Enlarge image

Schedule IN-119 Instructions

Vermont Tax Adjustments and Nonrefundable Credits

Page 1

Please print in BLUE or BLACK ink only.

Line-by-Line Instructions

Part I ADJUSTMENTS TO VERMONT INCOME TAX

Additions to Vermont Tax

Line 1 Tax on Qualified Plans and tax-favored accounts, including individual retirement accounts (IRAs),

health savings accounts (HSAs), and medical savings accounts (MSAs) reported on federal

Form 1040, U.S. Individual Income Tax Return.

Line 2 Recapture of Investment Tax Credit from federal Form 4255, Recapture of Investment Credit.

Line 3 Tax on Lump-Sum Distributions from federal Form 4972, Tax on Lump-Sum Distributions.

Line 4 Add Lines 1 through 3 and enter result. INSTR (Place at FIRST page)

Instr. pages

Line 5 Multiply Line 4 by 24% (0.24) and enter result.

Line 6 Recapture of Vermont tax credit(s). Recapture occurs when a previously claimed credit is

changed. Vermont piggy backs on federal recapture law. Recapture occurs when a taxpayer claims

but ultimately did not receive the federal credit or claims and received the federal credit but had it 1 - 4

reduced.

Line 7 Add Lines 5 and 6.

Subtractions from Vermont Tax

Line 8 Enter Credit for the Elderly or the Disabled from federal Form 1040, Schedule R, Credit for the

Elderly or the Disabled.

Line 9 Investment Tax Credit from federal Form 3468, Investment Credit, and federal Form 3800, General

Business Credit. This credit is limited to the amount of Investment Tax Credit attributable to the

Vermont-property portion and what is allowed against the federal income tax for the taxable year.

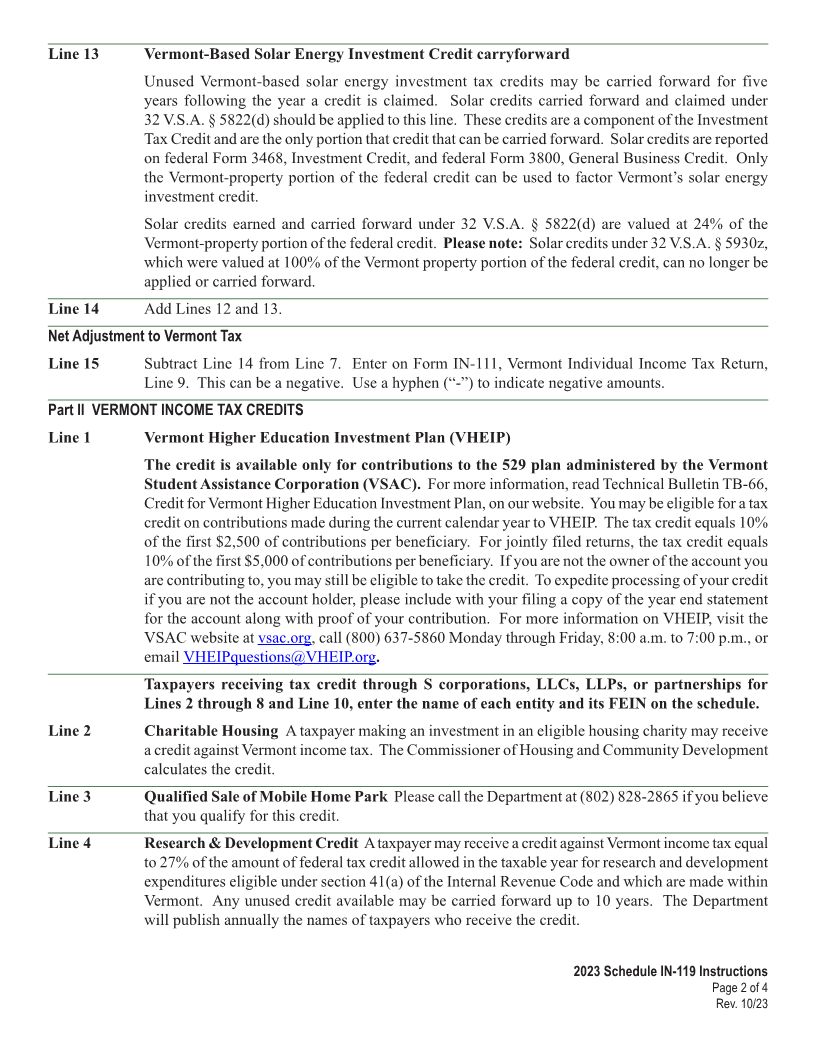

Line 10 Vermont Farm Income Averaging

VERMONT FARM INCOME AVERAGING

Credit This credit is available to

WORKSHEET

farmers who calculate federal tax using

federal Form 1040, Schedule J, Income 1. Calculate and enter here federal income tax using

federal Form 1040, Schedule D, federal Form 1040,

Averaging for Farmers and Fishermen. Schedule D Worksheet, or federal tax rate schedules

Complete the worksheet. as if federal Form 1040, Schedule J was

not used. ............................... $ _______________1.

Line 11 Add Lines 8 through 10. less

Line 12 Multiply Line 11 by 24% (0.24) and enter 2. Enter federal tax from

federal Form 1040 Schedule J, Line 23 ....... 2. $ _______________

the result. 3. Subtract Line 2 from Line 1. This is your Vermont Farm

Income Averaging Credit. Enter the result on

Schedule IN-119, Part I, Line 10 ............... $ _____________3.

2023 Schedule IN-119 Instructions

Page 1 of 4

Rev. 10/23