Enlarge image

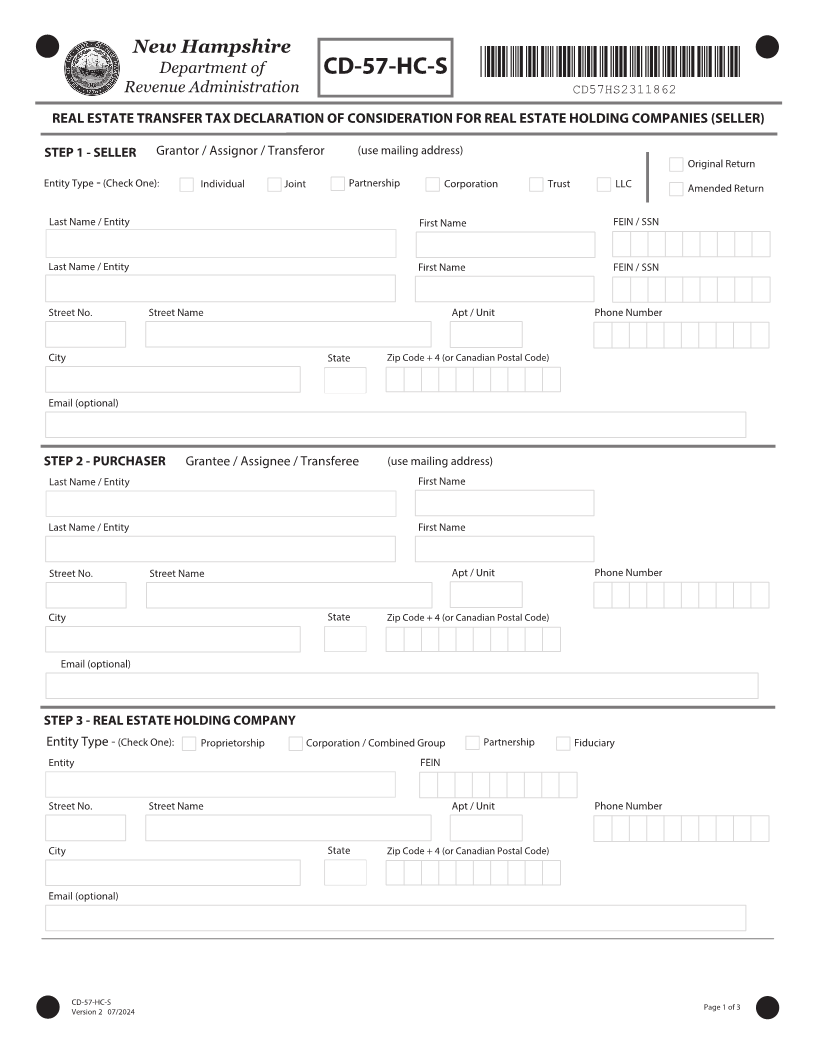

New Hampshire

Department of CD-57-HC-S *CD57HS2311862*

Revenue Administration CD57HS2311862

REAL ESTATE TRANSFER TAX DECLARATION OF CONSIDERATION FOR REAL ESTATE HOLDING COMPANIES (SELLER)

STEP 1 - SELLER Grantor / Assignor / Transferor VTF NBJMJOH BEESFTT

Original Return

Entity Type -(Check One): Individual Joint Partnership Corporation Trust LLC Amended Return

Last Name / Entity First Name FEIN / SSN

Last Name / Entity First Name FEIN / SSN

Street No. Street Name Apt / Unit Phone Number

City State Zip Code + 4 (or Canadian Postal Code)

Email (optional)

STEP 2 - PURCHASER Grantee / Assignee / Transferee VTF NBJMJOH BEESFTT

Last Name / Entity First Name

Last Name / Entity First Name

Street No. Street Name Apt / Unit Phone Number

City State Zip Code + 4 (or Canadian Postal Code)

Email (optional)

STEP 3 - REAL ESTATE HOLDING COMPANY

Entity Type - (Check One): Proprietorship Corporation / Combined Group Partnership Fiduciary

Entity FEIN

Street No. Street Name Apt / Unit Phone Number

City State Zip Code + 4 (or Canadian Postal Code)

Email (optional)

CD-57-HC-S Page 1 of

7FSTJPO 0 /202