Enlarge image

New Hampshire

202

Department of *ADDINF2411862*

Revenue Administration ADDLINFO ADDINF2411862

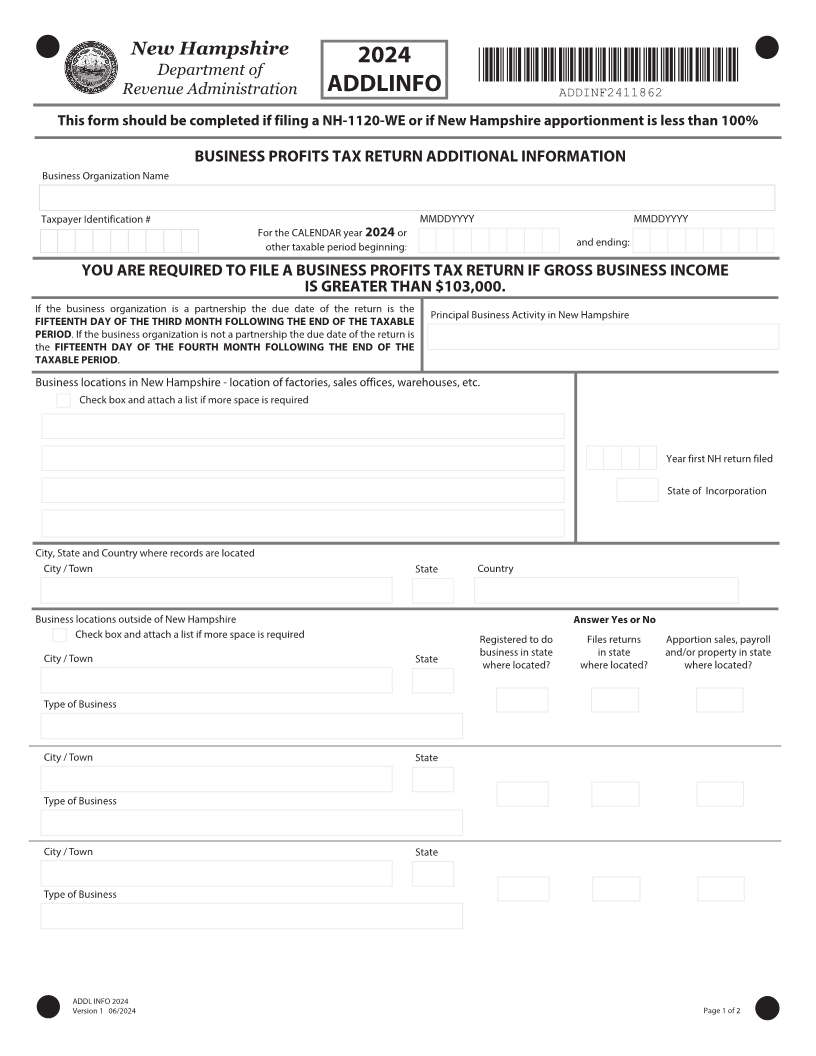

This form should be completed if filing a NH-1120-WE or if New Hampshire apportionment is less than 100%

BUSINESS PROFITS TAX RETURN ADDITIONAL INFORMATION

Business Organization Name

Taxpayer Identification # MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or

other taxable period beginning: and ending:

YOU ARE REQUIRED TO FILE A BUSINESS PROFITS TAX RETURN IF GROSS BUSINESS INCOME

IS GREATER THAN $ ,000.

If the business organization is a partnership the due date of the return is the Principal Business Activity in New Hampshire

FIFTEENTH DAY OF THE THIRD MONTH FOLLOWING THE END OF THE TAXABLE

PERIOD. If the business organization is not a partnership the due date of the return is

the FIFTEENTH DAY OF THE FOURTH MONTH FOLLOWING THE END OF THE

TAXABLE PERIOD.

Business locations in New Hampshire - location of factories, sales offices, warehouses, etc.

Check box and attach a list if more space is required

Year first NH return filed

State of Incorporation

City, State and Country where records are located

City / Town State Country

Business locations outside of New Hampshire Answer Yes or No

Check box and attach a list if more space is required Registered to do Files returns Apportion sales, payroll

City / Town State business in state in state and/or property in state

where located? where located? where located?

Type of Business

City / Town State

Type of Business

City / Town State

Type of Business

ADDL INFO 202

Version 1 0 /202 Page 1 of 2