Enlarge image

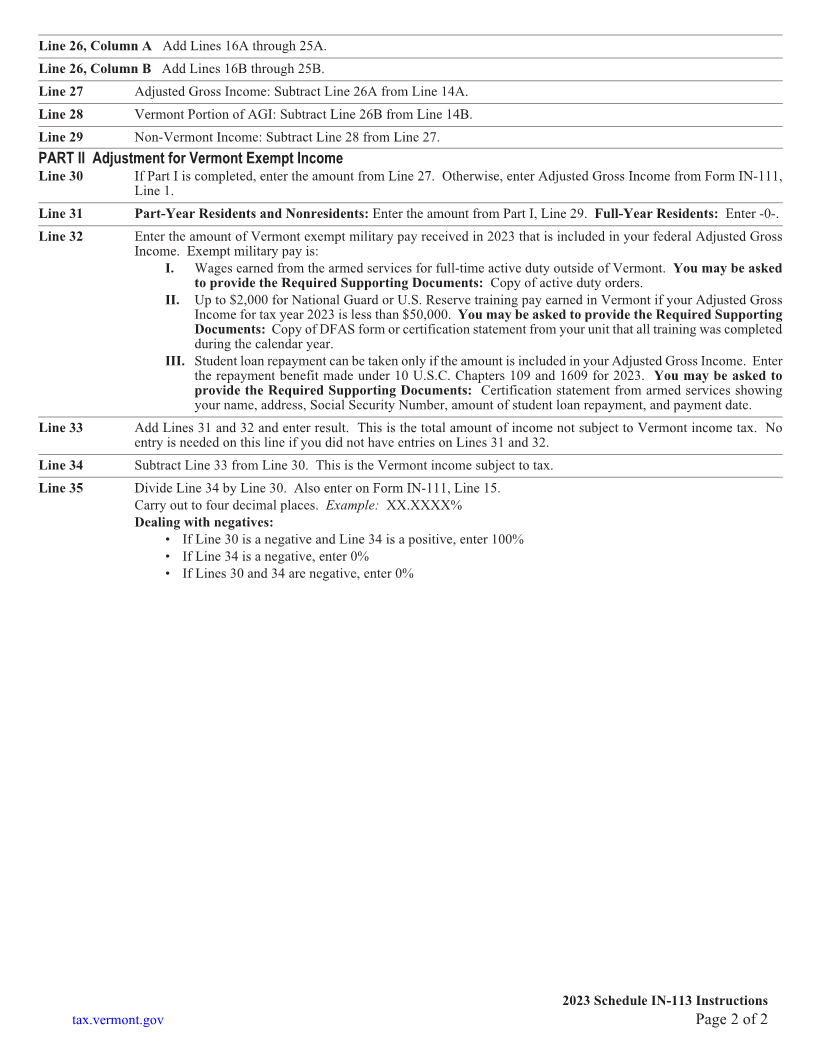

SCHEDULE IN-113 Income Adjustment

WHO MUST FILE IN-113

You must file Schedule IN-113 if you are either:

• a nonresident or part-year resident and earned or received Vermont income,

OR Page 1

• a Vermont resident claiming income exempt from Vermont income tax

Nonresident: Complete both Parts I and II to determine the allocation of Vermont income. Visit our website for definition

of nonresident income.

Resident: Complete Part II to adjust for Vermont tax exempt military pay.

Part-Year Resident: Part-year residents may, in some cases, be able to adjust Vermont income by both the Vermont percentage of

income on Schedule IN-113 and claim a credit for income tax paid to another tax jurisdiction on Schedule IN-117,

Vermont Credit for Income Tax Paid to Other State or Canadian Province. The income tax paid to the other tax

jurisdiction must be for income earned while a Vermont resident. Schedule IN-117, Line 2 cannot exceed the amount

on Schedule IN-113, Line 27. Visit our website for more information.

Dates of Vermont Residency in 2023 Enter the dates you lived in Vermont in 2023. Leave blank if you did not live in Vermont.

Name of State(s) During Non-Vermont Residency Write the names of the other states, Canadian provinces, or countries where you

were a resident in 2023 using standard 2-letter abbreviations.

PART I (For Nonresidents and Some Part-Year Vermont Residents)

Unless otherwise indicated in the line instructions, the Vermont portion is the income received from Vermont sources

or received while a Vermont resident.

Lines 1 - 13, Column A Enter the income for these categories as shown on your federal income tax return.

NOTE: For Line 3A - Use taxable amount “Ordinary dividends” from federal Form 1040, U.S. Individual Income Tax

Return.

For Line 10A - Use amount from federal Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions,

Credits, etc., before recalculation for exclusion of bonus depreciation.

For Line 12A - Use amount reported on federal Form 1040, Schedule 1.

For Line 13A - Use amounts from federal Form 1040, Schedule 1, lines reporting “other gains and losses” and

“other income.”

Line 13, Column A Examples of other income: gambling winnings including lotteries, raffles, or lump-sum payment from sale of

right to receive future lottery annuity; reimbursement this year for items itemized last year such as medical expenses;

interest; income from rental of personal property; taxable distributions from Coverdell Education Savings Account

or Qualified Tuition Plan, medical savings account or Archer Medical Savings Account.

Lines 1 - 13, Column B Enter the Vermont portion for these categories from your federal income tax return.

NOTE: For Line 3B - Use the amount of ordinary dividends received while a Vermont resident.

For Line 9B - Include amount from Line 2 of Vermont Schedule K-1VT, Shareholder, Partner, or Member

Information plus all additional Vermont-sourced capital gains.

For Line 10B - Use sum of Line 1 and Line 3 of Schedule K-1VT before recalculation for exclusion of bonus

depreciation.

For Line 12B - Enter total amount received for Vermont unemployment.

For Line 13B - Use the amount of other income earned or received from federal Form 1040, Schedule 1, lines

reporting “other gains and losses” and “other income,” from Vermont sources.

Line 14, Column A Add Lines 1A through 13A.

Line 14, Column B Add Lines 1B through 13B.

Lines 15 - 23, Column A Enter the amount for these categories as shown on your federal Form 1040.

Lines 15 - 23, Column B Enter the portion of the deductions paid or incurred during your Vermont residency or resulting from

Vermont income earned or received.

Line 24, Column A Enter the combined amounts of Educator Expenses and Tuition and Fees from federal Form 1040, Schedule 1.

Line 24, Column B The Vermont portion of Educator Expenses and Tuition and Fees during Vermont residency.

Line 25, Column A Enter deduction(s) to Adjusted Gross Income that are included in the total on federal Form 1040.

Line 25, Column B Enter the portion of the deductions paid or incurred during your Vermont residency or resulting from Vermont

income earned or received.

2023 Schedule IN-113 Instructions

tax.vermont.gov Page 1 of 2