Enlarge image

SCHEDULE IN-112 Vermont Tax Adjustments and Credits

Print your name and Social Security Number on this schedule. Please use blue or black ink to make all entries.

Who Must File Schedule IN-112

You must file Schedule IN-112 for:

• Additions and Subtractions to Federal Adjusted Gross Income (Part I) Page 1

- Interest Income from State and Local Taxes Exempt from Federal Tax

- Interest and Dividend Income

- Federal Bonus Depreciation

- Taxable Refunds of State and Local Taxes

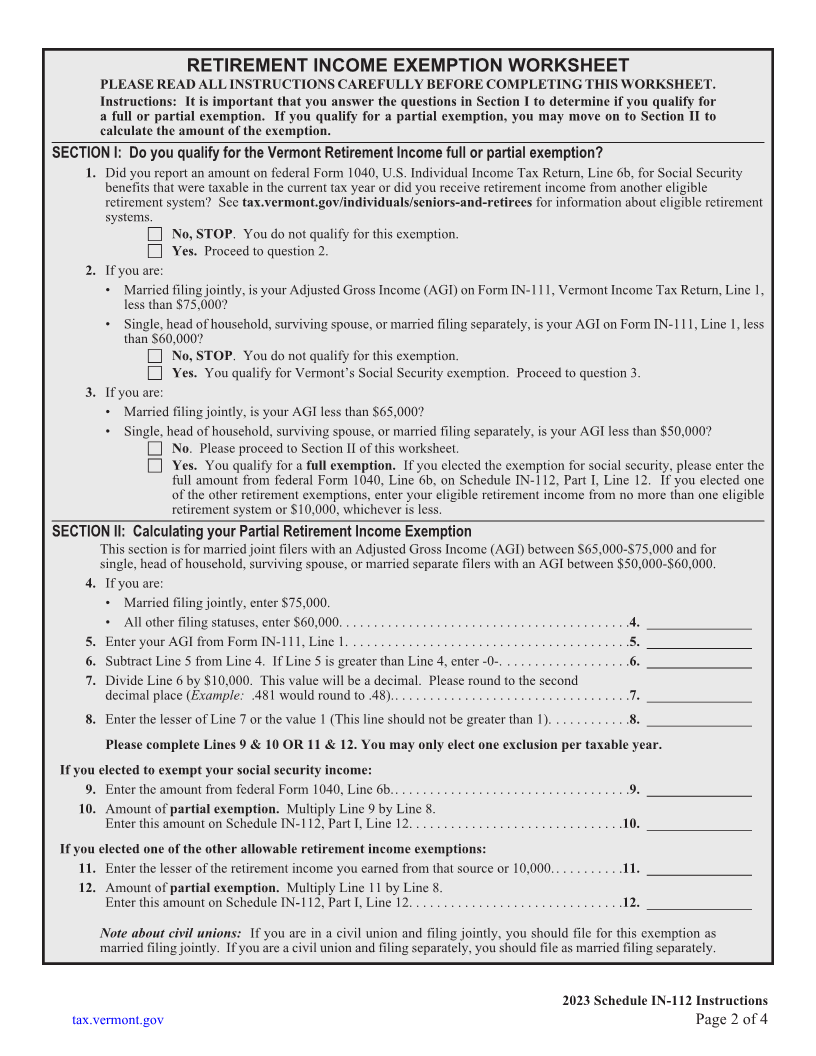

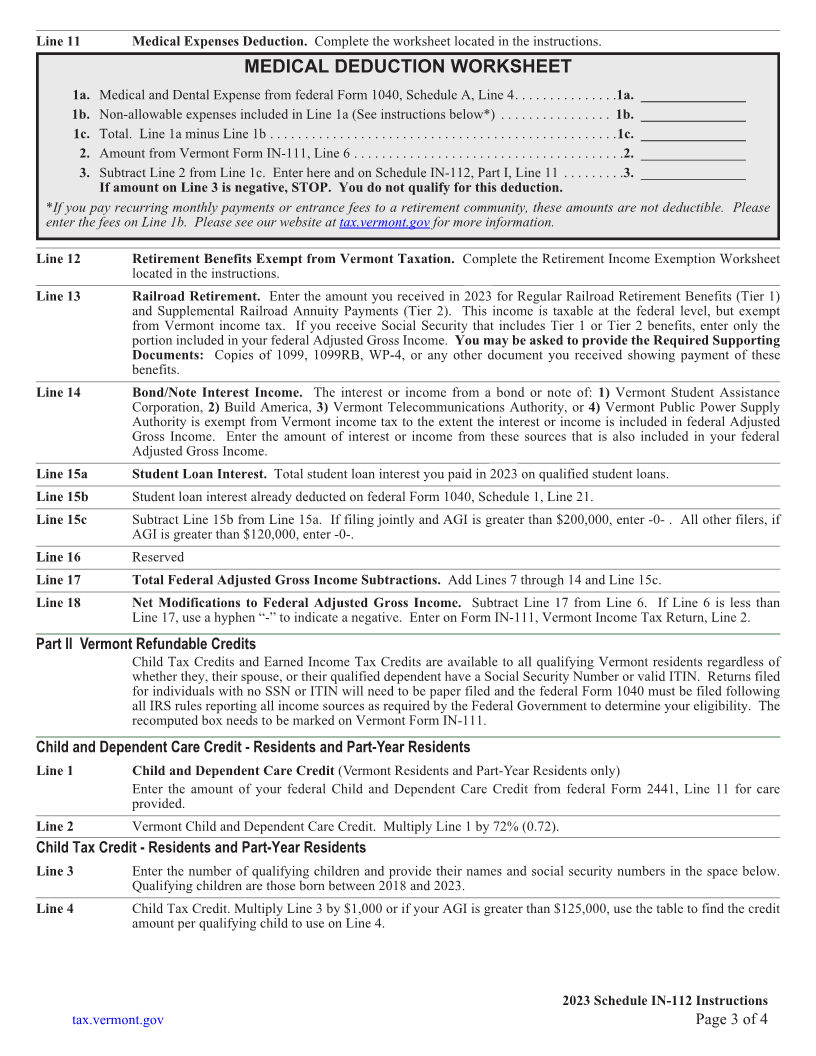

- Medical Expense Deduction

- Retirement Benefits Exempt from Taxation

- Railroad Retirement Income

- Bond/Note Interest Income

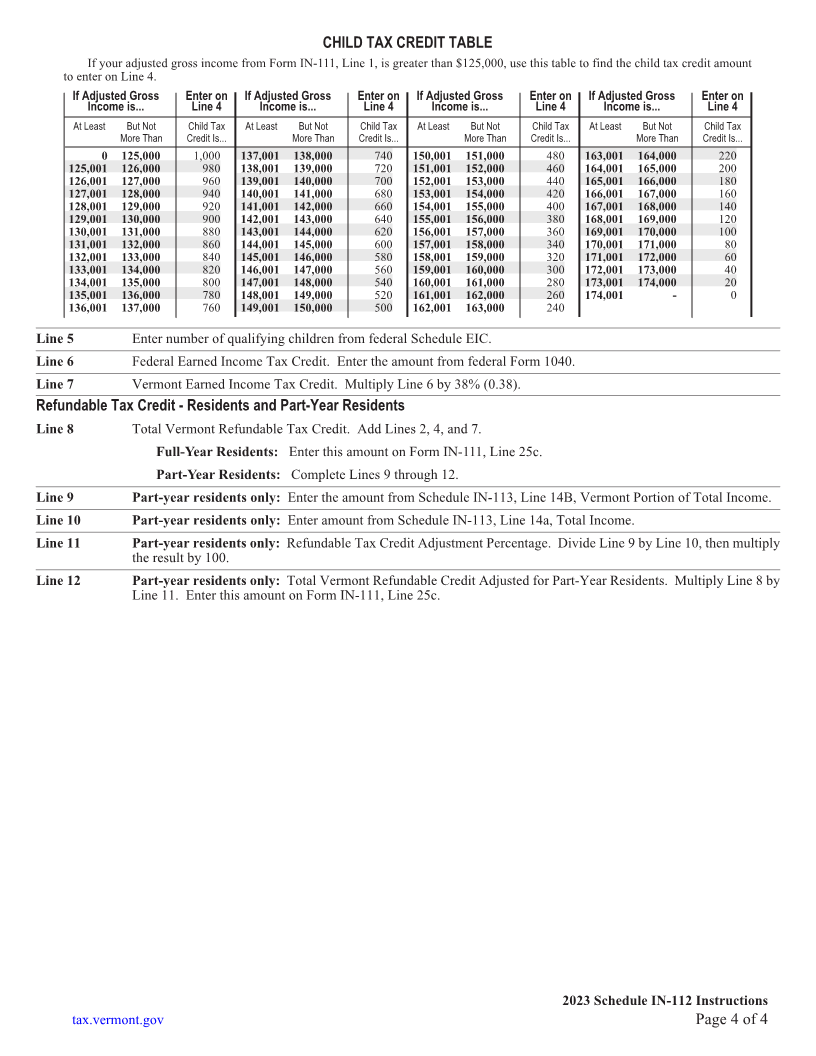

• Vermont Refundable Credits (Part II)

- Child and Dependent Care Credit

- Vermont Child Tax Credit

- Vermont Earned Income Tax Credit

Part I Additions to and Subtractions from Federal Adjusted Gross Income

Additions to Federal Adjusted Gross Income

Lines 1 through 3, General Information

Interest and dividend income from non-Vermont state and local obligations which are exempted from federal taxable

income are taxable in Vermont. A Vermont obligation is one from the state of Vermont or a Vermont municipality.

Line 1 Enter the total interest and dividend income received from all state and local obligations exempted from federal tax

as reported on federal Form 1040, U.S. Individual Income Tax Return.

Line 2 Enter the interest and dividend income from Vermont obligations. This may have been paid directly to you or

through a mutual fund or other legal entity that invests in Vermont state and local obligations. If you receive this

income from a mutual fund that has only a portion of its assets invested in Vermont state and local obligations, enter

only the amount for the Vermont obligation(s).

Line 3 Subtract Line 2 from Line 1. This is the amount of interest and dividend income from non-Vermont state and local

obligations that must be included in Vermont Taxable Income.

Line 4 Federal Bonus Depreciation. Vermont does not recognize the bonus depreciation allowed under federal law. Enter

the difference between the depreciation calculated by standard MACRS methods and the depreciation calculated using

the federal bonus depreciation for assets placed in service in 2023. Read Technical Bulletin TB-44, Disallowance

of Bonus Depreciation Provisions of Federal Economic Stimulus Act of 2008, on our website for information on

calculating the amount to add back to taxable income.

Line 5 Reserved

Line 6 Total Federal Adjusted Gross Income Additions. Add Lines 3 and 4.

Subtractions From Federal Adjusted Gross Income

Line 7 Interest Income from U.S. Obligations. Interest income from U.S. government obligations (such as U.S. Treasury

bonds, bills, and notes) is exempt from Vermont tax under the laws of the United States. Enter the amount of

interest income from U.S. Obligations on this line. Read Technical Bulletin TB-24, Exemption of Income of U.S.

Government Obligations, on our website.

Line 8 Capital Gains Exclusion. See Schedule IN-153, Capital Gains Exclusion Calculation, and instructions to calculate

the capital gains exclusion for 2023. Read Department regulation § 1.5811(21)(B)(ii) and Technical Bulletin

TB-60, Taxation of Gain on the Sale of Capital Assets, on our website to help determine your capital gain exclusion.

Complete and submit Schedule IN-153.

Line 9 Adjustment for Bonus Depreciation on Prior Year Property. Enter the difference between the depreciation

calculated by standard MACRS methods and the depreciation calculated at the federal level. For information on

calculating the amount that can be subtracted from taxable income, read Technical Bulletin TB-44 on our website.

Line 10 Taxable Refunds of State and Local Income Taxes. Enter the amount reported on your federal Form 1040,

Schedule 1.

2023 Schedule IN-112 Instructions

tax.vermont.gov Page 1 of 4