Enlarge image

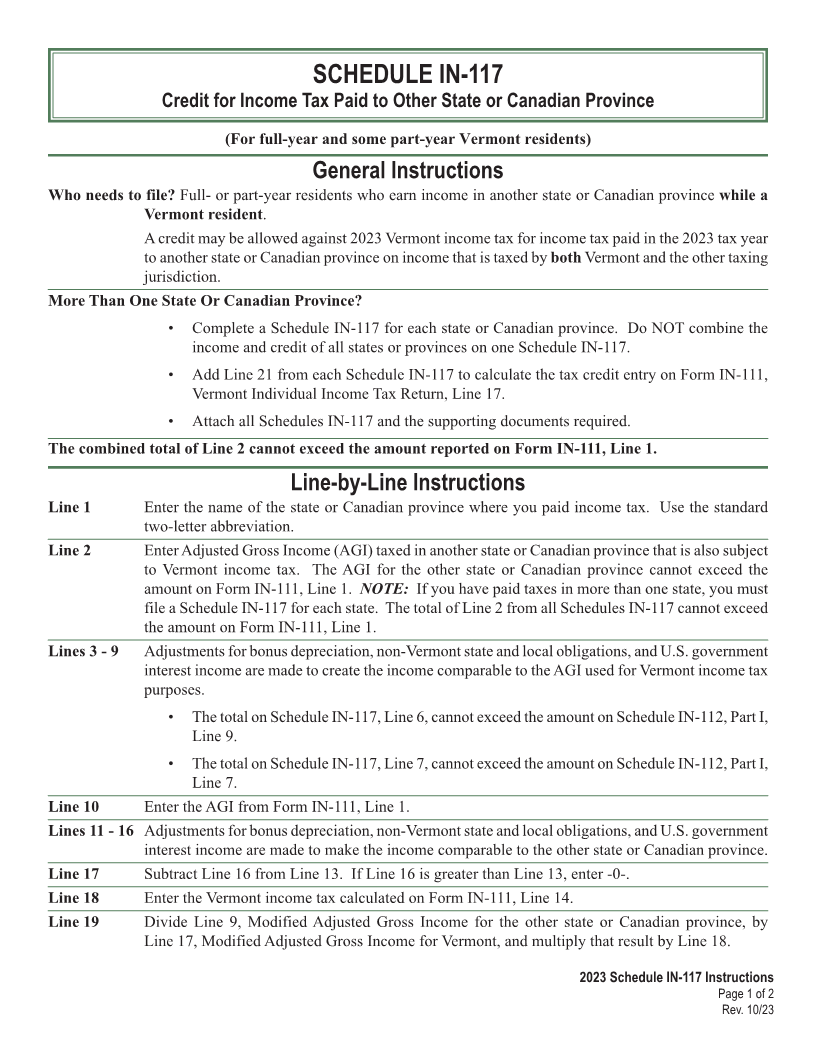

SCHEDULE IN-117

Credit for Income Tax Paid to Other State or Canadian Province

Page 1

(For full-year and some part-year Vermont residents)

General Instructions

Who needs to file? Full- or part-year residents who earn income in another state or Canadian province while a

Vermont resident.

A credit may be allowed against 2023 Vermont income tax for income tax paid in the 2023 tax year

to another state or Canadian province on income that is taxed by both Vermont and the other taxing

jurisdiction.

More Than One State Or Canadian Province?

• Complete a Schedule IN-117 for each state or Canadian province. Do NOT combine the

income and credit of all states or provinces on one Schedule IN-117.

• Add Line 21 from each Schedule IN-117 to calculate the tax credit entry on Form IN-111,

Vermont Individual Income Tax Return, Line 17. INSTR (Place at FIRST page)

Instr. pages

• Attach all Schedules IN-117 and the supporting documents required.

The combined total of Line 2 cannot exceed the amount reported on Form IN-111, Line 1.

Line-by-Line Instructions 1 - 2

Line 1 Enter the name of the state or Canadian province where you paid income tax. Use the standard

two-letter abbreviation.

Line 2 Enter Adjusted Gross Income (AGI) taxed in another state or Canadian province that is also subject

to Vermont income tax. The AGI for the other state or Canadian province cannot exceed the

amount on Form IN-111, Line 1. NOTE: If you have paid taxes in more than one state, you must

file a Schedule IN-117 for each state. The total of Line 2 from all Schedules IN-117 cannot exceed

the amount on Form IN-111, Line 1.

Lines 3 - 9 Adjustments for bonus depreciation, non-Vermont state and local obligations, and U.S. government

interest income are made to create the income comparable to the AGI used for Vermont income tax

purposes.

• The total on Schedule IN-117, Line 6, cannot exceed the amount on Schedule IN-112, Part I,

Line 9.

• The total on Schedule IN-117, Line 7, cannot exceed the amount on Schedule IN-112, Part I,

Line 7.

Line 10 Enter the AGI from Form IN-111, Line 1.

Lines 11 - 16 Adjustments for bonus depreciation, non-Vermont state and local obligations, and U.S. government

interest income are made to make the income comparable to the other state or Canadian province.

Line 17 Subtract Line 16 from Line 13. If Line 16 is greater than Line 13, enter -0-.

Line 18 Enter the Vermont income tax calculated on Form IN-111, Line 14.

Line 19 Divide Line 9, Modified Adjusted Gross Income for the other state or Canadian province, by

Line 17, Modified Adjusted Gross Income for Vermont, and multiply that result by Line 18.

2023 Schedule IN-117 Instructions

Page 1 of 2

Rev. 10/23