Enlarge image

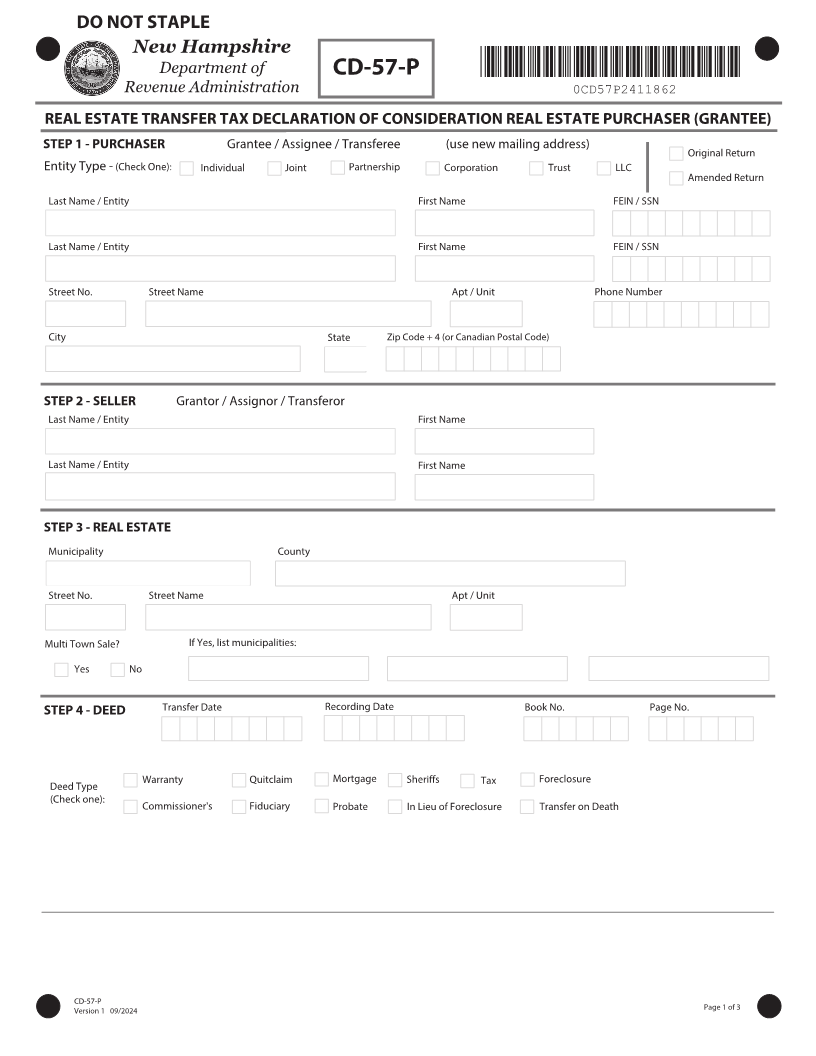

DO NOT STAPLE

New Hampshire

Department of CD-57-P *0CD57P2411862*

Revenue Administration 0CD57P2411862

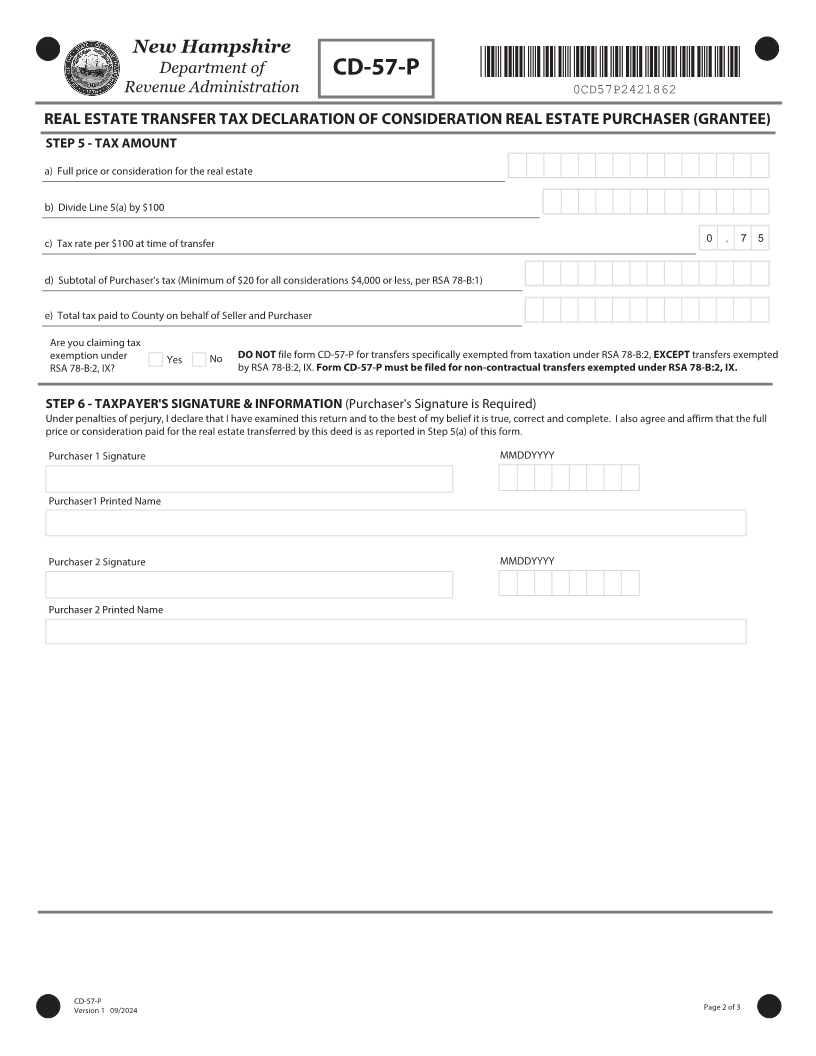

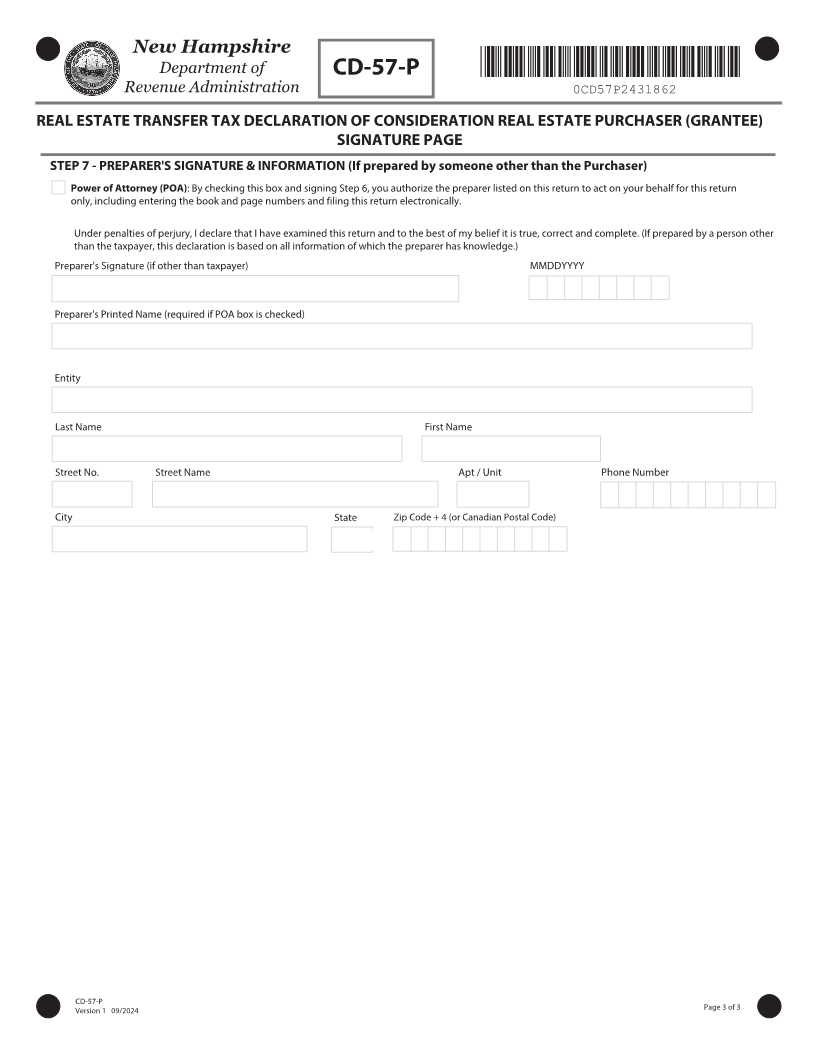

REAL ESTATE TRANSFER TAX DECLARATION OF CONSIDERATION REAL ESTATE PURCHASER (GRANTEE)

STEP 1 - PURCHASER Grantee / Assignee / Transferee (use new mailing address)

Original Return

Entity Type - (Check One): Individual Joint Partnership Corporation Trust LLC

Amended Return

Last Name / Entity First Name FEIN / SSN

Last Name / Entity First Name FEIN / SSN

Street No. Street Name Apt / Unit Phone Number

City State Zip Code + 4 (or Canadian Postal Code)

STEP 2 - SELLER Grantor / Assignor / Transferor

Last Name / Entity First Name

Last Name / Entity First Name

STEP 3 - REAL ESTATE

Municipality County

Street No. Street Name Apt / Unit

Multi Town Sale? If Yes, list municipalities:

Yes No

STEP 4 - DEED Transfer Date Recording Date Book No. Page No.

Warranty Quitclaim Mortgage Sheriffs Foreclosure

Deed Type Tax

(Check one):

Commissioner's Fiduciary Probate In Lieu of Foreclosure 5SBOTGFS PO %FBUI

CD-57-P Page 1 of

7FSTJPO 0 /202