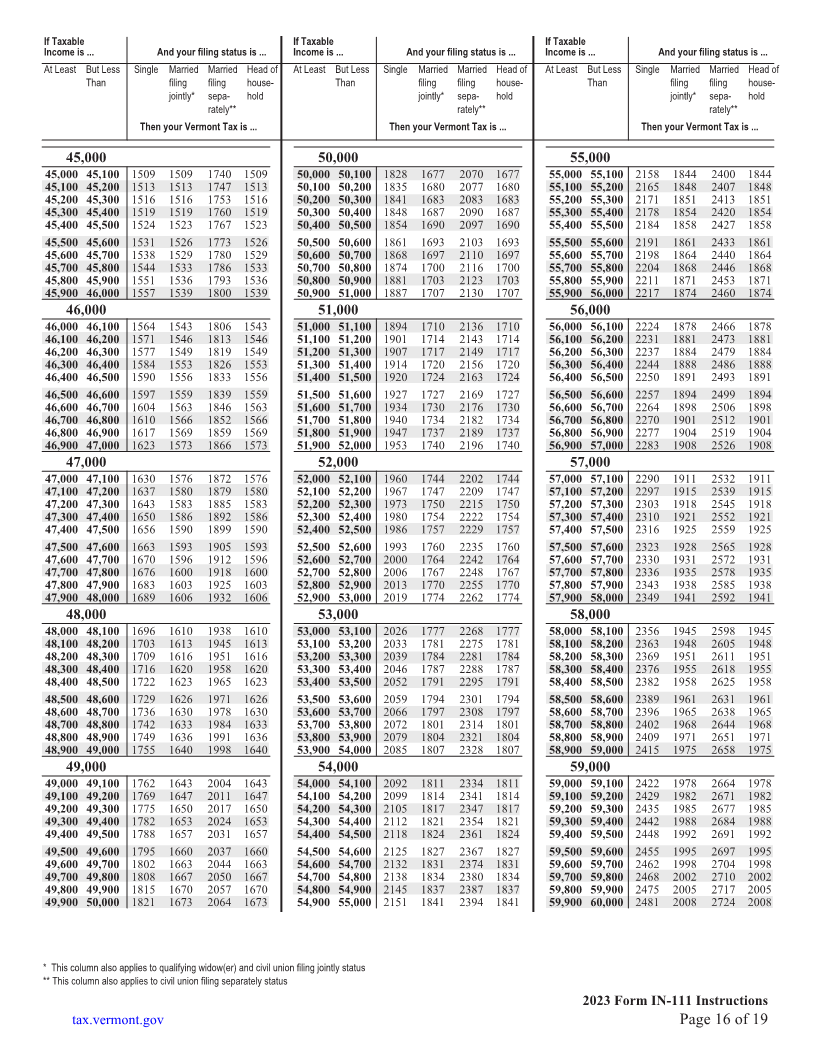

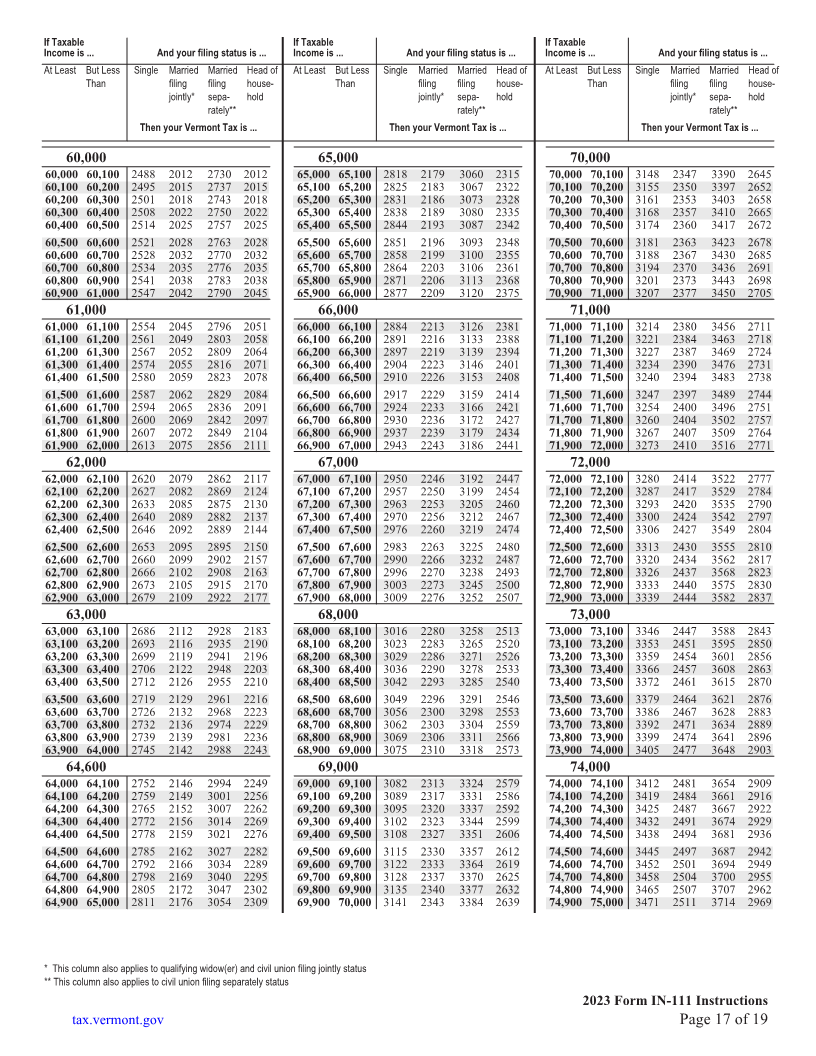

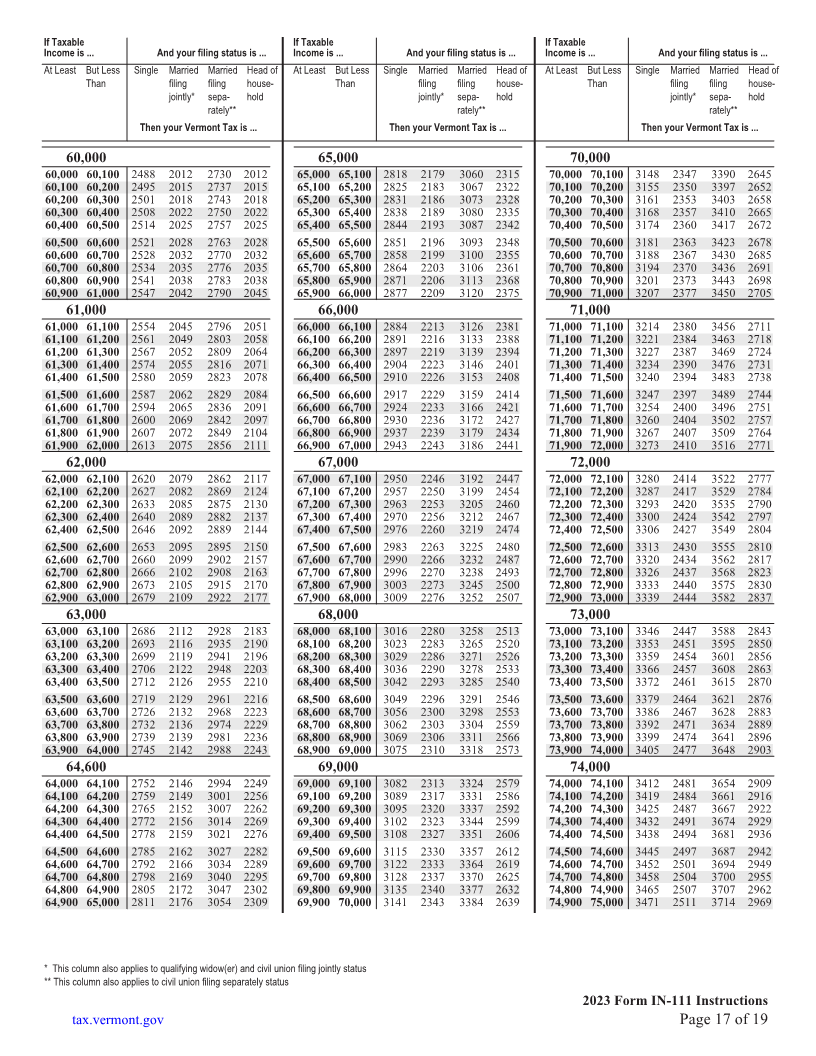

If Taxable If Taxable If Taxable

Income is ... And your filing status is ... Income is ... And your filing status is ... Income is ... And your filing status is ...

At Least But Less Single Married Married Head of At Least But Less Single Married Married Head of At Least But Less Single Married Married Head of

Than filing filing house- Than filing filing house- Than filing filing house-

jointly* sepa- hold jointly* sepa- hold jointly* sepa- hold

rately** rately** rately**

Then your Vermont Tax is ... Then your Vermont Tax is ... Then your Vermont Tax is ... Page Page 1717

Tax Tables - LAST page

60,000 65,000 70,000

60,000 60,100 2488 2012 2730 2012 65,000 65,100 2818 2179 3060 2315 70,000 70,100 3148 2347 3390 2645 Tax Tables begin on page

60,100 60,200 2495 2015 2737 2015 65,100 65,200 2825 2183 3067 2322 70,100 70,200 3155 2350 3397 2652

60,200 60,300 2501 2018 2743 2018 65,200 65,300 2831 2186 3073 2328 70,200 70,300 3161 2353 3403 2658

60,300 60,400 2508 2022 2750 2022 65,300 65,400 2838 2189 3080 2335 70,300 70,400 3168 2357 3410 2665

60,400 60,500 2514 2025 2757 2025 65,400 65,500 2844 2193 3087 2342 70,400 70,500 3174 2360 3417 2672 13

60,500 60,600 2521 2028 2763 2028 65,500 65,600 2851 2196 3093 2348 70,500 70,600 3181 2363 3423 2678

60,600 60,700 2528 2032 2770 2032 65,600 65,700 2858 2199 3100 2355 70,600 70,700 3188 2367 3430 2685

60,700 60,800 2534 2035 2776 2035 65,700 65,800 2864 2203 3106 2361 70,700 70,800 3194 2370 3436 2691

60,800 60,900 2541 2038 2783 2038 65,800 65,900 2871 2206 3113 2368 70,800 70,900 3201 2373 3443 2698

60,900 61,000 2547 2042 2790 2045 65,900 66,000 2877 2209 3120 2375 70,900 71,000 3207 2377 3450 2705

61,000 66,000 71,000

61,000 61,100 2554 2045 2796 2051 66,000 66,100 2884 2213 3126 2381 71,000 71,100 3214 2380 3456 2711

61,100 61,200 2561 2049 2803 2058 66,100 66,200 2891 2216 3133 2388 71,100 71,200 3221 2384 3463 2718

61,200 61,300 2567 2052 2809 2064 66,200 66,300 2897 2219 3139 2394 71,200 71,300 3227 2387 3469 2724

61,300 61,400 2574 2055 2816 2071 66,300 66,400 2904 2223 3146 2401 71,300 71,400 3234 2390 3476 2731

61,400 61,500 2580 2059 2823 2078 66,400 66,500 2910 2226 3153 2408 71,400 71,500 3240 2394 3483 2738

61,500 61,600 2587 2062 2829 2084 66,500 66,600 2917 2229 3159 2414 71,500 71,600 3247 2397 3489 2744

61,600 61,700 2594 2065 2836 2091 66,600 66,700 2924 2233 3166 2421 71,600 71,700 3254 2400 3496 2751

61,700 61,800 2600 2069 2842 2097 66,700 66,800 2930 2236 3172 2427 71,700 71,800 3260 2404 3502 2757

61,800 61,900 2607 2072 2849 2104 66,800 66,900 2937 2239 3179 2434 71,800 71,900 3267 2407 3509 2764

61,900 62,000 2613 2075 2856 2111 66,900 67,000 2943 2243 3186 2441 71,900 72,000 3273 2410 3516 2771

62,000 67,000 72,000

62,000 62,100 2620 2079 2862 2117 67,000 67,100 2950 2246 3192 2447 72,000 72,100 3280 2414 3522 2777

62,100 62,200 2627 2082 2869 2124 67,100 67,200 2957 2250 3199 2454 72,100 72,200 3287 2417 3529 2784

62,200 62,300 2633 2085 2875 2130 67,200 67,300 2963 2253 3205 2460 72,200 72,300 3293 2420 3535 2790

62,300 62,400 2640 2089 2882 2137 67,300 67,400 2970 2256 3212 2467 72,300 72,400 3300 2424 3542 2797

62,400 62,500 2646 2092 2889 2144 67,400 67,500 2976 2260 3219 2474 72,400 72,500 3306 2427 3549 2804

62,500 62,600 2653 2095 2895 2150 67,500 67,600 2983 2263 3225 2480 72,500 72,600 3313 2430 3555 2810

62,600 62,700 2660 2099 2902 2157 67,600 67,700 2990 2266 3232 2487 72,600 72,700 3320 2434 3562 2817

62,700 62,800 2666 2102 2908 2163 67,700 67,800 2996 2270 3238 2493 72,700 72,800 3326 2437 3568 2823

62,800 62,900 2673 2105 2915 2170 67,800 67,900 3003 2273 3245 2500 72,800 72,900 3333 2440 3575 2830

62,900 63,000 2679 2109 2922 2177 67,900 68,000 3009 2276 3252 2507 72,900 73,000 3339 2444 3582 2837

63,000 68,000 73,000

63,000 63,100 2686 2112 2928 2183 68,000 68,100 3016 2280 3258 2513 73,000 73,100 3346 2447 3588 2843

63,100 63,200 2693 2116 2935 2190 68,100 68,200 3023 2283 3265 2520 73,100 73,200 3353 2451 3595 2850

63,200 63,300 2699 2119 2941 2196 68,200 68,300 3029 2286 3271 2526 73,200 73,300 3359 2454 3601 2856

63,300 63,400 2706 2122 2948 2203 68,300 68,400 3036 2290 3278 2533 73,300 73,400 3366 2457 3608 2863

63,400 63,500 2712 2126 2955 2210 68,400 68,500 3042 2293 3285 2540 73,400 73,500 3372 2461 3615 2870

63,500 63,600 2719 2129 2961 2216 68,500 68,600 3049 2296 3291 2546 73,500 73,600 3379 2464 3621 2876

63,600 63,700 2726 2132 2968 2223 68,600 68,700 3056 2300 3298 2553 73,600 73,700 3386 2467 3628 2883

63,700 63,800 2732 2136 2974 2229 68,700 68,800 3062 2303 3304 2559 73,700 73,800 3392 2471 3634 2889

63,800 63,900 2739 2139 2981 2236 68,800 68,900 3069 2306 3311 2566 73,800 73,900 3399 2474 3641 2896

63,900 64,000 2745 2142 2988 2243 68,900 69,000 3075 2310 3318 2573 73,900 74,000 3405 2477 3648 2903

64,600 69,000 74,000

64,000 64,100 2752 2146 2994 2249 69,000 69,100 3082 2313 3324 2579 74,000 74,100 3412 2481 3654 2909

64,100 64,200 2759 2149 3001 2256 69,100 69,200 3089 2317 3331 2586 74,100 74,200 3419 2484 3661 2916

64,200 64,300 2765 2152 3007 2262 69,200 69,300 3095 2320 3337 2592 74,200 74,300 3425 2487 3667 2922

64,300 64,400 2772 2156 3014 2269 69,300 69,400 3102 2323 3344 2599 74,300 74,400 3432 2491 3674 2929

64,400 64,500 2778 2159 3021 2276 69,400 69,500 3108 2327 3351 2606 74,400 74,500 3438 2494 3681 2936

64,500 64,600 2785 2162 3027 2282 69,500 69,600 3115 2330 3357 2612 74,500 74,600 3445 2497 3687 2942

64,600 64,700 2792 2166 3034 2289 69,600 69,700 3122 2333 3364 2619 74,600 74,700 3452 2501 3694 2949

64,700 64,800 2798 2169 3040 2295 69,700 69,800 3128 2337 3370 2625 74,700 74,800 3458 2504 3700 2955

64,800 64,900 2805 2172 3047 2302 69,800 69,900 3135 2340 3377 2632 74,800 74,900 3465 2507 3707 2962

64,900 65,000 2811 2176 3054 2309 69,900 70,000 3141 2343 3384 2639 74,900 75,000 3471 2511 3714 2969

* This column also applies to qualifying widow(er) and civil union filing jointly status

** This column also applies to civil union filing separately status

2023 Form IN-111 Instructions

tax.vermont.gov Page 17 of 19

|