Enlarge image

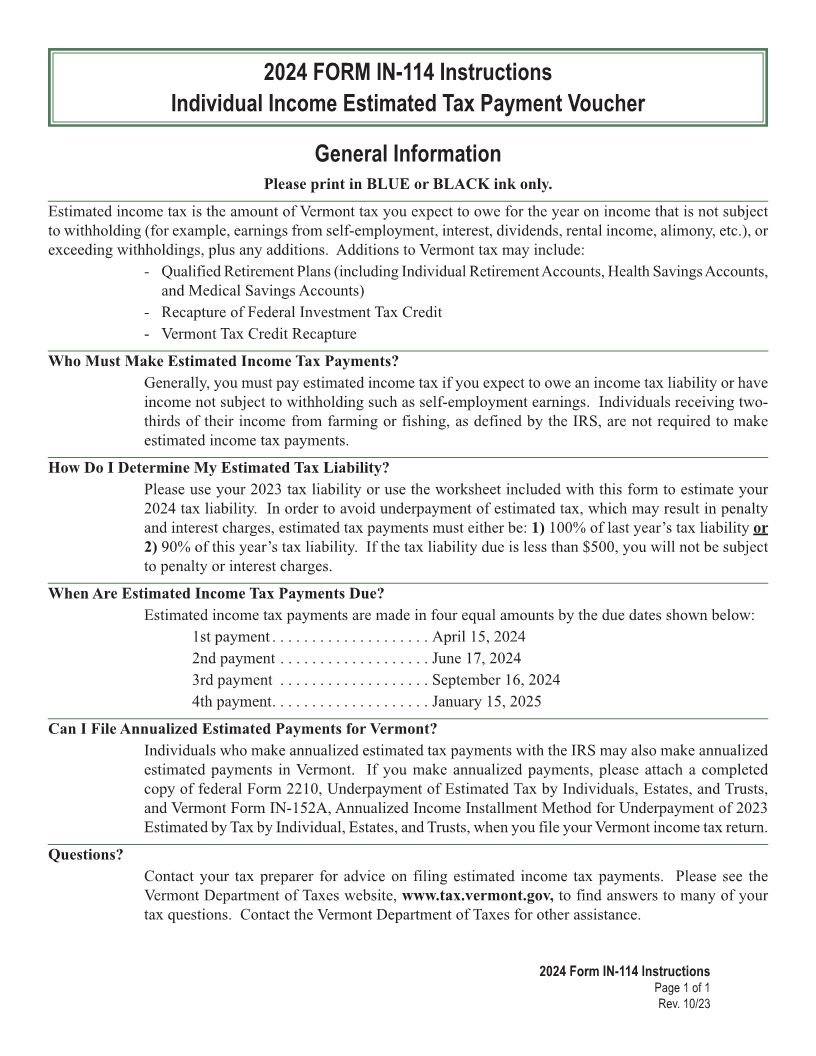

2024 FORM IN-114 Instructions

Individual Income Estimated Tax Payment Voucher

Page 1

General Information

Please print in BLUE or BLACK ink only.

Estimated income tax is the amount of Vermont tax you expect to owe for the year on income that is not subject

to withholding (for example, earnings from self-employment, interest, dividends, rental income, alimony, etc.), or

exceeding withholdings, plus any additions. Additions to Vermont tax may include:

- Qualified Retirement Plans (including Individual Retirement Accounts, Health Savings Accounts,

and Medical Savings Accounts)

- Recapture of Federal Investment Tax Credit

- Vermont Tax Credit Recapture

Who Must Make Estimated Income Tax Payments?

Generally, you must pay estimated income tax if you expect to owe an income tax liability or have

INSTR (Place at FIRST page)

income not subject to withholding such as self-employment earnings. Individuals receiving two- Instr. pages

thirds of their income from farming or fishing, as defined by the IRS, are not required to make

estimated income tax payments.

How Do I Determine My Estimated Tax Liability?

Please use your 2023 tax liability or use the worksheet included with this form to estimate your 1 - 2

2024 tax liability. In order to avoid underpayment of estimated tax, which may result in penalty

and interest charges, estimated tax payments must either be: 1) 100% of last year’s tax liability or

2) 90% of this year’s tax liability. If the tax liability due is less than $500, you will not be subject

to penalty or interest charges.

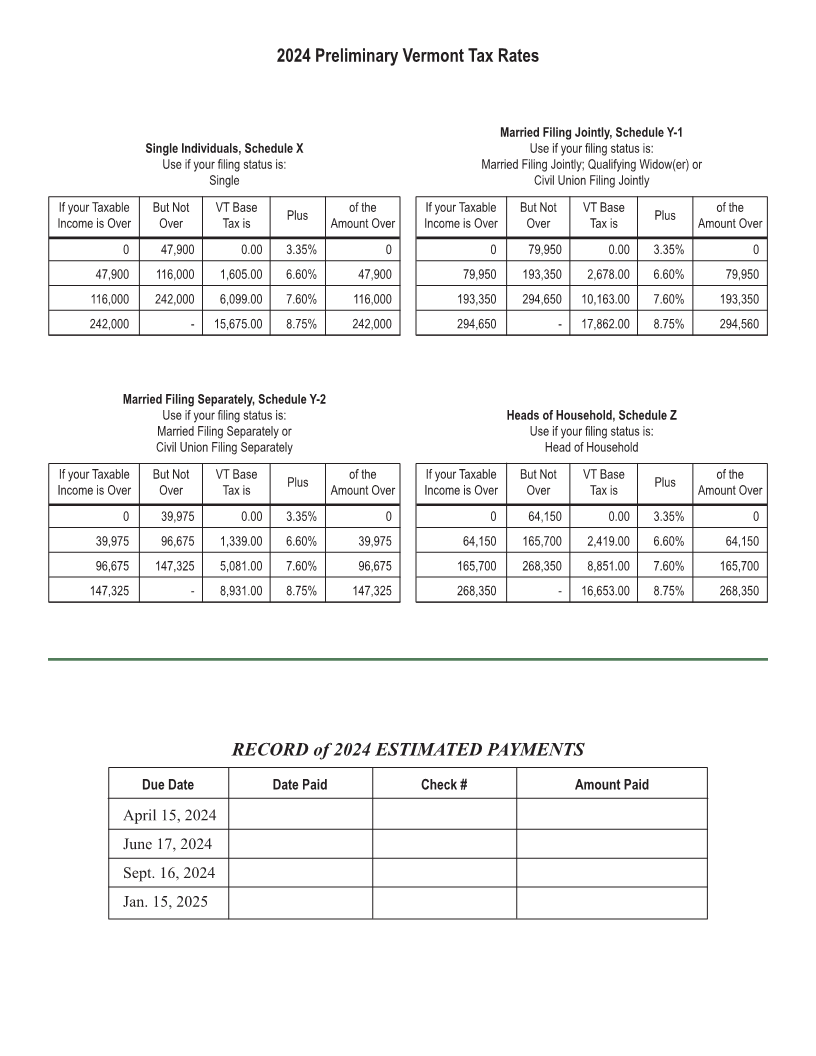

When Are Estimated Income Tax Payments Due?

Estimated income tax payments are made in four equal amounts by the due dates shown below:

1st payment .................... April 15, 2024

2nd payment ................... June 17, 2024

3rd payment ................... September 16, 2024

4th payment .................... January 15, 2025

Can I File Annualized Estimated Payments for Vermont?

Individuals who make annualized estimated tax payments with the IRS may also make annualized

estimated payments in Vermont. If you make annualized payments, please attach a completed

copy of federal Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts,

and Vermont Form IN-152A, Annualized Income Installment Method for Underpayment of 2023

Estimated by Tax by Individual, Estates, and Trusts, when you file your Vermont income tax return.

Questions?

Contact your tax preparer for advice on filing estimated income tax payments. Please see the

Vermont Department of Taxes website, www.tax.vermont.gov, to find answers to many of your

tax questions. Contact the Vermont Department of Taxes for other assistance.

2024 Form IN-114 Instructions

Page 1 of 1

Rev. 10/23