Enlarge image

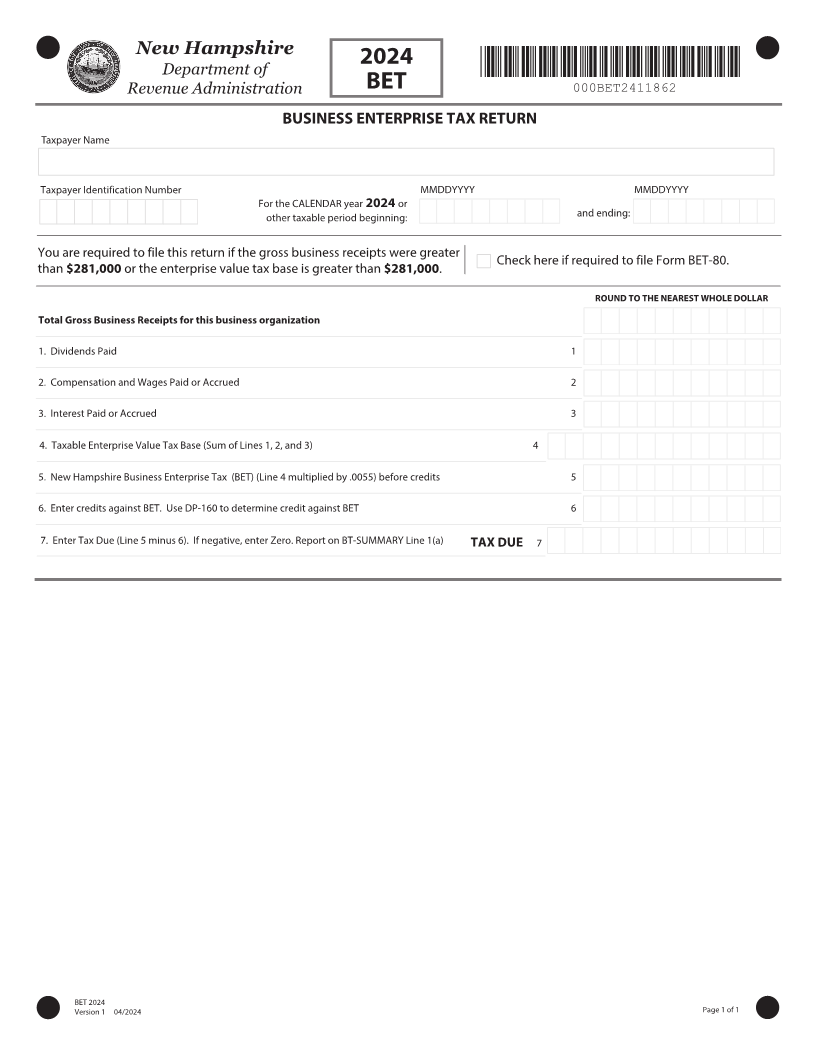

New Hampshire 202

Department of *000BET2411862*

BET

Revenue Administration 000BET2411862

BUSINESS ENTERPRISE TAX RETURN

Taxpayer Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or

other taxable period beginning: and ending:

You are required to file this return if the gross business receipts were greater

Check here if required to file Form BET-80

than $2 ,000 or the enterprise value tax base is greater than $2 ,000.

306/% 50 5)& /&"3&45 8)0-& %0--"3

Total Gross Business Receipts for this business organization

1. Dividends Paid 1

2. Compensation and Wages Paid or Accrued 2

3. Interest Paid or Accrued 3

4. Taxable Enterprise Value Tax Base (Sum of Lines 1, 2, and 3) 4

5. New Hampshire Business Enterprise Tax (BET) (Line 4 multiplied by .0055) before credits 5

6. Enter credits against BET. Use DP-160 to determine credit against BET 6

7. Enter Tax Due (Line 5 minus 6). If negative, enter Zero. Report on BT-SUMMARY Line 1(a) TAX DUE 7

BET 202 Page 1 of

Version 1 /202