Enlarge image

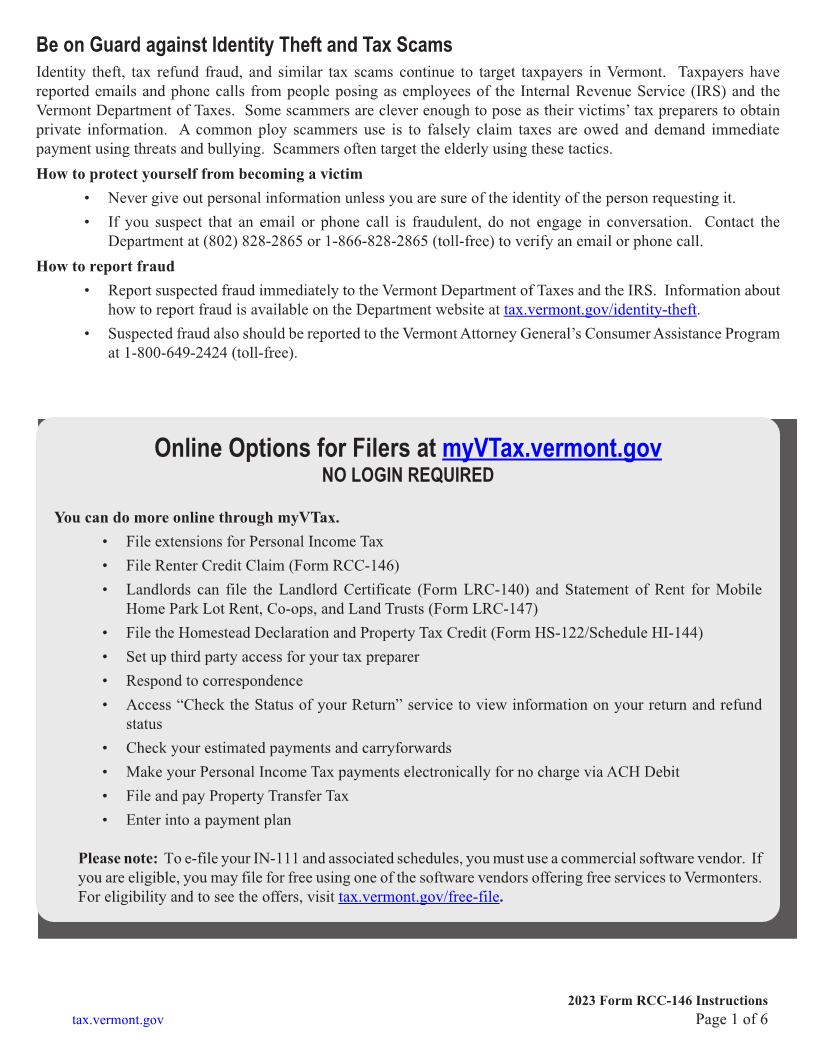

Be on Guard against Identity Theft and Tax Scams

Identity theft, tax refund fraud, and similar tax scams continue to target taxpayers in Vermont. Taxpayers have

reported emails and phone calls from people posing as employees of the Internal Revenue Service (IRS) and the

Vermont Department of Taxes. Some scammers are clever enough to pose as their victims’ tax preparers to obtain

private information. A common ploy scammers use is to falsely claim taxes are owed and demand immediate Page 1

payment using threats and bullying. Scammers often target the elderly using these tactics.

How to protect yourself from becoming a victim

• Never give out personal information unless you are sure of the identity of the person requesting it.

• If you suspect that an email or phone call is fraudulent, do not engage in conversation. Contact the

Department at (802) 828-2865 or 1-866-828-2865 (toll-free) to verify an email or phone call.

How to report fraud

• Report suspected fraud immediately to the Vermont Department of Taxes and the IRS. Information about

how to report fraud is available on the Department website at tax.vermont.gov/identity-theft.

• Suspected fraud also should be reported to the Vermont Attorney General’s Consumer Assistance Program

at 1-800-649-2424 (toll-free).

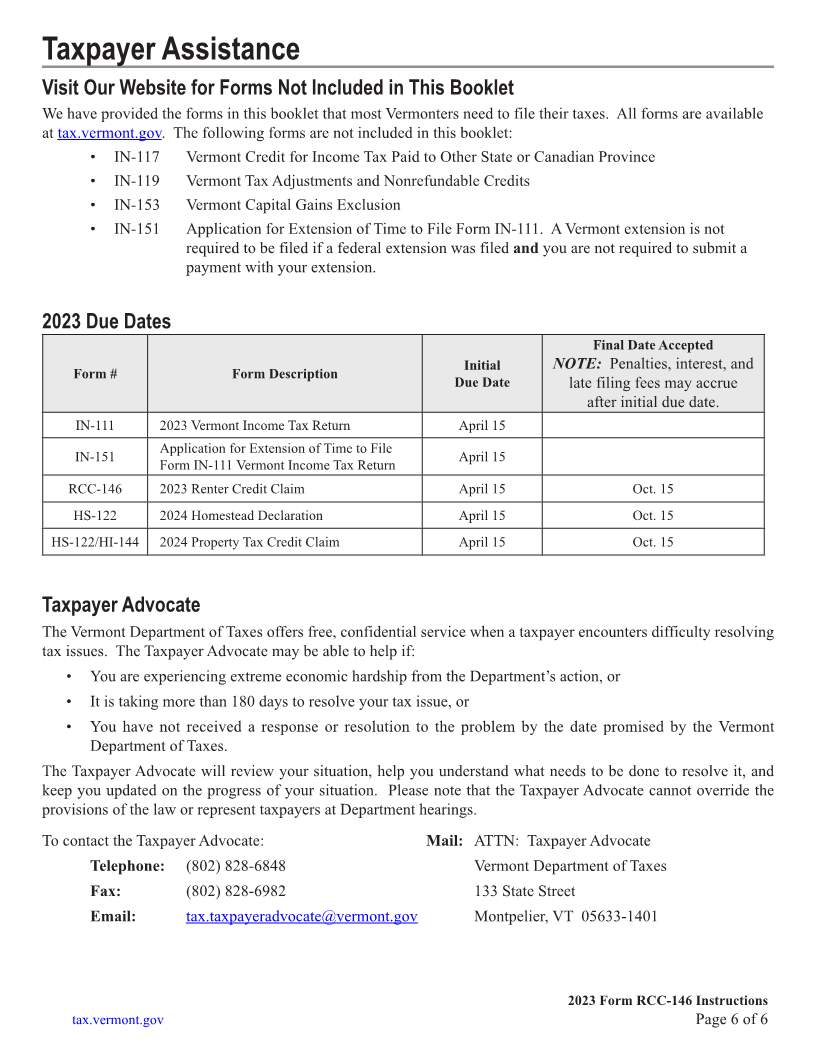

Online Options for Filers at myVTax.vermont.gov

NO LOGIN REQUIRED

You can do more online through myVTax.

• File extensions for Personal Income Tax

• File Renter Credit Claim (Form RCC-146)

• Landlords can file the Landlord Certificate (Form LRC-140) and Statement of Rent for Mobile

Home Park Lot Rent, Co-ops, and Land Trusts (Form LRC-147)

• File the Homestead Declaration and Property Tax Credit (Form HS-122/Schedule HI-144)

• Set up third party access for your tax preparer

• Respond to correspondence

• Access “Check the Status of your Return” service to view information on your return and refund

status

• Check your estimated payments and carryforwards

• Make your Personal Income Tax payments electronically for no charge via ACH Debit

• File and pay Property Transfer Tax

• Enter into a payment plan

Please note: To e-file your IN-111 and associated schedules, you must use a commercial software vendor. If

you are eligible, you may file for free using one of the software vendors offering free services to Vermonters.

For eligibility and to see the offers, visit tax.vermont.gov/free-file.

2023 Form RCC-146 Instructions

tax.vermont.gov Page 1 of 6